Anchorage Capital Partners is preparing to flex its muscles at David Jones, showing owner Woolworths that it has the funding and expertise to turn around the struggling retailer.

Lender sources said Anchorage has lined up $150 million in working capital and $50 million in guarantees to help fund its bid, and has equity from itsCharter Hall has David Jones’ property in Sydney, and is the logical acquirer for its sites in Melbourne.

Charter Hall Group, which acquired David Jones’ flagship Sydney CBD store in December 2020, is the most logical acquirer and is well known to both Woolworths and David Jones. The other part of Anchorage’s pitch is its turnaround credentials, particularly in the retail sector. Anchorage is known in the industry for its “back to basics” strategy, making sure its portfolio companies get the most simple things right first, and carving businesses out of conglomerates . Goldman Sachs and Allens, both working for Woolworths, have heard it before.

Anchorage, given its turnaround experience and capital, appears the safer bet. The last thing Woolworths needs is another David Jones scandal; its David Jones foray will be talked about in Australian retail and MWoolworths paid more than $2 billion for the group in 2014, only to take write-downs worth more thanBankers are known to be keeping close to Charter Hall, realising the potential for it to get involved in the follow-on property deal.

co-edits Street Talk, specialising in private equity, investment banking, M&A and equity capital markets. He has 10 years' experience as a business journalist and worked at PwC, auditing and advising financial services companies.

Australia Latest News, Australia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Teoh Capital considers buying David JonesSky News Business Editor Ross Greenwood says Woolworths of South Africa is close to its wish to sell Australia's oldest retailer David Jones. “It has not been a match made in heaven since Woolworths paid around $2.1 billion for DJs in 2014 – two years ago that value was written down to around $900 million,” Mr Greenwood said. “This year the current CEO Roy Bagattini, said the original price didn't make sense. “But there are reports today that Teoh Capital famous for its ownership and sale of TPG Telecom might be lining up to buy DJs.'

Teoh Capital considers buying David JonesSky News Business Editor Ross Greenwood says Woolworths of South Africa is close to its wish to sell Australia's oldest retailer David Jones. “It has not been a match made in heaven since Woolworths paid around $2.1 billion for DJs in 2014 – two years ago that value was written down to around $900 million,” Mr Greenwood said. “This year the current CEO Roy Bagattini, said the original price didn't make sense. “But there are reports today that Teoh Capital famous for its ownership and sale of TPG Telecom might be lining up to buy DJs.'

Read more »

TPG’s Teoh family in shock run for David JonesBREAKING: Teoh Capital is thinking about making a big splash in Australia’s retail sector with the acquisition of 184-year old retailer David Jones.

TPG’s Teoh family in shock run for David JonesBREAKING: Teoh Capital is thinking about making a big splash in Australia’s retail sector with the acquisition of 184-year old retailer David Jones.

Read more »

TPG’s Teoh family in shock run for David JonesTeoh Capital is thinking about making a big splash in Australia’s retail sector with the acquisition of 184-year old retailer David Jones.

TPG’s Teoh family in shock run for David JonesTeoh Capital is thinking about making a big splash in Australia’s retail sector with the acquisition of 184-year old retailer David Jones.

Read more »

FC Capital loaned $120m to fruit grower chaired by its founderFC Capital, the lender at the heart of the Big Un scandal, appears to be propping up a troubled fruit company chaired by its founder.

FC Capital loaned $120m to fruit grower chaired by its founderFC Capital, the lender at the heart of the Big Un scandal, appears to be propping up a troubled fruit company chaired by its founder.

Read more »

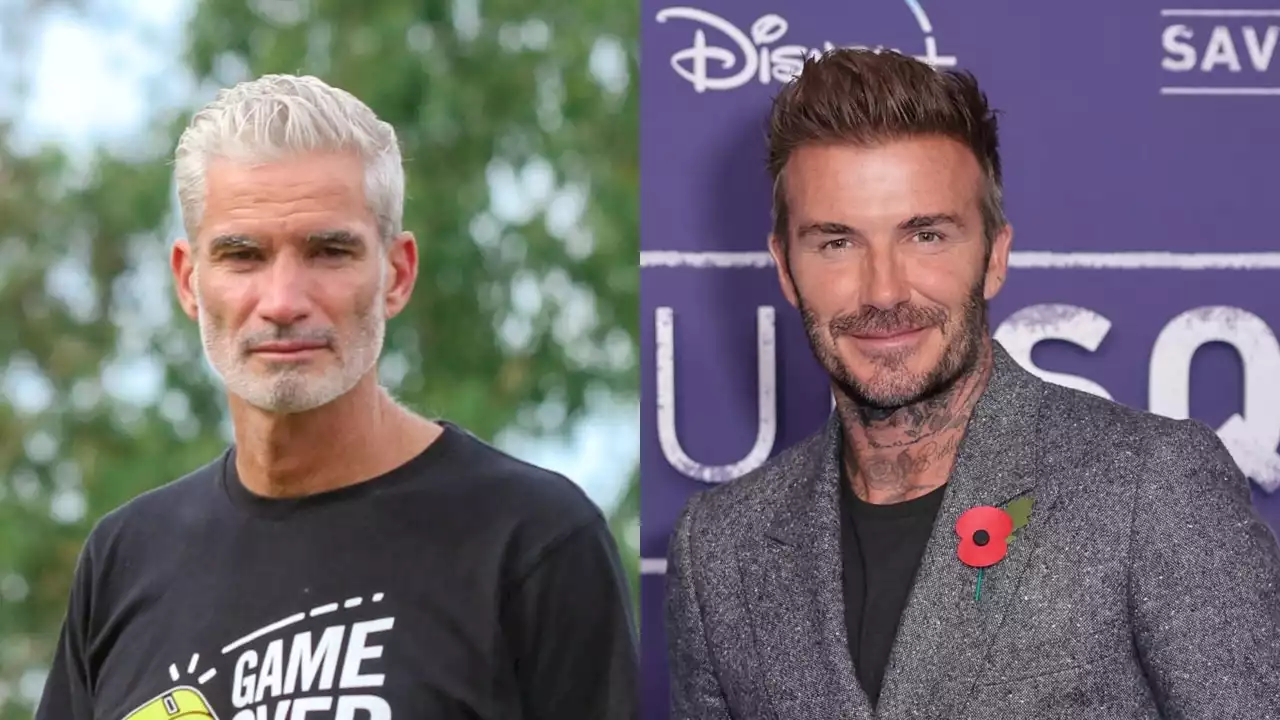

'Absolutely horrendous': Former Socceroo slams David BeckhamAustralian soccer legend Craig Foster has fired up at former Manchester United star David Beckham for working with Qatar in upcoming World Cup which he labelled as 'absolutely horrendous'.

'Absolutely horrendous': Former Socceroo slams David BeckhamAustralian soccer legend Craig Foster has fired up at former Manchester United star David Beckham for working with Qatar in upcoming World Cup which he labelled as 'absolutely horrendous'.

Read more »