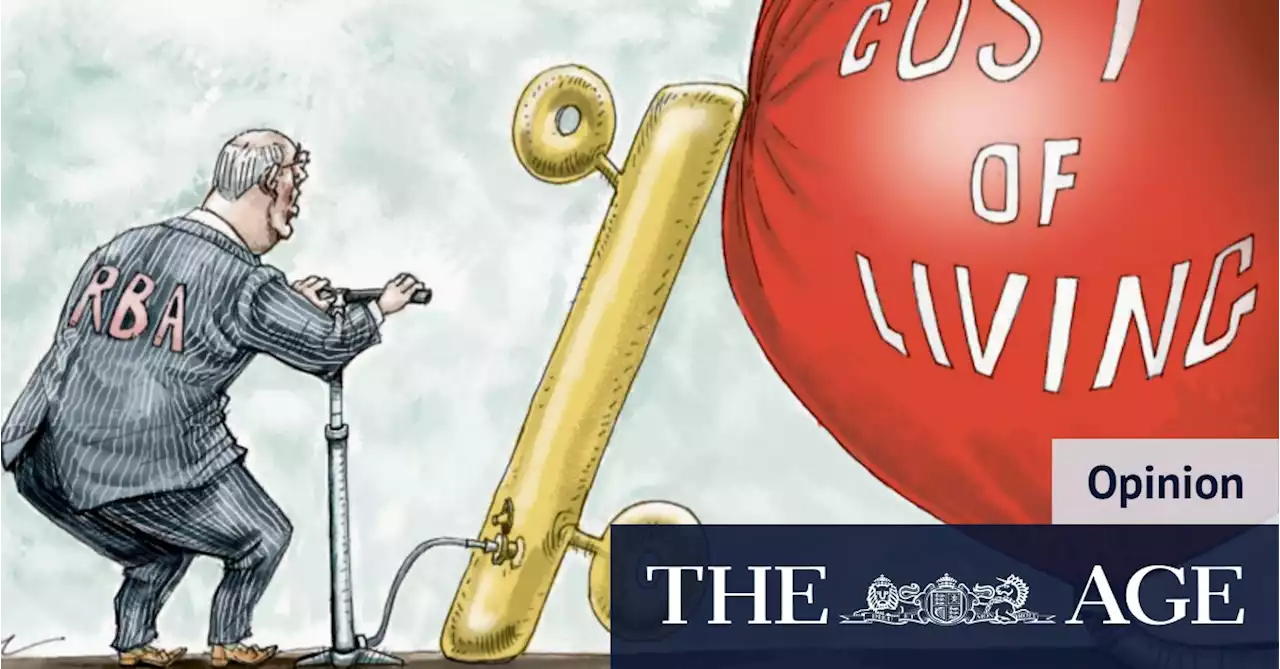

If the RBA lifts the cash rate on Tuesday, ANZ and NAB bosses will be in the spotlight as they explain defending profits and lifting costs for customers.

As inflation soared to its highest level since 2001 this week – making it highly likely the Reserve Bank will start to raise interest rates on Tuesday – strategists at ANZ Bank and National Australia Bank would have been feeling apprehensive as both banks prepare to report multibillion-dollar interim profits.

Other thorny political issues that will come into focus through bank results next week include housing affordability and the impact of falling house prices; the prospect of higher defaults by stressed borrowers; and the levels of interest rates being paid to savers.jack-up the official cash rate for the first time during an election campaign since 2007“It’s a tricky time for the banks,” says Michelle Lopez, head of Australian equities at global fund manager Abrdn.

If the RBA does move on Tuesday, all the major banks will have to decide when and by how much to lift the standard variable rates charged to mortgage borrowers. Despite the large headline profit numbers, analysts say growing cost pressures make it likely the banks will pass on the higher cash rate in full, matching the official rise with increases to SVRs.After ANZ and NAB, Macquarie will report full-year results on Friday, while Westpac reports interim numbers the following Monday, May 9.

But she says banks will also be considering other issues, including competition in the market and the impact of higher loan repayments to the broader economy, as rates continue to move higher. Other issues facing ANZ boss Shayne Elliott and NAB counterpart Ross McEwan next week will be the treatment of savers, after many elderly customers have suffered from ultra-low rates paid on savings accounts.

Australia Latest News, Australia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

ANZ predicts interest rate hike next week, deems 0.1 per cent 'inappropriate'Australia's cost of living crisis is deepening this morning, with inflation soaring to a 21-year high. ChristineAhern 9News READ MORE:

ANZ predicts interest rate hike next week, deems 0.1 per cent 'inappropriate'Australia's cost of living crisis is deepening this morning, with inflation soaring to a 21-year high. ChristineAhern 9News READ MORE:

Read more »

The RBA is caught between poll and marketsJosh Frydenberg has reminded the RBA of its plan to wait for wages data before increasing interest rates, but major banks are urging the RBA to move next week

The RBA is caught between poll and marketsJosh Frydenberg has reminded the RBA of its plan to wait for wages data before increasing interest rates, but major banks are urging the RBA to move next week

Read more »

Interest rates are set to start rising. What does that mean for mortgage holders and homebuyers?The RBA could hike rates as early as May. Will borrowers race towards fixed-rate home loans?

Interest rates are set to start rising. What does that mean for mortgage holders and homebuyers?The RBA could hike rates as early as May. Will borrowers race towards fixed-rate home loans?

Read more »

The cost of living is soaring, but higher interest rates won’t helpIf the Reserve Bank raises interest rates on Tuesday it will add to the cost pressures facing many consumers and become political dynamite. | OPINION by Ross Gittins

The cost of living is soaring, but higher interest rates won’t helpIf the Reserve Bank raises interest rates on Tuesday it will add to the cost pressures facing many consumers and become political dynamite. | OPINION by Ross Gittins

Read more »

Pain coming for home owners as RBA mulls string of rate risesThe Reserve Bank is expected to lift interest rates to 0.25 per cent at its next meeting. But economists and markets say the rises won’t stop there.

Pain coming for home owners as RBA mulls string of rate risesThe Reserve Bank is expected to lift interest rates to 0.25 per cent at its next meeting. But economists and markets say the rises won’t stop there.

Read more »

One is not like the other - RBA not re-living 2007 campaign riseThe last time the RBA lifted rates in an election campaign, John Howard was PM. As Scott Morrison heads to the polls, markets again expect the RBA to move, but there are big differences between 2007 and 2022.

One is not like the other - RBA not re-living 2007 campaign riseThe last time the RBA lifted rates in an election campaign, John Howard was PM. As Scott Morrison heads to the polls, markets again expect the RBA to move, but there are big differences between 2007 and 2022.

Read more »