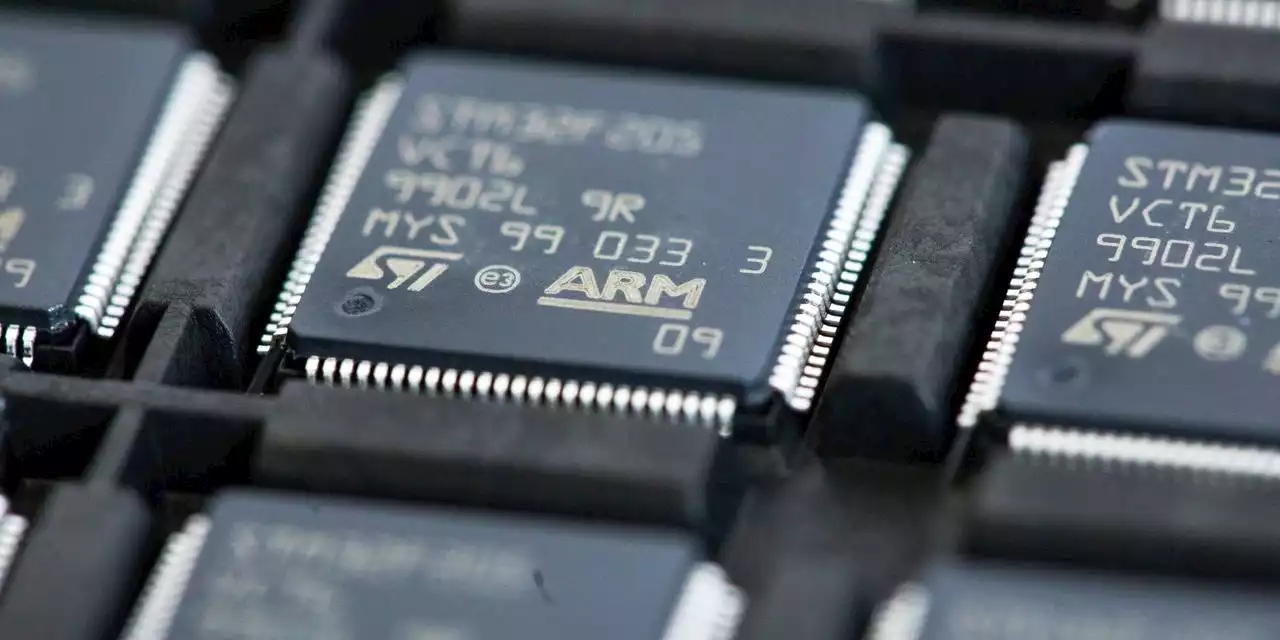

British supplier of designs for chips, long seen as the industry’s Switzerland, is challenged with growing beyond its dominance in mobile phones without upsetting existing customers.

This copy is for your personal, non-commercial use only. Distribution and use of this material are governed by our Subscriber Agreement and by copyright law.

For non-personal use or to order multiple copies, please contact Dow Jones Reprints at 1-800-843-0008 or visit www.djreprints.com.Company seeks growth in new markets and AI amid geopolitical tensions

Australia Latest News, Australia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

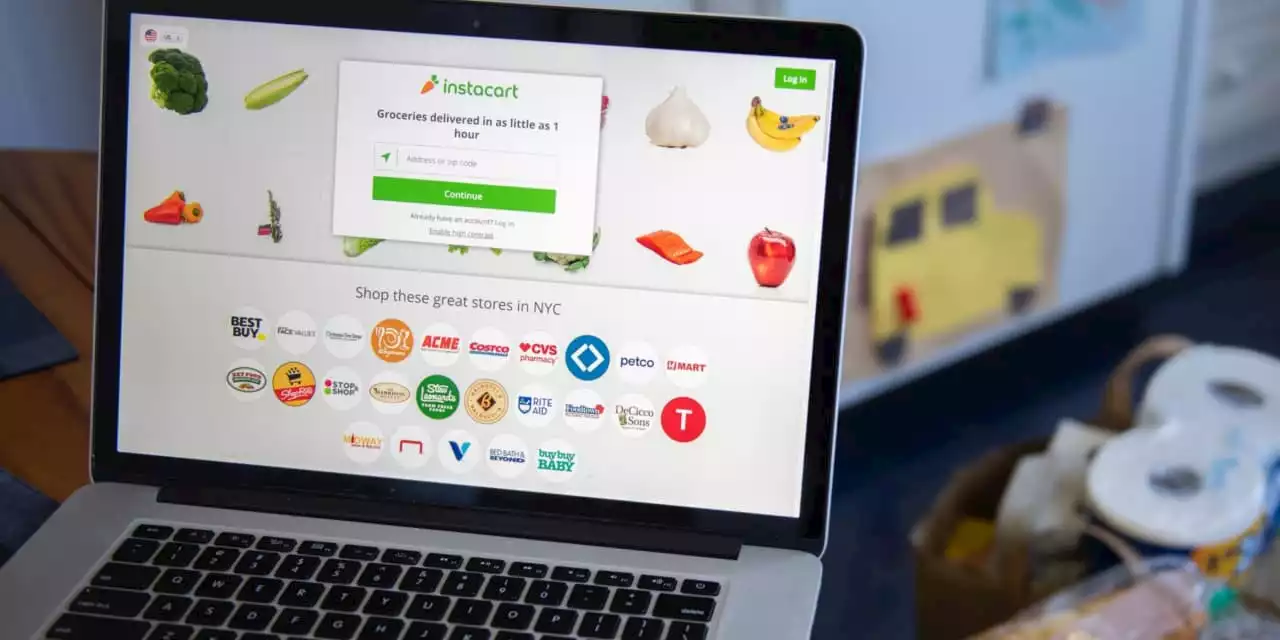

Instacart raises IPO price range after Arm's strong Wall Street debutInstacart controls about 22% of the $132 billion U.S. online grocery-delivery market, according to Evercore. The company said it had 5.1 million users as of June 2023.

Instacart raises IPO price range after Arm's strong Wall Street debutInstacart controls about 22% of the $132 billion U.S. online grocery-delivery market, according to Evercore. The company said it had 5.1 million users as of June 2023.

Read more »

Arm’s stock rises another 6.6% early Friday as it builds on robust gains after IPOArm Holdings Plc’s stock rose 6.6% in premarket trade Friday, extending the 25% gain it saw in its trading debut on Nasdaq on Thursday. The chip maker’s...

Arm’s stock rises another 6.6% early Friday as it builds on robust gains after IPOArm Holdings Plc’s stock rose 6.6% in premarket trade Friday, extending the 25% gain it saw in its trading debut on Nasdaq on Thursday. The chip maker’s...

Read more »

Arm valuation already 'looks full' after IPO, Needham saysArm stock could already be fully saturated a day after going public, according to Needham.

Arm valuation already 'looks full' after IPO, Needham saysArm stock could already be fully saturated a day after going public, according to Needham.

Read more »

Instacart Raises IPO Price Target After Successful Arm DebutInstacart's valuation rises to a range of $9.3 billion to $9.9 billion.

Instacart Raises IPO Price Target After Successful Arm DebutInstacart's valuation rises to a range of $9.3 billion to $9.9 billion.

Read more »

| Instacart Set to Raise IPO Price Target After Successful Arm DebutAt the high end of the new range, the grocery-delivery company would be valued at nearly $10 billion on a fully diluted basis.

| Instacart Set to Raise IPO Price Target After Successful Arm DebutAt the high end of the new range, the grocery-delivery company would be valued at nearly $10 billion on a fully diluted basis.

Read more »

Instacart bumps up IPO price, following big debut for ArmInstacart on Friday raised the estimated price of its IPO to between $28 and $30 a share, up from a prior range of $26 to $28, according to a filing. The...

Instacart bumps up IPO price, following big debut for ArmInstacart on Friday raised the estimated price of its IPO to between $28 and $30 a share, up from a prior range of $26 to $28, according to a filing. The...

Read more »