SoftBank boss Masayoshi Son faces a sobering end to his six-year chip party, write KarenKKwok and peter_tl

. An initial public offering will probably mean the Japanese group accepting a valuation below the $32 billion it paid for the business in 2016.

SoftBank has few alternatives to an IPO. Regulators are dubious about consolidation in an industry grappling with global shortages and concerns over the reliability of supply chains. The UK company’s neutral position, offering its chip designs to everyone without favouring a single customer, rules out most prospective buyers. Another mooted idea – selling Arm to a consortium of chipmakers – would prove difficult and unstable.

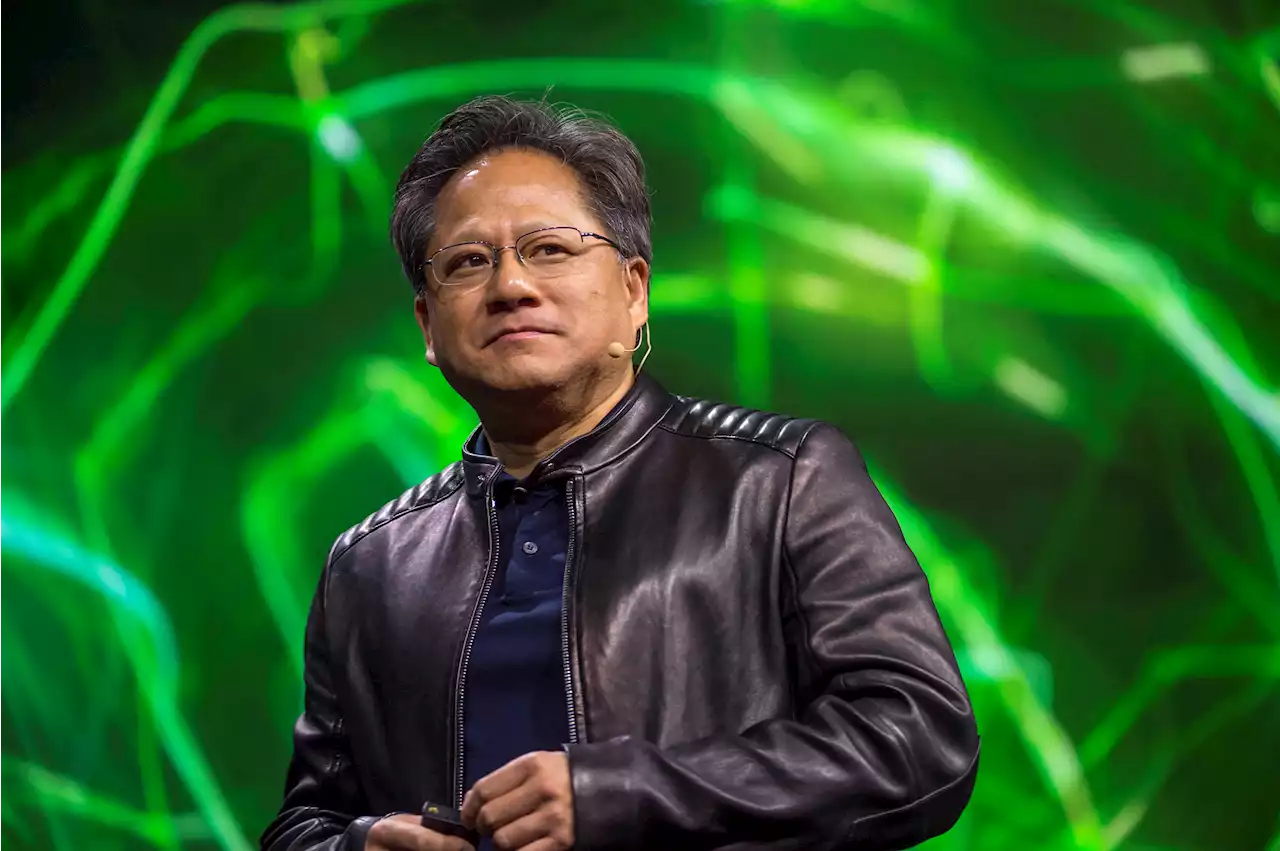

It’s also a tricky time for a stock market listing. The recent selloff has whacked highly valued tech stocks, prompting some private startups to postpone their market debuts . However, valuations for chipmakers are still relatively buoyant. Nvidia shares are worth almost twice as much as when the company run by Jensen Huang unveiled its Arm takeover in September 2020.Arm’s revenue grew 9.5% to almost $2 billion in the year to March 2021, according to UK Companies House. Assume its top line grows at the same rate for the next three years and sales will hit $2.6 billion. Nvidia trades at 16.

Son will hope that stock market investors see the same potential in Arm that he touted when buying the business almost six years ago. But barring an unlikely stock market revival, his chip splurge faces a financially disappointing end.

Australia Latest News, Australia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

SoftBank Plans to Take Arm Public After Nvidia's $66 Billion Takeover Deal CollapsesThe deal was originally announced in 2020 and had a value at the time of $40 billion in Nvidia stock and cash, before Nvidia’s stock rose.

SoftBank Plans to Take Arm Public After Nvidia's $66 Billion Takeover Deal CollapsesThe deal was originally announced in 2020 and had a value at the time of $40 billion in Nvidia stock and cash, before Nvidia’s stock rose.

Read more »

SoftBank Alibaba problem is worth more than an ArmWeak earnings from the Japanese conglomerate were eclipsed by its failed sale of the chip designer. Floating it instead could yet work well, but it won’t ease boss Masayoshi Son’s bigger issue: his stake in the Chinese e-commerce titan, which is worth as much as his entire firm.

SoftBank Alibaba problem is worth more than an ArmWeak earnings from the Japanese conglomerate were eclipsed by its failed sale of the chip designer. Floating it instead could yet work well, but it won’t ease boss Masayoshi Son’s bigger issue: his stake in the Chinese e-commerce titan, which is worth as much as his entire firm.

Read more »

Doomed From the Start? Why Nvidia Failed to Buy Arm From SoftBankThe semiconductor giants issued a joint statement Tuesday saying the deal has been scrapped due to “significant regulatory challenges.”

Doomed From the Start? Why Nvidia Failed to Buy Arm From SoftBankThe semiconductor giants issued a joint statement Tuesday saying the deal has been scrapped due to “significant regulatory challenges.”

Read more »

Nvidia officially terminates its Arm purchaseSoftBank Group announced plans today for an initial public offering for Arm instead.

Nvidia officially terminates its Arm purchaseSoftBank Group announced plans today for an initial public offering for Arm instead.

Read more »

Nvidia Abandons Plans To Acquire ARM Amid Regulatory Pressure, British Chipmaker Will Explore IPONvidia’s plans to acquire ARM have been scrapped amid regulatory pushback from the U.S., U.K. and Europe.

Nvidia Abandons Plans To Acquire ARM Amid Regulatory Pressure, British Chipmaker Will Explore IPONvidia’s plans to acquire ARM have been scrapped amid regulatory pushback from the U.S., U.K. and Europe.

Read more »