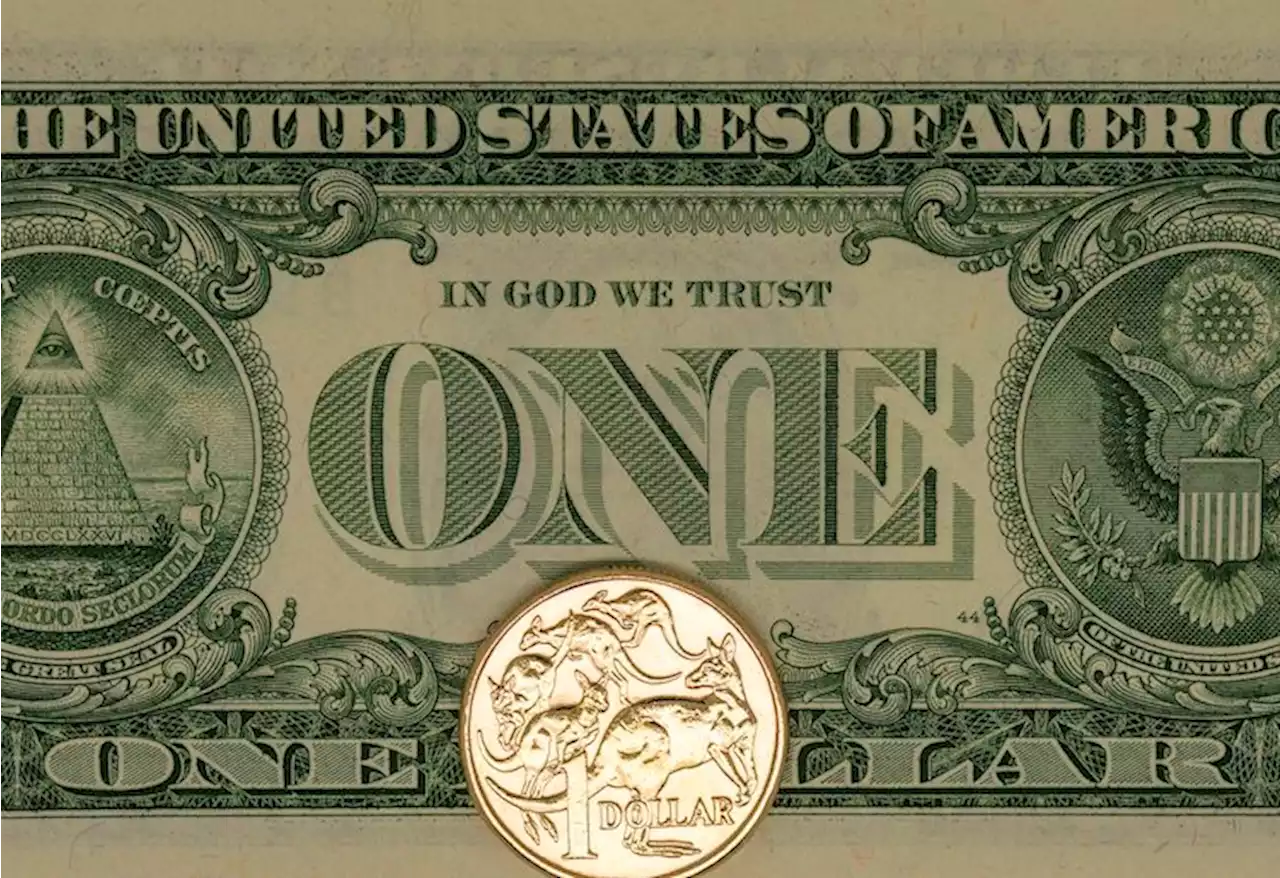

AUD/USD stays mildly offered near 0.6700 amid hawkish Fed bets, China concerns – by anilpanchal7 AUDUSD RBA Fed China RiskAppetite

While tracing the clues, headlines surrounding Australia’s biggest customer China and fears of the US Federal Reserve’s aggression gain major attention. It should be noted that the mixed comments from Reserve Bank of Australia official Jonathan Kearns also seemed to have exerted downside pressure on the risk-barometer pair.Elsewhere, comments from China’s State Planner, National Development and Reform Commission , act as an extra negative catalyst for the AUD/USD prices.

Elsewhere, US President Biden said, “I'm more optimistic than I have been in a long time.” The national leader also stated that they are going to get control of inflation. On the same line are the covid updates from China as it unlocks Dalian and Chengdu cities while witnessing zero coronavirus cases in Beijing and one, versus zero the previous day, outside Shanghai’s quarantine zone.

While portraying the mood, the S&P 500 Futures print mild losses while tracking Wall Street’s Friday close. It should be noted that the off in Japan restricts the bond moves in Asia but the yields are sturdy near the multi-day high amid recession fears and hawkish Fed expectations. It should be noted that the odds of the Fed’s 75 basis points rate hike rose to 82% while the market’s expectations of a full one percentage increase in the Fed rate lifted to 18% at the latest.

Looking forward, a light calendar and off in the UK may restrict AUD/USD moves. However, the risk-aversion and the pre-Fed anxiety could keep the pair on the back foot. Also important are the RBA Minutes, comments fromAUD/USD bears await a daily closing below the two-month-old support line, close to 0.6700 by the press time, to refresh the multi-month low.

Australia Latest News, Australia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

AUD/USD Price Analysis: Retreats towards two-month-old support near 0.6700 on PBOC actionAUD/USD Price Analysis: Retreats towards two-month-old support near 0.6700 on PBOC action – by anilpanchal7 AUDUSD PBOC Technical Analysis SwingTrading ChartPatterns

AUD/USD Price Analysis: Retreats towards two-month-old support near 0.6700 on PBOC actionAUD/USD Price Analysis: Retreats towards two-month-old support near 0.6700 on PBOC action – by anilpanchal7 AUDUSD PBOC Technical Analysis SwingTrading ChartPatterns

Read more »

Pairs in Focus This Week \u2013 EUR/USD, GBP/USD, AUD/USD, USD/JPGet the Forex Forecast using fundamentals, sentiment, and technical positions analyses for major pairs for the week of September 18th, 2022 here.

Pairs in Focus This Week \u2013 EUR/USD, GBP/USD, AUD/USD, USD/JPGet the Forex Forecast using fundamentals, sentiment, and technical positions analyses for major pairs for the week of September 18th, 2022 here.

Read more »

AUD/USD approaches 0.6770 hurdle as RBA’s Kearns sounds optimistic ahead of Fed, PMIsAUD/USD picks up bids to refresh intraday high around 0.6770, consolidating the losses after dropping to the 28-month low the previous day. In doing s

AUD/USD approaches 0.6770 hurdle as RBA’s Kearns sounds optimistic ahead of Fed, PMIsAUD/USD picks up bids to refresh intraday high around 0.6770, consolidating the losses after dropping to the 28-month low the previous day. In doing s

Read more »

Gold Price Forecast: XAU/USD stays inside bearish channel below $1,700, Fed in focusGold price (XAU/USD) remains steady at around $1,675 as Asian traders begin the key week comprising the monetary policy meeting of the Fed. The yellow

Gold Price Forecast: XAU/USD stays inside bearish channel below $1,700, Fed in focusGold price (XAU/USD) remains steady at around $1,675 as Asian traders begin the key week comprising the monetary policy meeting of the Fed. The yellow

Read more »

GBP/USD steadies near 1.1430 as focus shifts to Biden-Truss meet, Fed vs. BOE playGBP/USD struggles to remain above 1.1400 as traders begin the key week comprising the monetary policy announcements from the US Federal Reserve (Fed)

GBP/USD steadies near 1.1430 as focus shifts to Biden-Truss meet, Fed vs. BOE playGBP/USD struggles to remain above 1.1400 as traders begin the key week comprising the monetary policy announcements from the US Federal Reserve (Fed)

Read more »