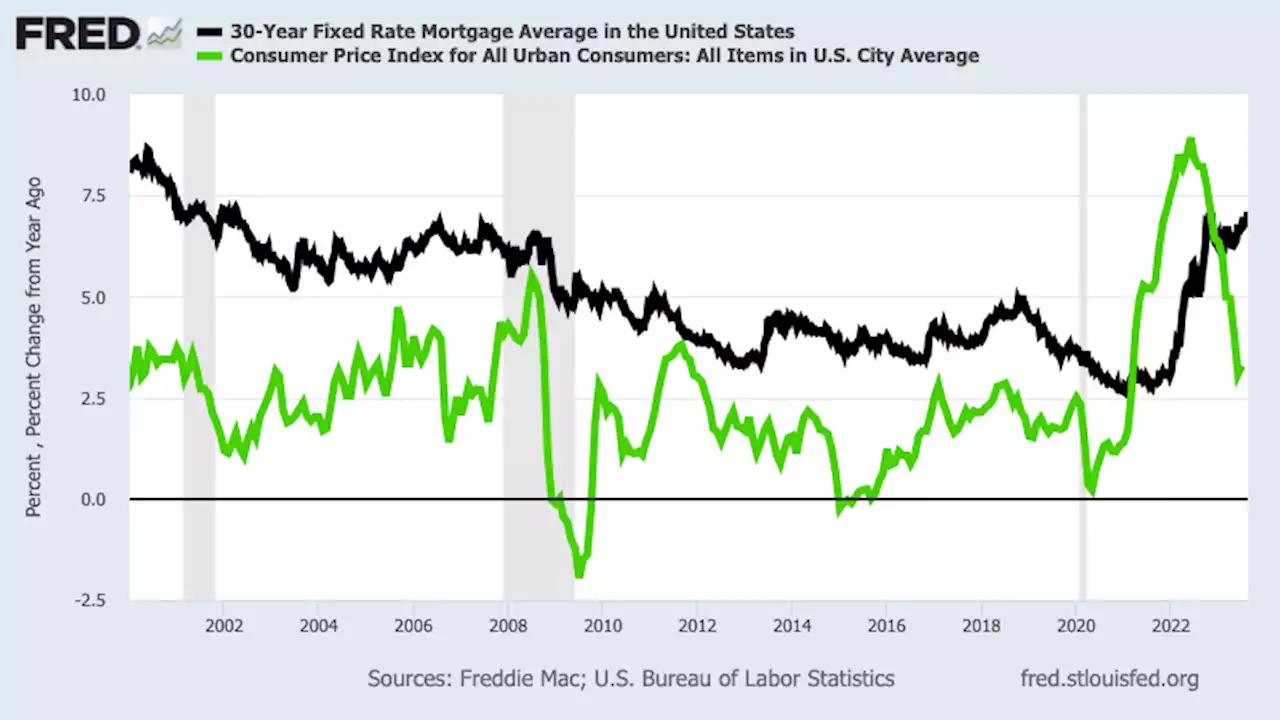

Rates is key to a homebuyer’s payment benchmark to jump 18% from February’s 2023 low.

After a springtime dip, rates have risen across financial markets this summer. The main culprit is a stern

Federal Reserve that’s willing to keep all interest rates high to make sure problematic inflation won’t returnLast November, mortgages hit their last peak of 7.08% as the Fed’s attempts to cool an overheated economy took full force. But as inflation began to slide from a four-decade high of 9%, fears ballooned about a possible recession. The Fed’s chore was done, right?And while inflation has cooled even further, there’s plenty of evidence the economy remains resilient, at a minimum.

Australia Latest News, Australia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Weekly mortgage demand drops again, as interest rates match a 22-year highMortgage rates rose for the third straight week last week, matching a 22-year high. As a result, mortgage demand dropped as well.

Weekly mortgage demand drops again, as interest rates match a 22-year highMortgage rates rose for the third straight week last week, matching a 22-year high. As a result, mortgage demand dropped as well.

Read more »

What 7% Mortgage Rates Mean for Home BuyersBuyers should focus on what they can control rather than try to predict mortgage rates.

What 7% Mortgage Rates Mean for Home BuyersBuyers should focus on what they can control rather than try to predict mortgage rates.

Read more »

Mortgage rates hit 22-year high, Bankrate saysThe average rate on 30-year mortgages climbed to 7.31% this week, according to Bankrate's weekly national survey of large lenders.

Mortgage rates hit 22-year high, Bankrate saysThe average rate on 30-year mortgages climbed to 7.31% this week, according to Bankrate's weekly national survey of large lenders.

Read more »

Weekly mortgage demand drops again, as interest rates match a 22-year highLast year the 30-year fixed was 5.45%, and in 2021, it was in the 3% range, showing just how far costs have risen since the Federal Reserve began raising rates.

Weekly mortgage demand drops again, as interest rates match a 22-year highLast year the 30-year fixed was 5.45%, and in 2021, it was in the 3% range, showing just how far costs have risen since the Federal Reserve began raising rates.

Read more »

Mortgage rates surge to 21-year highThe 30-year fixed-rate mortgage averaged 7.09% over the week ending on Thursday, Freddie Mac data shows.

Mortgage rates surge to 21-year highThe 30-year fixed-rate mortgage averaged 7.09% over the week ending on Thursday, Freddie Mac data shows.

Read more »

Homebuilder sentiment plummets as mortgage rates surge againBuilder confidence unexpectedly dropped for first time this year.

Homebuilder sentiment plummets as mortgage rates surge againBuilder confidence unexpectedly dropped for first time this year.

Read more »