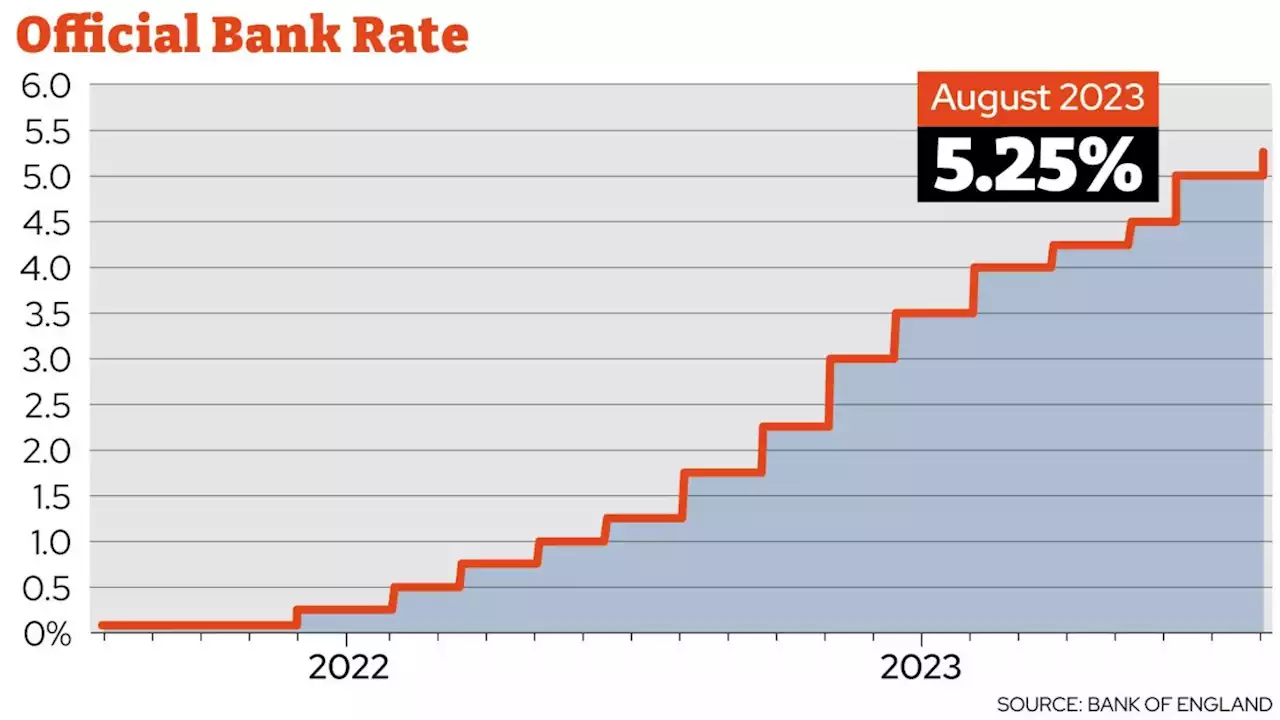

The Bank of England has increased its base rate to 5.25 per cent from 5 per cent - the 14th rate rise in a row

The Bank of England heaped further pressure on mortgage holders on Thursday as it hiked interest rates again in yet another bid to get inflation under control. The Bank warned of “crystallising” risks, which were pushing inflation upwards as it decided to increase its base rate to 5.25 per cent from 5 per cent - it is the 14th rate rise in a row.

However, in an unusual three-way disagreement, two members of the Bank’s decision-making Monetary Policy Committee voted to hike the rate further, while one wanted to keep it unchanged. The majority said that some of the risks of more persistent domestic inflation had “crystallised,” a word which the bank used repeatedly through its report on Thursday.

Top Money Stories Today What the rate rise means for mortgages Commenting on the rate rise and impact for mortgage holders and savers, Helen Morrissey, head of retirement analysis at Hargreaves Lansdown, said: “Today’s rise piles further misery on homeowners with those on tracker mortgages seeing rises overnight. Standard variable rate mortgage holders may find their rates move up slightly less but, with budgets under strain, any increase is hugely unwelcome.

“As a result, it’s cheaper for lenders to secure a fixed rate, so they are passing those savings on. Any downward trend will be welcomed by people looking to fix their mortgage costs, though it’s fair to say people looking to remortgage are finding themselves in a very different world to the one they were in when they got their previous deal.”

Latest Personal Finance News What the rate rise means for annuities If you are considering an annuity, then today’s announcement could bring further good news with the potential for further income increases.

Australia Latest News, Australia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Sarah Breeden appointed deputy Bank of England governor\n\t\t\tGet local insights from Lisbon to Moscow with an unrivalled network of journalists across Europe,\n\t\t\texpert analysis, our dedicated ‘Brussels Briefing’ newsletter. Customise your myFT page to track\n\t\t\tthe countries of your choice.\n\t\t

Read more »

Bank of England expected to hike interest rate for 14th time in a rowEconomists think a 0.25 percentage point rise to 5.25% is the most likely outcome on Thursday. But there are concerns about the impact of rising rates on many households.

Bank of England expected to hike interest rate for 14th time in a rowEconomists think a 0.25 percentage point rise to 5.25% is the most likely outcome on Thursday. But there are concerns about the impact of rising rates on many households.

Read more »

What time is the Bank of England's August interest rate announcement today?Economists are widely predicting the Bank will raise the base by 0.25 percentage points

What time is the Bank of England's August interest rate announcement today?Economists are widely predicting the Bank will raise the base by 0.25 percentage points

Read more »

Bank of England increases interest rates to 5.25% - what it means for mortgages and savingsThe Bank of England has increased the base rate from 5% to 5.25% this lunchtime, the 14th consecutive rise since December 2021, when rates were just 0.1% Here, CallumCMason examines what a 0.25 percentage point rise means for your money ⬇️

Bank of England increases interest rates to 5.25% - what it means for mortgages and savingsThe Bank of England has increased the base rate from 5% to 5.25% this lunchtime, the 14th consecutive rise since December 2021, when rates were just 0.1% Here, CallumCMason examines what a 0.25 percentage point rise means for your money ⬇️

Read more »

Bank of England increases interest rate for 14th time in a row to 5.25%BREAKING: The Bank of England has increased the base interest rate from 5% to 5.25% in the 14th consecutive hike 📺 Sky 501, Virgin 602, Freeview 233 and YouTube

Bank of England increases interest rate for 14th time in a row to 5.25%BREAKING: The Bank of England has increased the base interest rate from 5% to 5.25% in the 14th consecutive hike 📺 Sky 501, Virgin 602, Freeview 233 and YouTube

Read more »

Mortgage warning for millions as Bank of England hikes interest rates againMILLIONS of homeowners are braced for more mortgage misery as the Bank of England has hiked interest rates to a new 15-year high. The Bank’s Monetary Policy Committee (MPC) has lifted the…

Mortgage warning for millions as Bank of England hikes interest rates againMILLIONS of homeowners are braced for more mortgage misery as the Bank of England has hiked interest rates to a new 15-year high. The Bank’s Monetary Policy Committee (MPC) has lifted the…

Read more »