The 'bank of mum and dad' is increasingly providing cash assistance to struggling younger Australians, helping with living expenses and mortgage payments amid the cost-of-living crisis. The informal system, estimated to be between the fifth and ninth-largest lender in Australia, is seeing large sums transferred, often exceeding $200,000, to assist with homeownership.

The bank of mum and dad appears to be moving increasingly from a mortgage lender to an ATM – a cash provider to bail out families trapped in the cost-of-living crisis.

But the size of the amounts provided by parents to get a foothold in the property market was particularly notable: the bulk of these transfers were greater than $100,000 and many were in excess of $200,000. Grandparents are also becoming a meaningful contributor to family finances, often called on to pay for education or extracurricular activities like music lessons. The UBS survey says they now account for 14 per cent of these financial “transfers”.It is hardly surprising that the bank of mum and dad has been estimated to be between the fifth and the ninth-largest lender in the country, with about $35 billion in loans.

In decades gone by, Schellbach says, it was only the mega rich who were in a position to help their children buy homes. While the pre-death intergenerational wealth transfer via the bank of mum and dad makes sense, it isn’t without societal pitfalls. It creates a divide between those with parents with excess cash to hand their kids and those without.

BANK OF MUM AND DAD COST OF LIVING HOUSING MARKET FINANCIAL ASSISTANCE INTERGENERATIONAL WEALTH TRANSFER

Australia Latest News, Australia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Bank of Mum and Dad: From Mortgage Lender to ATMWith younger Australians struggling financially, the 'bank of mum and dad' is taking on a new role, increasingly providing cash bailouts for living expenses and mortgage interest payments. A new survey reveals that transfers from parents to children for housing deposits are substantial, often exceeding $200,000. Grandparents are also playing a larger role, contributing to education and extracurricular activities. This informal lending system is now estimated to be among the top lenders in the country, with about $35 billion in loans.

Bank of Mum and Dad: From Mortgage Lender to ATMWith younger Australians struggling financially, the 'bank of mum and dad' is taking on a new role, increasingly providing cash bailouts for living expenses and mortgage interest payments. A new survey reveals that transfers from parents to children for housing deposits are substantial, often exceeding $200,000. Grandparents are also playing a larger role, contributing to education and extracurricular activities. This informal lending system is now estimated to be among the top lenders in the country, with about $35 billion in loans.

Read more »

Bank of Mum and Dad Fuels Australian Housing Market Amidst Cost-of-Living CrisisThe traditional role of the 'Bank of Mum and Dad' is evolving, shifting from primarily providing first home deposits to offering vital financial assistance for living expenses and mortgage payments. This trend highlights the growing challenges faced by younger Australians in navigating the increasingly expensive housing market. With soaring property values and rising interest rates, parents are stepping in to support their children, contributing significantly to the nation's financial landscape. However, this reliance on familial support raises concerns about financial inequality and the potential for elder financial abuse.

Bank of Mum and Dad Fuels Australian Housing Market Amidst Cost-of-Living CrisisThe traditional role of the 'Bank of Mum and Dad' is evolving, shifting from primarily providing first home deposits to offering vital financial assistance for living expenses and mortgage payments. This trend highlights the growing challenges faced by younger Australians in navigating the increasingly expensive housing market. With soaring property values and rising interest rates, parents are stepping in to support their children, contributing significantly to the nation's financial landscape. However, this reliance on familial support raises concerns about financial inequality and the potential for elder financial abuse.

Read more »

Bank of Mum and Dad: From Mortgage Lender to ATM for Cost-of-Living CrisisThe 'Bank of Mum and Dad' is playing a more significant role in Australian finances, increasingly acting as a source of cash for living expenses and mortgage assistance rather than just first home deposits. A new survey reveals that substantial sums, often exceeding $100,000, are being transferred from parents to help children navigate the cost-of-living crisis. This informal lending system is estimated to be among the top lenders in the country, with around $35 billion in loans. While beneficial for many, this trend also raises concerns about widening socioeconomic divides and potential elder financial abuse.

Bank of Mum and Dad: From Mortgage Lender to ATM for Cost-of-Living CrisisThe 'Bank of Mum and Dad' is playing a more significant role in Australian finances, increasingly acting as a source of cash for living expenses and mortgage assistance rather than just first home deposits. A new survey reveals that substantial sums, often exceeding $100,000, are being transferred from parents to help children navigate the cost-of-living crisis. This informal lending system is estimated to be among the top lenders in the country, with around $35 billion in loans. While beneficial for many, this trend also raises concerns about widening socioeconomic divides and potential elder financial abuse.

Read more »

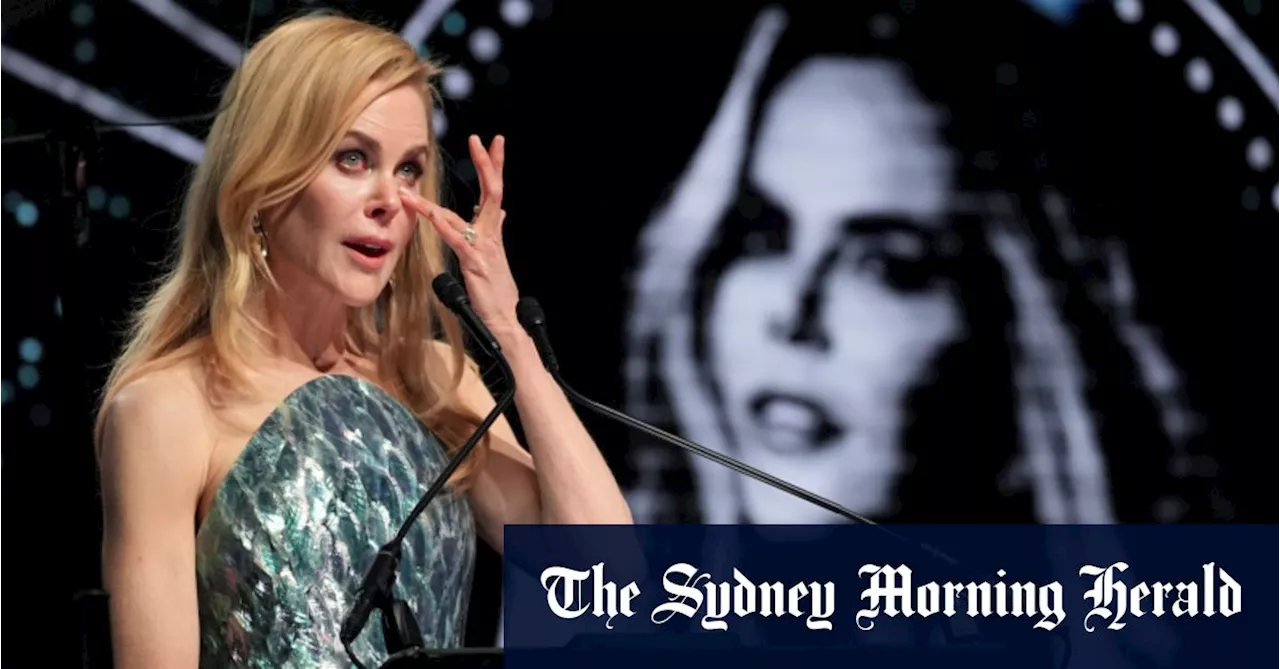

‘This is for you’: Nicole Kidman’s tearful dedication to late mother“My whole career has been for my mum and dad,” an emotional Kidman said.

‘This is for you’: Nicole Kidman’s tearful dedication to late mother“My whole career has been for my mum and dad,” an emotional Kidman said.

Read more »

‘Bawled my eyes out’: Kiwi dad left stunned by Aussie supermarket pricesA New Zealand father has revealed he was “overwhelmed” with emotion after discovering the price of groceries at Aldi since moving to Australia.

‘Bawled my eyes out’: Kiwi dad left stunned by Aussie supermarket pricesA New Zealand father has revealed he was “overwhelmed” with emotion after discovering the price of groceries at Aldi since moving to Australia.

Read more »

ANZ CEO Forgoes $3.2 Million in Bonuses After Investor BacklashOutgoing ANZ chief executive Shayne Elliott will forego $3.2 million in bonuses following a major investor revolt against the bank's executive pay scheme at its annual general meeting. Nearly 40% of investors voted against the pay scheme, marking the bank's first AGM strike in six years. Shareholders expressed concerns about perceived mismanagement and reputational issues, such as the bank's bond trading scandal and the delayed rollout of its new Plus banking platform. Acknowledging the criticism, ANZ chairman Paul O'Sullivan stated that Elliott would forfeit his long-term variable remuneration to mitigate the impact on the bank.

ANZ CEO Forgoes $3.2 Million in Bonuses After Investor BacklashOutgoing ANZ chief executive Shayne Elliott will forego $3.2 million in bonuses following a major investor revolt against the bank's executive pay scheme at its annual general meeting. Nearly 40% of investors voted against the pay scheme, marking the bank's first AGM strike in six years. Shareholders expressed concerns about perceived mismanagement and reputational issues, such as the bank's bond trading scandal and the delayed rollout of its new Plus banking platform. Acknowledging the criticism, ANZ chairman Paul O'Sullivan stated that Elliott would forfeit his long-term variable remuneration to mitigate the impact on the bank.

Read more »