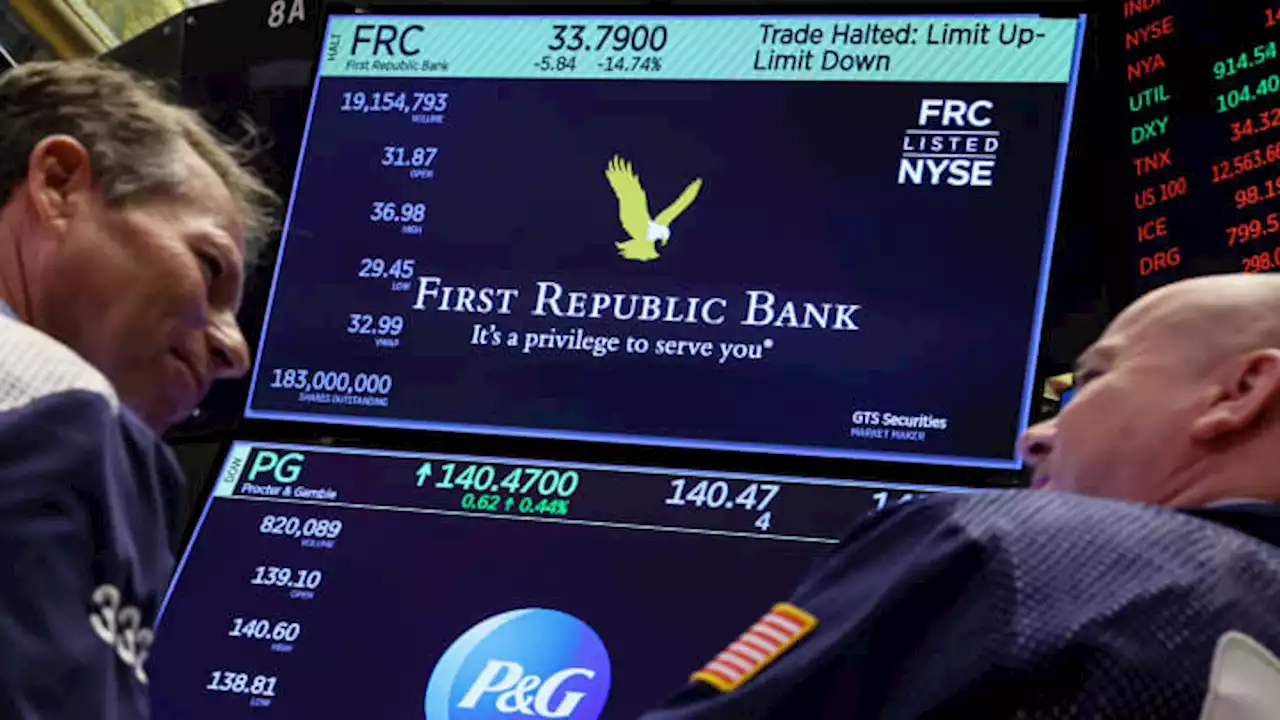

The potential First Republic rescue plan is the latest twist in a saga sparked by the sudden collapse of Silicon Valley Bank last month.

after CEO Michael Roffler opted not to take any questions after a brief 12-minute conference call.

To help a deal happen, advisors may offer warrants or preferred stock so that banks involved in the rescue can reap some of the upside of saving First Republic, the sources said.For years, First Republic was the envy of peers as its focus on rich Americans helped turbocharge growth and allowed it to poach talent. But that model broke down in the aftermath of the SVB failure as its wealthy customers quickly pulled uninsured deposits.

First Republic loaded up on low-yielding assets including Treasurys, municipal bonds and mortgages, making what was essentially a bet that interest rates wouldn't rise. When they did, the bank found itself with tens of billions of dollars in losses.

Australia Latest News, Australia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

First Republic bank says deposits tumbled 40% to $104.5 billion in the first quarterThe lender said things have stabilized since last month's banking emergency, but it will still reduce headcount by 20% to 25% in the second quarter.

First Republic bank says deposits tumbled 40% to $104.5 billion in the first quarterThe lender said things have stabilized since last month's banking emergency, but it will still reduce headcount by 20% to 25% in the second quarter.

Read more »

What First Republic's results mean for the regional bank trade, according to Wall StreetFirst Republic saw a larger deposit decline than many of its rivals during the first quarter.

What First Republic's results mean for the regional bank trade, according to Wall StreetFirst Republic saw a larger deposit decline than many of its rivals during the first quarter.

Read more »

First Republic Bank deposits tumble more than $100 bln as it explores optionsFirst Republic Bank shares sank more than 20% after the closing bell on Monday after the lender said deposits plunged by more than $100 billion in the first quarter and it was exploring options such as restructuring its balance sheet.

First Republic Bank deposits tumble more than $100 bln as it explores optionsFirst Republic Bank shares sank more than 20% after the closing bell on Monday after the lender said deposits plunged by more than $100 billion in the first quarter and it was exploring options such as restructuring its balance sheet.

Read more »

First Republic Bank deposits tumble more than $100 billion as it explores optionsFirst Republic Bank shares sank more than 20% after the closing bell on Monday as it said deposits plunged by more than $100 billion in the first quarter and it was exploring options such as restructuring its balance sheet.

First Republic Bank deposits tumble more than $100 billion as it explores optionsFirst Republic Bank shares sank more than 20% after the closing bell on Monday as it said deposits plunged by more than $100 billion in the first quarter and it was exploring options such as restructuring its balance sheet.

Read more »

First Republic shares slide as Q1 report reveals 40% dip in deposits after banking crisisFirst Republic Bank released its first-quarter financial results, which revealed a 40% decline in deposits compared to the end of 2022 in the wake of the recent banking crisis.

First Republic shares slide as Q1 report reveals 40% dip in deposits after banking crisisFirst Republic Bank released its first-quarter financial results, which revealed a 40% decline in deposits compared to the end of 2022 in the wake of the recent banking crisis.

Read more »

Treasury yields lower after First Republic stock-price slide10-year Treasury yields slipped to a seven-session low after news on Monday renewed concerns about an economic slowdown and stresses in the banking sector.

Treasury yields lower after First Republic stock-price slide10-year Treasury yields slipped to a seven-session low after news on Monday renewed concerns about an economic slowdown and stresses in the banking sector.

Read more »