Following years of investment in renewable energy, BP and Shell are now leading a pullback, selling off assets and scaling back ambitious targets. This shift reflects a broader trend among major oil companies as they refocus on their traditional oil and gas businesses.

Last week BP announced that it had sold its offshore wind assets into a joint venture with Japan’s JERA, itself a joint venture between Tokyo Electric Power and Chubu Electric Power, to create one of the world’s largest offshore wind businesses.

Where previously they planned to cap or reduce their production, now they are planning and investing to increase it. Where, over the past five years, Exxon’s share price has risen 54 per cent and Chevron’s 23 per cent, BP’s has fallen 22 per cent and Shell’s more than 6 per cent. That kind of disparity in performance tends to galvanise shareholders, along with executives motivated by their remuneration.

The problem, of course, is that the companies can’t satisfy both constituencies and in a contest between emissions and returns is one that ultimately shareholders will always win.

RENEWABLES OIL GAS BP SHELL INVESTMENT

Australia Latest News, Australia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Big Oil Retreats from Renewables: BP and Shell Lead the Way Back to Fossil FuelsThis news article discusses the recent shift by major oil companies, such as BP and Shell, away from their previous investments and commitments to renewable energy sources. It highlights their strategic moves to sell off renewable assets and prioritize their traditional oil and gas operations.

Big Oil Retreats from Renewables: BP and Shell Lead the Way Back to Fossil FuelsThis news article discusses the recent shift by major oil companies, such as BP and Shell, away from their previous investments and commitments to renewable energy sources. It highlights their strategic moves to sell off renewable assets and prioritize their traditional oil and gas operations.

Read more »

Welcome to the GSL T20 in Guyana where big oil, geopolitics and cricket collideT20 tournament has sprung up amid battle for oil and allies but do the cricketers actually know what is going on?

Welcome to the GSL T20 in Guyana where big oil, geopolitics and cricket collideT20 tournament has sprung up amid battle for oil and allies but do the cricketers actually know what is going on?

Read more »

The big picture: a lost office world of endless paper and big cigarsLars Tunbjörk’s late-90s picture of a Manhattan legal firm recalls a time before modular sofas and mobile phones

The big picture: a lost office world of endless paper and big cigarsLars Tunbjörk’s late-90s picture of a Manhattan legal firm recalls a time before modular sofas and mobile phones

Read more »

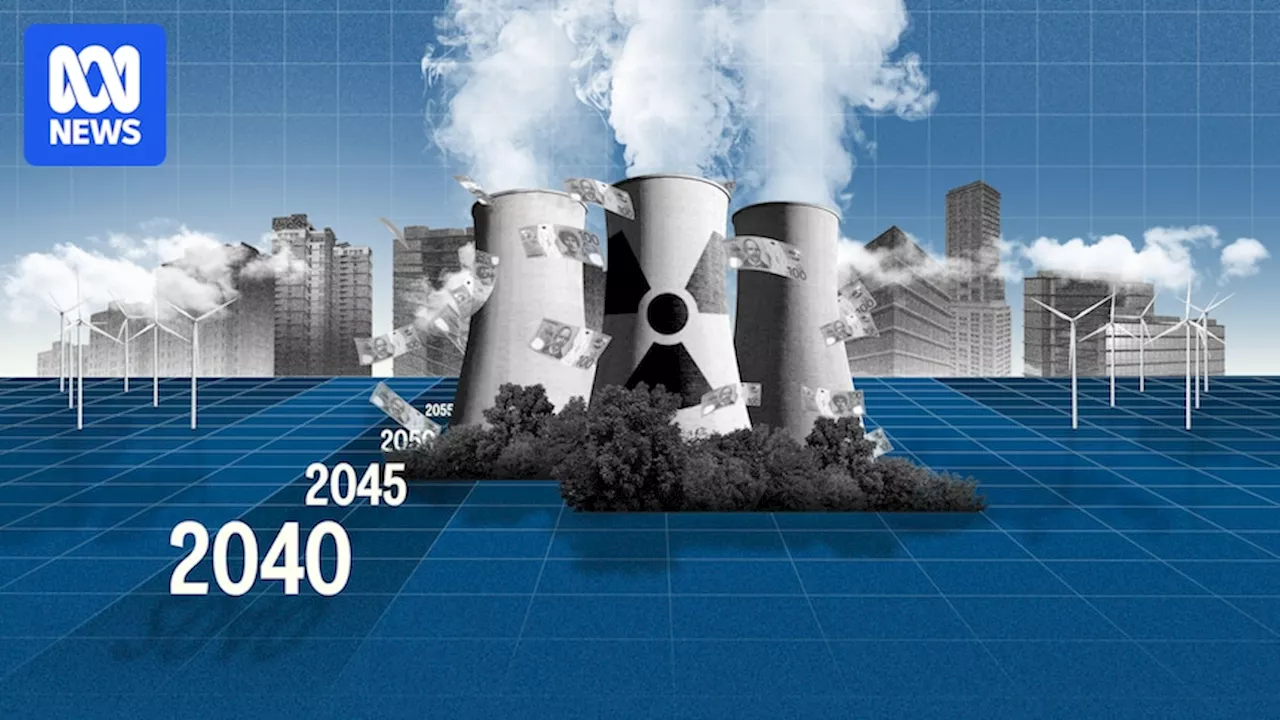

Treasurer defends ‘investable’ renewables over nuclear ‘insanity’Treasurer Jim Chalmers has hit out at the Coalition’s proposed nuclear energy policy, arguing that it is economically unfeasible and would rely heavily on taxpayer funding.

Treasurer defends ‘investable’ renewables over nuclear ‘insanity’Treasurer Jim Chalmers has hit out at the Coalition’s proposed nuclear energy policy, arguing that it is economically unfeasible and would rely heavily on taxpayer funding.

Read more »

CSIRO reaffirms nuclear power likely to cost twice as much as renewablesAfter heavy criticism, Australia's leading science agency doubles down its findings that the cost of nuclear power for Australia would likely be double that of renewable energy, and it would take at least 15 years for a plant to be built.

CSIRO reaffirms nuclear power likely to cost twice as much as renewablesAfter heavy criticism, Australia's leading science agency doubles down its findings that the cost of nuclear power for Australia would likely be double that of renewable energy, and it would take at least 15 years for a plant to be built.

Read more »

Renewables surge shows Australia can meet 2035 ambitious reductionsThe UK has promised to cut emissions by 81 per cent by 2035. The Climate Change Authority is considering how much more we could do.

Renewables surge shows Australia can meet 2035 ambitious reductionsThe UK has promised to cut emissions by 81 per cent by 2035. The Climate Change Authority is considering how much more we could do.

Read more »