Bank of America's Michael Hartnett isn't ready to pivot

P 500, followed by a 300-point drop by September 4.

The two key money moves, as per Bank of America’s latest weekly flow data: $US22.3 billion into stocks, and $US37.9 billion out of cash.Driven by enthusiasm over artificial intelligence, $US19 billion has flowed into tech stocks the past eight weeks. Mr Hartnett said that’s the “strongest momentum” for the sector since March 2021. Both Apple and Microsoft this week reset their respective record highs.

First, there was neither a first-quarter earnings recession nor a first half economic one as nominal GDP “remained supercharged” by US government spending, the Russia-Ukraine war and a US labour market “impervious” to rising interest rates. For now, bulls are in control and that’s likely to continue, Mr Hartnett said, until Fed policymakers reintroduce “fear” by signalling that rates won’t peak until they reach 6 per cent in order “to crack embedded inflation”.

Australia Latest News, Australia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

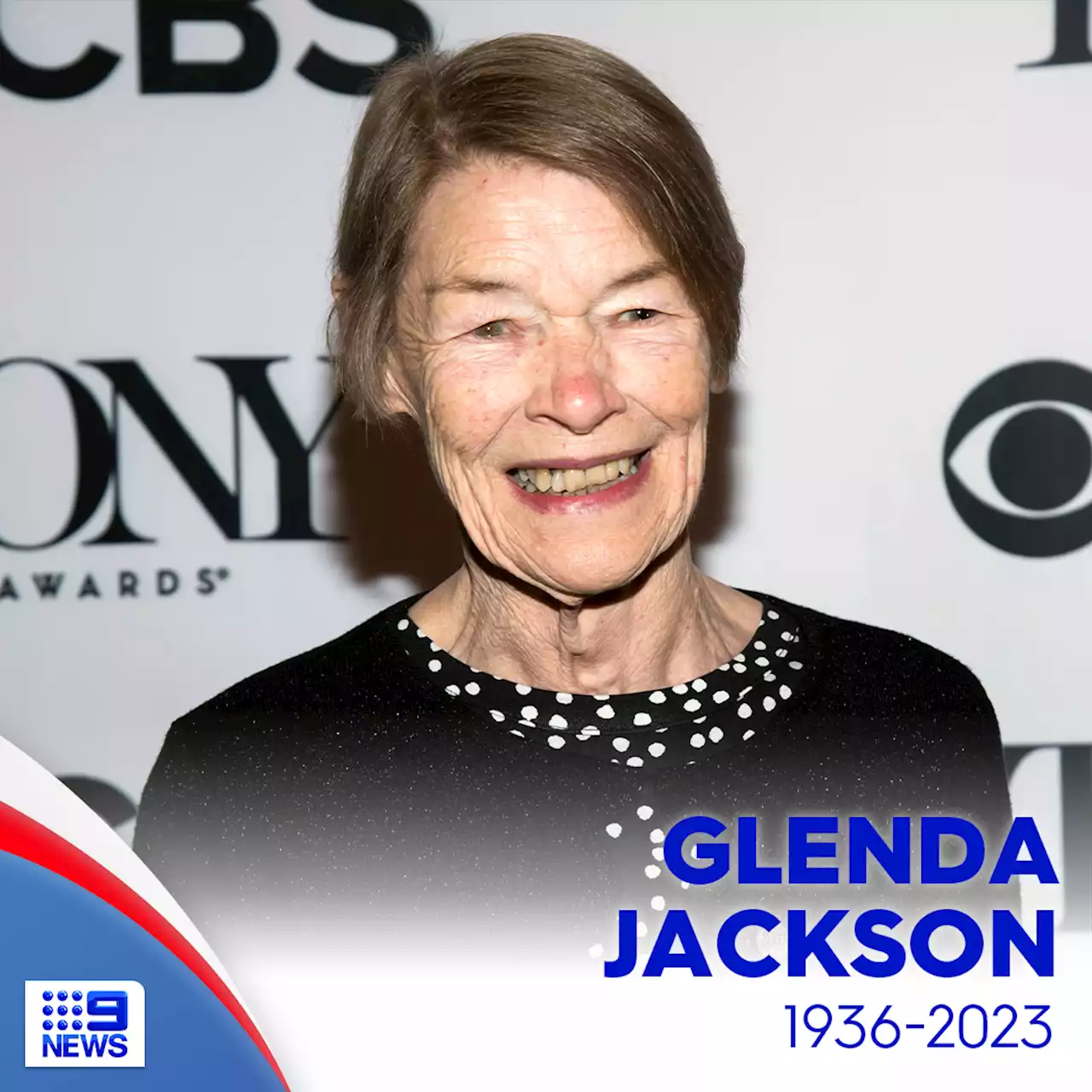

Two-time Oscar winner Glenda Jackson, who mixed acting with politics, dies at 87Glenda Jackson, a two-time Academy Award-winning performer who had a second career in politics as a British lawmaker, has died at 87. DETAILS: 9News

Two-time Oscar winner Glenda Jackson, who mixed acting with politics, dies at 87Glenda Jackson, a two-time Academy Award-winning performer who had a second career in politics as a British lawmaker, has died at 87. DETAILS: 9News

Read more »

Westpac first major bank to raise interest rates for customersLast week Westpac was the first major bank to raise interest rates for its customers within hours of the Reserve Bank’s decision. The company hiked rates by 25 basis points, with other banks slowly increasing their rates throughout the week.

Westpac first major bank to raise interest rates for customersLast week Westpac was the first major bank to raise interest rates for its customers within hours of the Reserve Bank’s decision. The company hiked rates by 25 basis points, with other banks slowly increasing their rates throughout the week.

Read more »