Stablecoins causing liquidity issues on exchanges exemplify the volatility that always seems to surprise crypto traders. noshitcoins illustrates the impact of the $USDC depeg and banking crisis on Bitcoin and crypto markets.

on March 10. The fear grew after the issuing management company Circle confirmed that $3.3 billion in reserves were held at Silicon Valley Bank.

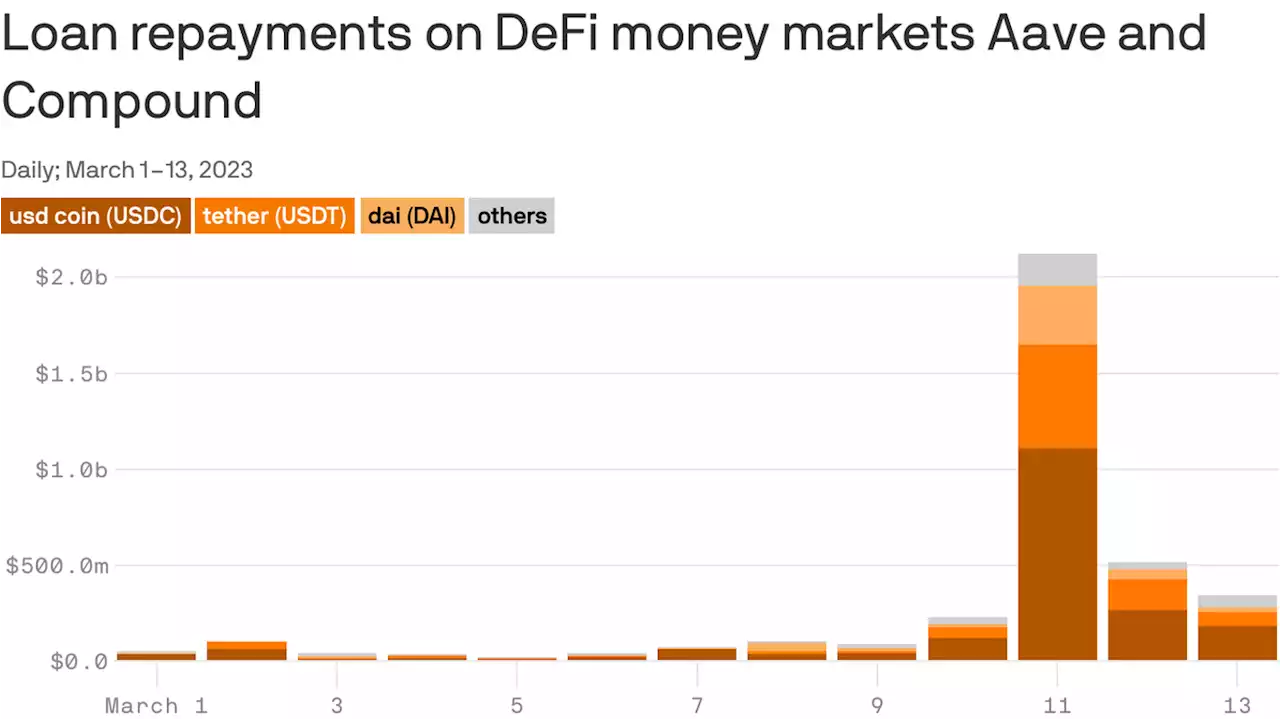

Such an unusual movement caused price distortion across exchanges, prompting Binance and Coinbase to disable the automatic conversion of the USDC stablecoin. The decoupling from $1 bottomed near $0.87 in the early hours of March 11 and was restored to $0.98 after FDIC's successful intervention in SVB was confirmed.

Let's take a look at Bitcoin derivatives metrics to see where professional traders stand in the current market.Bitcoin quarterly futures are popular among whales and arbitrage desks. These fixed-month contracts typically trade at a slight premium to spot markets, indicating that sellers are asking for more money to delay settlement for a longer period.

As a result, futures contracts in healthy markets should trade at a 5% to 10% annualized premium — a situation known as contango, which is not unique to crypto markets.The chart shows traders had been neutral-to-bearish until March 10 as the basis indicator oscillated between 2.5% and 5%. However, the situation quickly changed in the early hours of March 11 as the stablecoin USDC decoupled, and cryptocurrency exchanges were forced to change their conversion mechanisms.

Consequently, the Bitcoin 3-month futures premium turned into a discount, otherwise known as backwardation. Such movement is highly unusual and reflects investors' lack of trust in intermediaries or extreme pessimism towards the underlying asset. Even as the USDC stablecoin price approaches $0.995, the current 0% premium indicates a lack of leverage buying demand for Bitcoin via futures instruments.

Australia Latest News, Australia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Binance Adds BNB/USDC, BTC/USDC & ETH/USDC Trading Pairs | Binance SupportFellow Binancians, Binance will open trading for the BNB/USDC, BTC/USDC and ETH/USDC trading pairs at 2023-03-12 06:30 (UTC) . Start Trading on Binance Spot Now! Notes: Where any discrepancy ari...

Binance Adds BNB/USDC, BTC/USDC & ETH/USDC Trading Pairs | Binance SupportFellow Binancians, Binance will open trading for the BNB/USDC, BTC/USDC and ETH/USDC trading pairs at 2023-03-12 06:30 (UTC) . Start Trading on Binance Spot Now! Notes: Where any discrepancy ari...

Read more »

Insolvency fears led many to turn to other stablecoins, sell USDC at a major discountMany USDC holders have fled to other stablecoins amid fears surrounding its solvency, but not all of them have been successful during panic selling.

Insolvency fears led many to turn to other stablecoins, sell USDC at a major discountMany USDC holders have fled to other stablecoins amid fears surrounding its solvency, but not all of them have been successful during panic selling.

Read more »

How USDC investors saved millionsCircle's dollar-pegged stablecoin briefly broke away from its $1 peg, as market volatility led to bank failures that incited panic and fear across the industry.

How USDC investors saved millionsCircle's dollar-pegged stablecoin briefly broke away from its $1 peg, as market volatility led to bank failures that incited panic and fear across the industry.

Read more »

USDC Recovers to $0.95, Bitcoin Reclaims the $20K Mark (Weekend Watch)A stablecoin (USDC) is the best performer amid the top 10 cryptocurrencies by market cap for the past 24 hours.

USDC Recovers to $0.95, Bitcoin Reclaims the $20K Mark (Weekend Watch)A stablecoin (USDC) is the best performer amid the top 10 cryptocurrencies by market cap for the past 24 hours.

Read more »

Is Circle's USDC Stablecoin Crisis a Blessing in Disguise for Bitcoin?The recent crisis surrounding Circle's USD Coin (USDC) stablecoin may have inadvertently boosted Bitcoin, as people are turning to it to achieve a synthetic USD due to the collapse of USDC

Is Circle's USDC Stablecoin Crisis a Blessing in Disguise for Bitcoin?The recent crisis surrounding Circle's USD Coin (USDC) stablecoin may have inadvertently boosted Bitcoin, as people are turning to it to achieve a synthetic USD due to the collapse of USDC

Read more »

USDC Dominated Trading Volume on Decentralized Exchanges Amidst Depegging Incident – Market Updates Bitcoin NewsStatistics recorded on Saturday show that more than 55% of Uniswap’s trades involved $USDC against wrapped ether, and the stablecoin tether.

USDC Dominated Trading Volume on Decentralized Exchanges Amidst Depegging Incident – Market Updates Bitcoin NewsStatistics recorded on Saturday show that more than 55% of Uniswap’s trades involved $USDC against wrapped ether, and the stablecoin tether.

Read more »