On Breakingviews: It may sound hairy for banks to buy senior tranches of the CLOs they arrange, but it makes sense. The bigger problem is that such measures might not be enough to keep the $1 trillion market chugging along next year, writes Unmack1

. It seems like a repeat of the 2008 mess, when banks got stuck with unsellable mortgage securities. But it’s less risky than it sounds. Top-rated CLO tranches typically only take a hit once overall losses on the underlying loans exceed. So, for example, 70% of the whole portfolio would have to default, with the creditors recovering just half of their money, before AAA tranches see a loss. And the significantly higher spreads in 2022 implies bankers are being compensated well for that risk.

But the banks can’t keep the show on the road alone. If credit investors like hedge funds worry about a looming recession, they’re likely to steer clear of the riskier CLO securities that take the first hit when private equity-backed firms fail. A slower economy may also lead to rating downgrades on loans and CLO bonds, causing investors to demand higher yields. And the rising cost of debt continues to drag on private equity dealmaking, limiting the supply of the underlying loans.

CLOs pool debt used for buyouts and fund it by issuing bonds of varying risk to credit investors. Rating agencies typically give the highest-ranking tranches an AAA grade. European CLO sales, including refinancings, totalled 31 billion euros in the year to November, according to JPMorgan analysts, which was 67% below the level in the same period of 2021.

Banks’ willingness to act as an investor in AAA tranches has helped a number of CLOs “get over the line”, Morgan Stanley analysts wrote in a note to clients.Opinions expressed are those of the author. They do not reflect the views of Reuters News, which, under the Trust Principles, is committed to integrity, independence, and freedom from bias.

Australia Latest News, Australia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Breakingviews - Sinopharm's second Chinese herb shot is potentHerbal remedies usually take a while to work. In Sinopharm's case, two years may be enough. The Chinese pharmaceutical giant may revive a buyout of its 32%-owned traditional medicine arm listed in Hong Kong. A growing disconnect between the Asian hub’s markets and those on the mainland allows for the buyer to pay a bigger premium and still hope for lucrative relisting closer to home.

Breakingviews - Sinopharm's second Chinese herb shot is potentHerbal remedies usually take a while to work. In Sinopharm's case, two years may be enough. The Chinese pharmaceutical giant may revive a buyout of its 32%-owned traditional medicine arm listed in Hong Kong. A growing disconnect between the Asian hub’s markets and those on the mainland allows for the buyer to pay a bigger premium and still hope for lucrative relisting closer to home.

Read more »

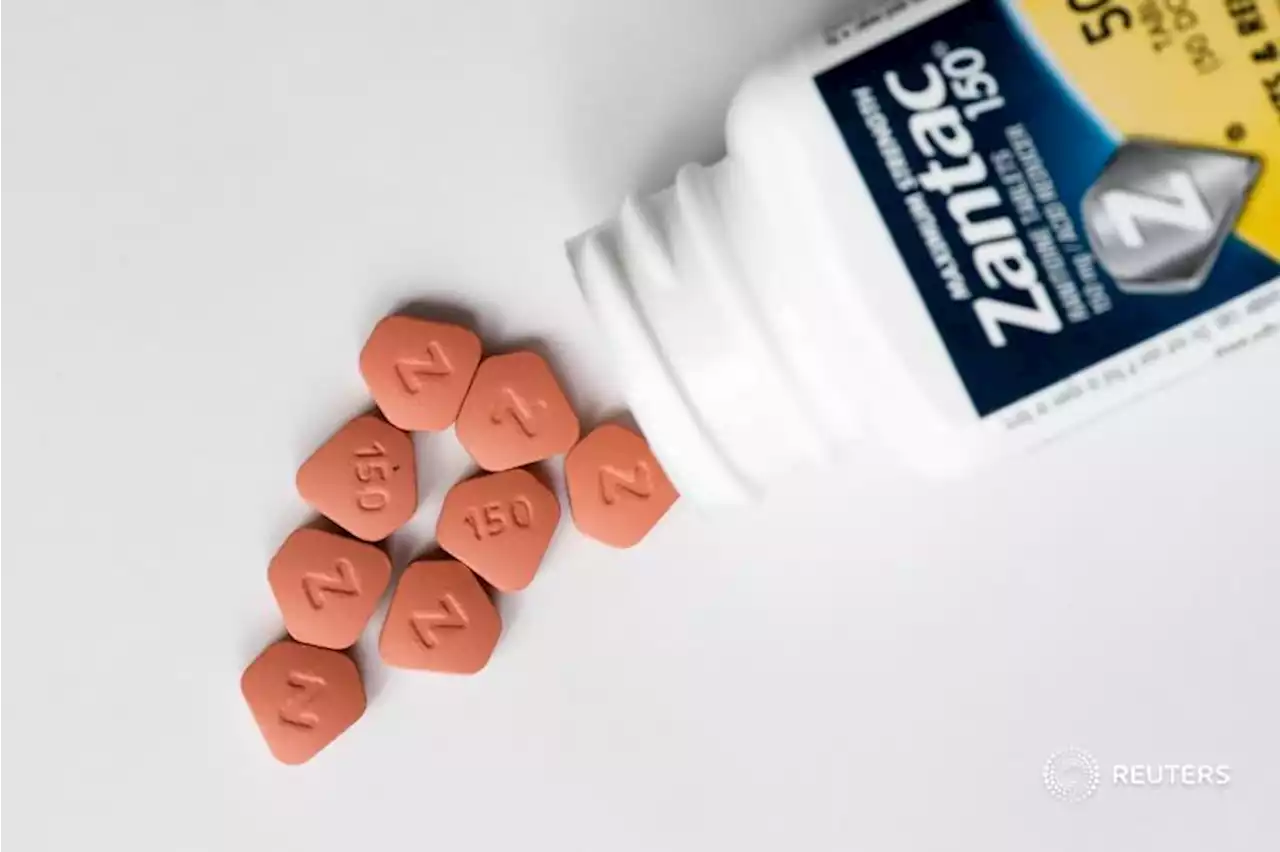

Breakingviews - Big Pharma’s heartburn win is a valuation salvePharmaceutical investors are accustomed to disappointment. An industry rule of thumb says that nine out of 10 drugs fail clinical trials, while treatments that succeed can bite companies on the tail if they have unanticipated side effects. The ghost of massive legal bill that drugmaker Bayer paid in 2020 has been haunting the sector. But a U.S. judge just made that spectre seem less threatening.

Breakingviews - Big Pharma’s heartburn win is a valuation salvePharmaceutical investors are accustomed to disappointment. An industry rule of thumb says that nine out of 10 drugs fail clinical trials, while treatments that succeed can bite companies on the tail if they have unanticipated side effects. The ghost of massive legal bill that drugmaker Bayer paid in 2020 has been haunting the sector. But a U.S. judge just made that spectre seem less threatening.

Read more »

Breakingviews - DWS’s best valuation fix is out of CEO’s handsDWS is thriving but not getting much credit. Despite volatile markets and an overhanging greenwashing scandal, the 6 billion euro group’s new boss Stefan Hoops on Wednesday pledged to boost its assets under management by focusing on racier areas like passive funds and alternative investments. He’s targeting earnings per share of 4.5 euros in 2025, a 15% increase on last year’s level and some 11% ahead of analysts’ forecasts for that year, according to Refinitiv data. A pledge to pay out 65% of earnings in 2025, and a hint of a 1 billion euro special dividend in 2024, would imply perhaps 2.9 billion euros of total shareholder payouts by 2025, according to Breakingviews calculations. That’s almost half DWS’s market value. The stock jumped 5.5%.

Breakingviews - DWS’s best valuation fix is out of CEO’s handsDWS is thriving but not getting much credit. Despite volatile markets and an overhanging greenwashing scandal, the 6 billion euro group’s new boss Stefan Hoops on Wednesday pledged to boost its assets under management by focusing on racier areas like passive funds and alternative investments. He’s targeting earnings per share of 4.5 euros in 2025, a 15% increase on last year’s level and some 11% ahead of analysts’ forecasts for that year, according to Refinitiv data. A pledge to pay out 65% of earnings in 2025, and a hint of a 1 billion euro special dividend in 2024, would imply perhaps 2.9 billion euros of total shareholder payouts by 2025, according to Breakingviews calculations. That’s almost half DWS’s market value. The stock jumped 5.5%.

Read more »

Breakingviews - Rio Tinto plays chancy round of Mongolian rouletteDecember 9 is shaping up to be a big day for Jakob Stausholm. Just ahead of his two-year anniversary as Rio Tinto’s chief executive, he will learn the fate of the mining giant’s tortuous efforts to buy out minority investors in Turquoise Hill Resources , the majority owner of a flagship project in Mongolia. Success would give the growth strategy a real boost; failure could mean senior heads roll.

Breakingviews - Rio Tinto plays chancy round of Mongolian rouletteDecember 9 is shaping up to be a big day for Jakob Stausholm. Just ahead of his two-year anniversary as Rio Tinto’s chief executive, he will learn the fate of the mining giant’s tortuous efforts to buy out minority investors in Turquoise Hill Resources , the majority owner of a flagship project in Mongolia. Success would give the growth strategy a real boost; failure could mean senior heads roll.

Read more »

Breakingviews - UniCredit CEO Orcel has leverage in pay debateAndrea Orcel’s remuneration is making headlines again. The UniCredit chief executive has already had a bumper year – in January, a Madrid court awarded him 51.4 million euros in compensation after Santander withdrew a job offer. A trickier question is what the 25 billion euro Italian bank’s board should agree to pay its veteran dealmaker for his day job.

Breakingviews - UniCredit CEO Orcel has leverage in pay debateAndrea Orcel’s remuneration is making headlines again. The UniCredit chief executive has already had a bumper year – in January, a Madrid court awarded him 51.4 million euros in compensation after Santander withdrew a job offer. A trickier question is what the 25 billion euro Italian bank’s board should agree to pay its veteran dealmaker for his day job.

Read more »