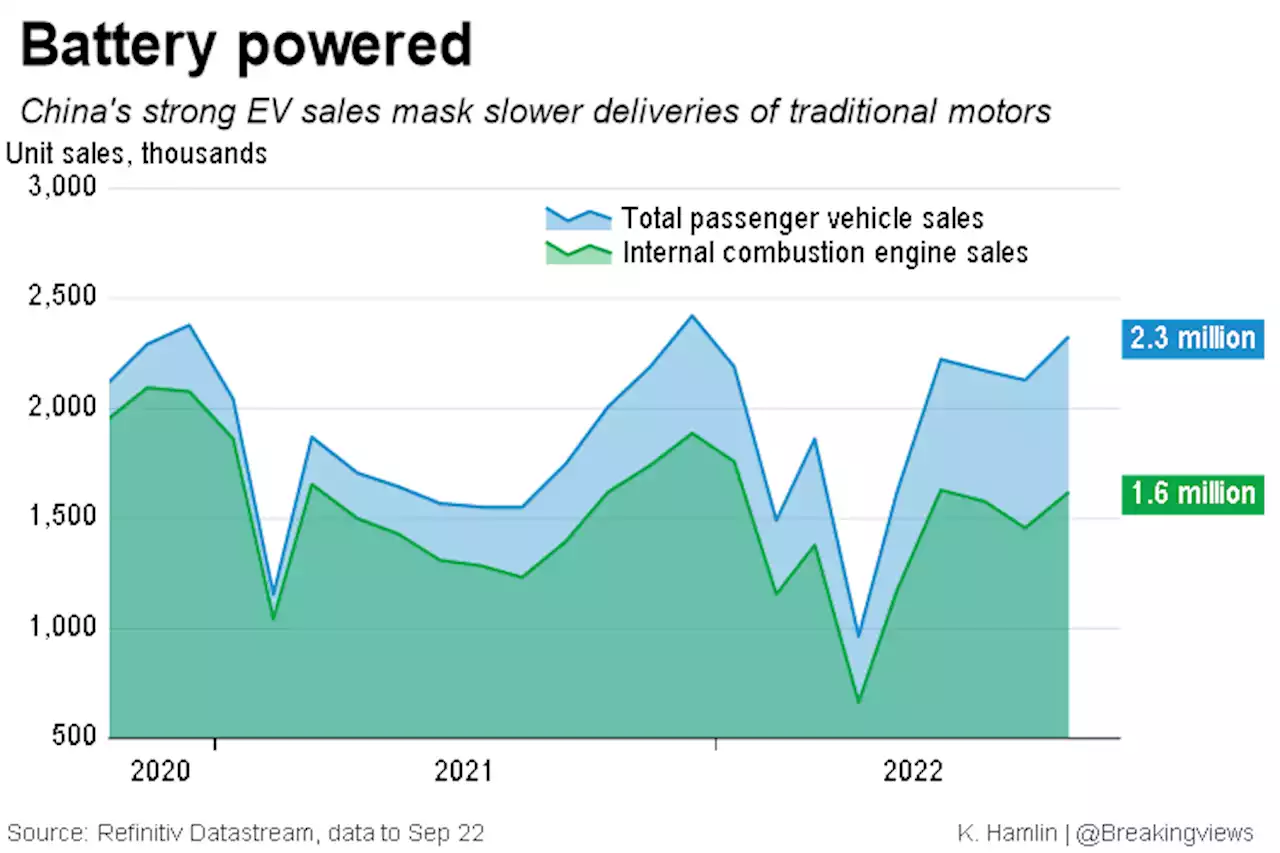

Chinese car sales grew by a third in September. But incentives greased a fragile recovery by pulling demand forward, and drivers’ demand for gas guzzlers is weakening, says KatrinaHamlin

Some recent purchases represent pent-up demand after months of lockdowns. Buyers were also capitalising on new policies: Beijing extended tax exemptions for electric cars in August, soon after halving auto purchase taxes for smaller gas guzzlers.scheme, where drivers relinquished older motors in return for subsidised newer models, successfully invigorated sales without undermining the months that followed. However, in China, underlying demand seems soft.

Purchases of traditional engines, representing two-thirds of the market, are down by a quarter year-to-date, making life tough for marques such as VolkswagenRegister now for FREE unlimited access to Reuters.comAs incentives expire, cars could follow a similar route to China’s commercial vehicles. A combination of new regulations and Covid-19 stimulus encouraged buyers to upgrade in 2020. Battery-powered designs were especially popular.

Australia Latest News, Australia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Breakingviews - China GDP delay amplifies economic distress signalIt’s mid-afternoon Monday in Beijing and a simple question is doing the rounds: will China’s latest GDP figures be published as scheduled the next day? The Chinese customs had unexpectedly its trade data on Friday. By 4PM it’s clear that the statistics bureau has followed suit, the only indication being a tweak to the online publication timetable set a year earlier. A day later, there’s still no sign of when the data will land, nor any clear explanation. The delay to this usually well-choreographed and executed quarterly exercise is an aberration. It’s also unnecessary.

Breakingviews - China GDP delay amplifies economic distress signalIt’s mid-afternoon Monday in Beijing and a simple question is doing the rounds: will China’s latest GDP figures be published as scheduled the next day? The Chinese customs had unexpectedly its trade data on Friday. By 4PM it’s clear that the statistics bureau has followed suit, the only indication being a tweak to the online publication timetable set a year earlier. A day later, there’s still no sign of when the data will land, nor any clear explanation. The delay to this usually well-choreographed and executed quarterly exercise is an aberration. It’s also unnecessary.

Read more »

J&J sales grow, but strong dollar tugs at expectationsJohnson & Johnson topped third-quarter expectations thanks to pharmaceutical sales growth, but a strong dollar made the health care giant tread cautiously again with its outlook.

J&J sales grow, but strong dollar tugs at expectationsJohnson & Johnson topped third-quarter expectations thanks to pharmaceutical sales growth, but a strong dollar made the health care giant tread cautiously again with its outlook.

Read more »

P&G starts fiscal year strong, but soaring dollar will stingProcter & Gamble expects sales for all of 2023 to fall between 1% and 3% compared with this year, with foreign exchange a six-percentage point headwind to sales growth.

P&G starts fiscal year strong, but soaring dollar will stingProcter & Gamble expects sales for all of 2023 to fall between 1% and 3% compared with this year, with foreign exchange a six-percentage point headwind to sales growth.

Read more »

Breakingviews - P&G’s pricing power hangs by a flossProcter & Gamble , which sells everything from diapers to laundry detergent, offers a lens into how consumers are feeling about their marginal dollar. show a company whose pricing power is hanging on by a piece of floss. That suggests people are about to ditch some of their few remaining small joys, even when it comes to necessary goods.

Breakingviews - P&G’s pricing power hangs by a flossProcter & Gamble , which sells everything from diapers to laundry detergent, offers a lens into how consumers are feeling about their marginal dollar. show a company whose pricing power is hanging on by a piece of floss. That suggests people are about to ditch some of their few remaining small joys, even when it comes to necessary goods.

Read more »

Breakingviews - Water risk powers fear-then-greed coal tradeShareholders have found a distressing silver lining to the floods that have been pounding eastern Australia. On Wednesday Whitehaven Coal revealed that its production fell 37% in the three months to the end of September compared to the same period last year in large part because rain cut off access to three of its mines for days at a time. Investors immediately sent stock in both the company and rival New Hope sinking 6% or more.

Breakingviews - Water risk powers fear-then-greed coal tradeShareholders have found a distressing silver lining to the floods that have been pounding eastern Australia. On Wednesday Whitehaven Coal revealed that its production fell 37% in the three months to the end of September compared to the same period last year in large part because rain cut off access to three of its mines for days at a time. Investors immediately sent stock in both the company and rival New Hope sinking 6% or more.

Read more »