From Breakingviews - Europe's biggest IPO prudently tests the water

Geothermal water is seen through a sight glass at a pipeline system of a geothermal power station of German power supplier EnBW Energie Baden Wuerttemberg AG, where a pilot facility for lithium extraction will be built, in Bruchsal, Germany, April 23, 2021. Picture taken April 23, 2021. REUTERS/Ralph Orlowski

LONDON, July 5 - Europe’s biggest listing this year is off to a cautious start. Hidroelectrica, Romania’s top hydropower producer,To entice investors, Hidroelectrica is promising to distribute at least 90% of its earnings in dividends. But the ample discount suggests impatience by CEO Bogdan Nicolae Badea to get the deal over the line: Bucharest is under pressure to list the state-owned company as soon as possible to access European Union funds.

Australia Latest News, Australia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Breakingviews - China plays it safe with new central bank chiefThe new boss of the People’s Bank of China (PBOC) is probably a relief to those anxiously watching the future of the most meritocratic regulator in the country. The ruling Communist Party on Saturday appointed Pan Gongsheng, who has been deputy governor for the past 11 years, as party secretary – the de facto boss that supervises the institution. The Wall Street Journal said that would be a prelude to Pan becoming governor next, citing unnamed sources.

Breakingviews - China plays it safe with new central bank chiefThe new boss of the People’s Bank of China (PBOC) is probably a relief to those anxiously watching the future of the most meritocratic regulator in the country. The ruling Communist Party on Saturday appointed Pan Gongsheng, who has been deputy governor for the past 11 years, as party secretary – the de facto boss that supervises the institution. The Wall Street Journal said that would be a prelude to Pan becoming governor next, citing unnamed sources.

Read more »

Breakingviews - Italy’s hottest financial saga gets new twistItaly’s most gripping corporate soap opera has entered a new chapter. Delfin, the holding company of the family of late eyewear billionaire Leonardo Del Vecchio, won regulatory approval to raise its stake in Assicurazioni Generali above its current holding of about 10%. Theoretically, that paves the way for Delfin, which already owns 20% in investment bank Mediobanca , to purchase up to 20% in the 30 billion euro top Italian insurer. The prospect got investors excited, lifting shares 5% on Monday. Yet the enthusiasm could be premature.

Breakingviews - Italy’s hottest financial saga gets new twistItaly’s most gripping corporate soap opera has entered a new chapter. Delfin, the holding company of the family of late eyewear billionaire Leonardo Del Vecchio, won regulatory approval to raise its stake in Assicurazioni Generali above its current holding of about 10%. Theoretically, that paves the way for Delfin, which already owns 20% in investment bank Mediobanca , to purchase up to 20% in the 30 billion euro top Italian insurer. The prospect got investors excited, lifting shares 5% on Monday. Yet the enthusiasm could be premature.

Read more »

Breakingviews - El Nino will brew up potent new economic stormJust when you thought it was safe to hope interest rates might soon peak, along comes more bad news. It looks likely that the El Nino weather phenomenon has returned, according to both the U.S. National Oceanographic and Atmospheric Administration and the Australian Bureau of Meteorology. Its appearance usually results in, or exacerbates, floods, heatwaves, water scarcity and wildfires, especially in the southern hemisphere. The damage these inflict on crops and infrastructure is inflationary, putting pressure on central banks to tighten monetary policy. If climate change makes such events stronger and more frequent, supply shocks will become embedded.

Breakingviews - El Nino will brew up potent new economic stormJust when you thought it was safe to hope interest rates might soon peak, along comes more bad news. It looks likely that the El Nino weather phenomenon has returned, according to both the U.S. National Oceanographic and Atmospheric Administration and the Australian Bureau of Meteorology. Its appearance usually results in, or exacerbates, floods, heatwaves, water scarcity and wildfires, especially in the southern hemisphere. The damage these inflict on crops and infrastructure is inflationary, putting pressure on central banks to tighten monetary policy. If climate change makes such events stronger and more frequent, supply shocks will become embedded.

Read more »

![]() Breakingviews - Ghost of Silicon Valley Bank turns up in ItalyA crisis at a small Italian insurer has rekindled concerns about the effect of rising rates. The rapid collapse of Silicon Valley Bank earlier this year was largely down to an ill-advised bond portfolio and liabilities that were less sticky than assumed. While Italy’s Eurovita isn’t a bank, its demise has some similarities with events across the Atlantic.

Breakingviews - Ghost of Silicon Valley Bank turns up in ItalyA crisis at a small Italian insurer has rekindled concerns about the effect of rising rates. The rapid collapse of Silicon Valley Bank earlier this year was largely down to an ill-advised bond portfolio and liabilities that were less sticky than assumed. While Italy’s Eurovita isn’t a bank, its demise has some similarities with events across the Atlantic.

Read more »

Breakingviews - Why central banks cannot relax in inflation fight: podcastWestern policymakers have frantically hiked interest rates to dampen consumer prices. In this Exchange podcast, Claudio Borio, a top official at the Bank for International Settlements, argues that rate-setters need to keep going to ensure costs of living won’t stay elevated.

Breakingviews - Why central banks cannot relax in inflation fight: podcastWestern policymakers have frantically hiked interest rates to dampen consumer prices. In this Exchange podcast, Claudio Borio, a top official at the Bank for International Settlements, argues that rate-setters need to keep going to ensure costs of living won’t stay elevated.

Read more »

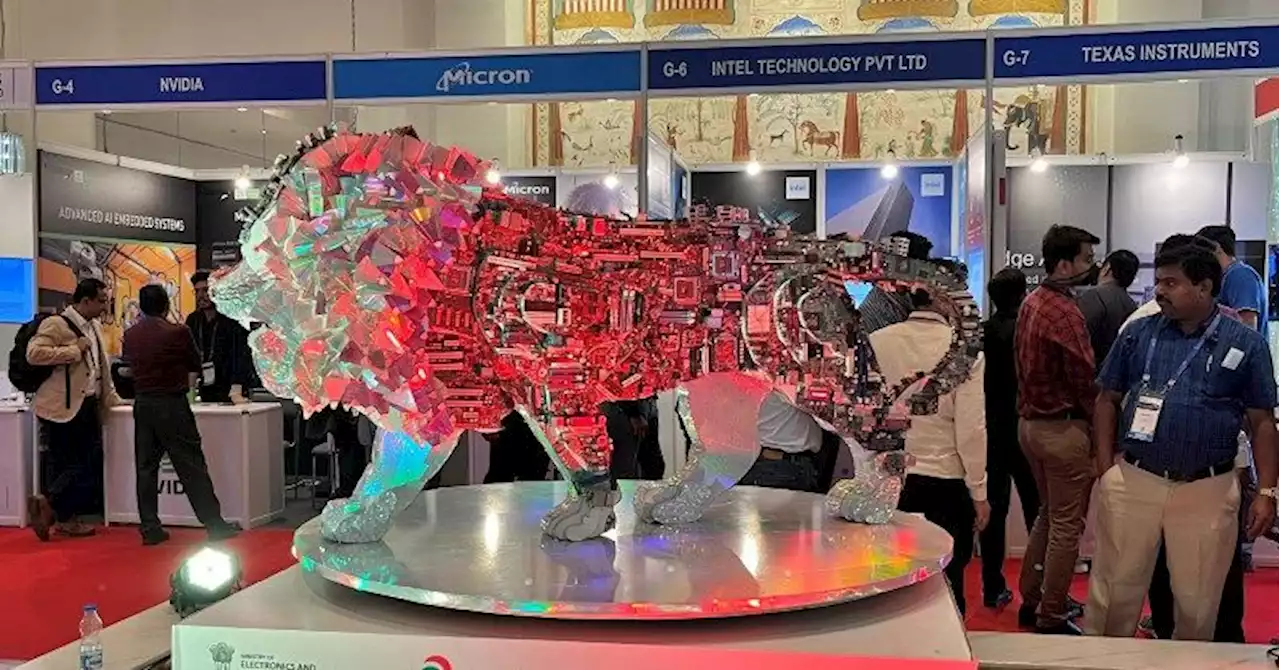

Breakingviews - India can aim lower in its chip dreamsIndia’s semiconductor dreams are facing a harsh reality. After struggling to woo cutting-edge chipmakers like Taiwan Semiconductor Manufacturing to set up operations in the country, the government may now have to settle for producing less-advanced chips instead. Yet that’s no mere consolation prize: the opportunity to grab share from China in this commoditised but vital part of the tech supply chain could pay off.

Breakingviews - India can aim lower in its chip dreamsIndia’s semiconductor dreams are facing a harsh reality. After struggling to woo cutting-edge chipmakers like Taiwan Semiconductor Manufacturing to set up operations in the country, the government may now have to settle for producing less-advanced chips instead. Yet that’s no mere consolation prize: the opportunity to grab share from China in this commoditised but vital part of the tech supply chain could pay off.

Read more »