There’s an absence of regulation on buy now, pay later services. But that may change soon. Read more:

Under the new rules, the popular service will be treated more like other credit products.

"For example, there's no point advertising for an interest-free product, when they're just going to slam you with pretty much double the amount for a late fee anyway, even if you're trying to communicate with these companies and make arrangements."The flagged changes have attracted the support of major players Afterpay and Zip, as well as the peak body for Australia's fintech industry.

Afterpay said in a statement that it welcomed progress on the reform options for "a fit-for-purpose" system that "provides certainty for industry, while Peter Gray, the co-found of Zip, said he anticipates there will be "very minimal" impact to the business as the company has already adopted measures like credit checks.

Reforms for the buy now, pay later industry are necessary because the opportunities it has brought business have come with "new and growing dangers to consumers", Financial Services Minister Stephen Jones said.Karen Cox, CEO of the Financial Rights Legal Centre, said it is important that strong enough safeguards are put in place on credit checks and obligations to ensure consumers aren't accruing debt well beyond their means to repay.

Kristen Hartnett, the national manager of Salvation Army's Moneycare financial counselling service, said she welcomed moves to provide regulation to a sector that has been up until now unregulated - and she urged those in financial distress to seek help.

Australia Latest News, Australia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Tough new regulations for buy now pay later industryThose who've been stung by buy now pay later schemes have welcomed the tough new rules brought in by the government in an effort to crack down on the industry. 9News

Tough new regulations for buy now pay later industryThose who've been stung by buy now pay later schemes have welcomed the tough new rules brought in by the government in an effort to crack down on the industry. 9News

Read more »

New regulations will ‘throttle’ buy now, pay laterAnalysts covering the buy now, pay later sector homed in on the potential for more stringent customer credit checking and credit limits to increase costs and slow growth. ausbiz auspol

New regulations will ‘throttle’ buy now, pay laterAnalysts covering the buy now, pay later sector homed in on the potential for more stringent customer credit checking and credit limits to increase costs and slow growth. ausbiz auspol

Read more »

Tough new regulations for buy now pay later industryThose who've been stung by buy now pay later schemes have welcomed the tough new rules brought in by the government in an effort to crack down on the industry. 9News

Tough new regulations for buy now pay later industryThose who've been stung by buy now pay later schemes have welcomed the tough new rules brought in by the government in an effort to crack down on the industry. 9News

Read more »

‘We’ve got the balance right’ in new buy now, pay later regulations: Stephen JonesAssistant Treasurer and Financial Services Minister Stephen Jones says the government has achieved an optimal balance with their newly implemented lending standards in the buy now, pay later industry. 'We're very confident we've got the right balance,' Mr Jones told Sky News Australia. 'I've seen the responses from consumer groups who widely and generally support the move that the government has taken to lift the bar to increase standards in lending in buy now, pay later.'

‘We’ve got the balance right’ in new buy now, pay later regulations: Stephen JonesAssistant Treasurer and Financial Services Minister Stephen Jones says the government has achieved an optimal balance with their newly implemented lending standards in the buy now, pay later industry. 'We're very confident we've got the right balance,' Mr Jones told Sky News Australia. 'I've seen the responses from consumer groups who widely and generally support the move that the government has taken to lift the bar to increase standards in lending in buy now, pay later.'

Read more »

Malcolm Turnbull gave this Cradle Mountain project $30 million. Five years later, it's been withdrawnThe Cradle Mountain Cableway is in serious doubt after the Commonwealth withdraws $30 million in funding from the project because the Tasmanian government missed a deadline.

Malcolm Turnbull gave this Cradle Mountain project $30 million. Five years later, it's been withdrawnThe Cradle Mountain Cableway is in serious doubt after the Commonwealth withdraws $30 million in funding from the project because the Tasmanian government missed a deadline.

Read more »

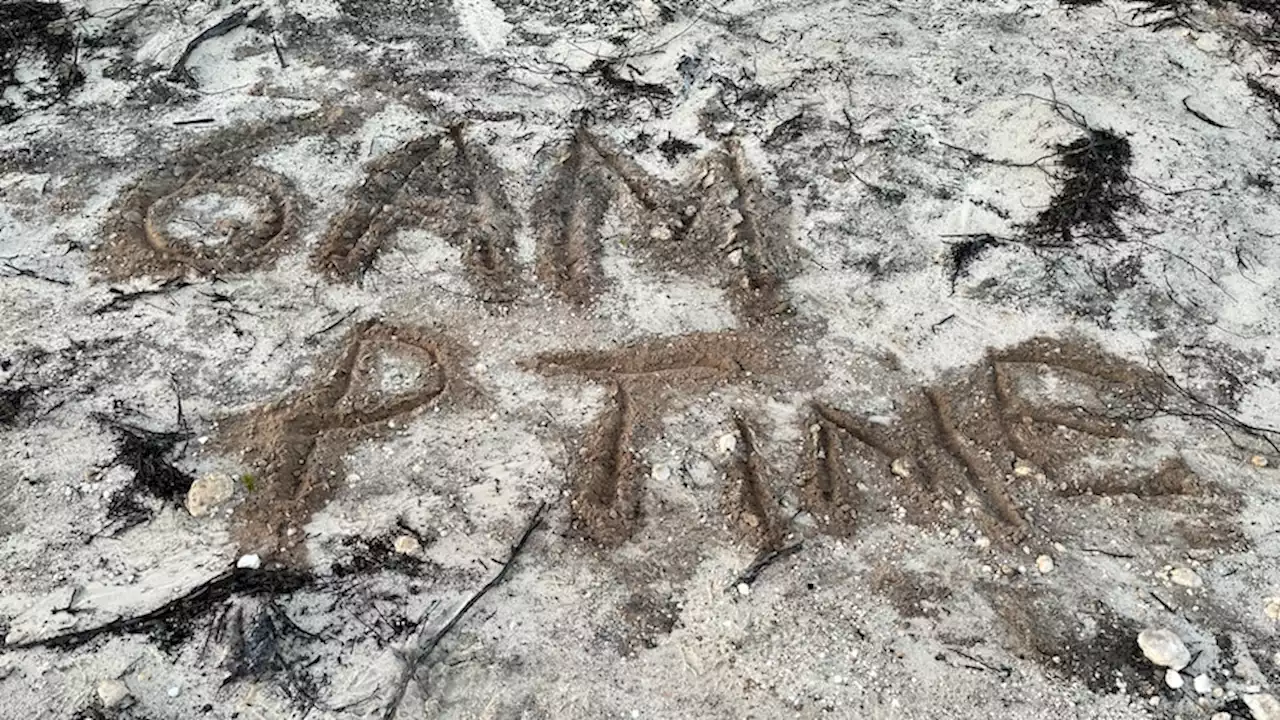

Man, 75, survives night alone lost on the NullarborA 75-year-old man who built a mattress out of tree branches and wrote a message for rescuers in the sand has been found by police after spending a night alone in 'one of the least populated places on the planet'.

Man, 75, survives night alone lost on the NullarborA 75-year-old man who built a mattress out of tree branches and wrote a message for rescuers in the sand has been found by police after spending a night alone in 'one of the least populated places on the planet'.

Read more »