This article provides a practical guide to budgeting, emphasizing the importance of planning and allocating funds effectively. It covers essential steps like identifying regular and irregular expenses, setting up a weekly budget, and prioritizing treats to ensure financial sustainability and well-being.

500 in a month (for one person, with no super-fancy meals) was a lot. Thankfully, I’ve rarely come close to that since. Fine dining isn’t high-value for me, but quality time with friends is. That month, I’d caught up with two friends who were in from out of town, a group I hadn’t seen in ages, and a few other catch-ups here and there. The money was worth the quality time spent. I managed the financial impact because I have a budget that I don’t hate.

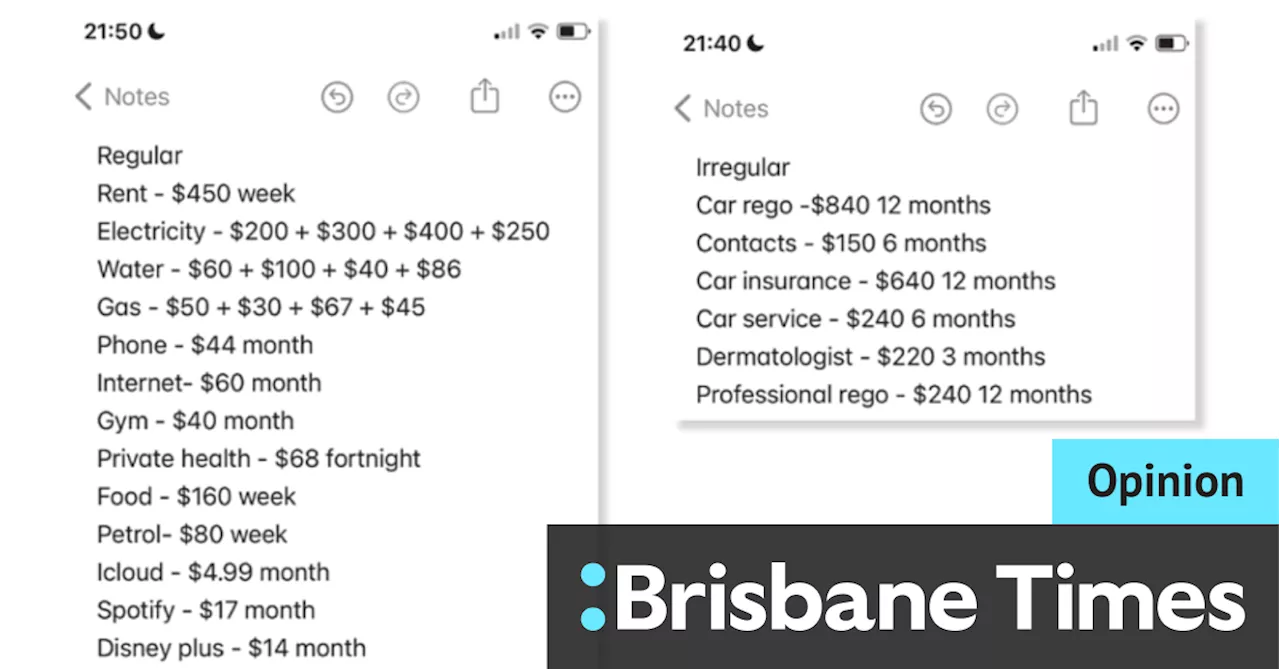

You’re doing yourself and your money a disservice when you don’t have a plan. Without one, your money will disappear, even if you don’t mean it to. Having a structure where your dollars know where they are all going, whether they’re reserved for fun or work, allows you to get the most return on the time you spent getting the dollars in the first place.\The expenses you need to pay – housing, utilities, food, childcare and direct debits such as health/pet insurance, gym membership etc. The expenses that are irregular and often sting. Think car registration, servicing and insurance, professional registration costs, dentist, specialists, optometrist, etc. This is where you take your debts from your shit list to your hit list. If you have no debt, you won’t need this. I use “emergency fund” as most people are familiar with this term. However, think of it more as your ultimate empowerment fund. You can build this up for whatever you want – quitting a job, replacing your hot water unit, insurance excesses, emergency flights home, etc. This is a goal account for whatever you want: holidays, school fees, starting a charity, home cinema, tattoos, etc. I once had a client with a knitting fund.\Let’s get the basics squared away. Go through at least three months of bank transactions. Currently, you’re looking for your regular and irregular ‘needs’ expenses. Have them on two different lists, one for regular and one for irregular. Include what they are, how often they occur and how much they are. It’s always better to acknowledge and plan for your weaknesses, rather than relying on your self-control. I recommend going back anywhere from six months to a full year to catch your irregular expenses in full, and to get a better idea of your utility costs. There can be a big variation between your summer and winter costs for these. Even though a mortgage is a debt, if you have one, count your repayments as a regular cost in this part rather than a debt paydown. Debt paydowns should focus on non-housing (and usually high-interest, high-stress) debt. Your notes will look something like Betty’s: Assuming you’re doing your budget weekly, you need to convert these to weekly costs. For your utilities, get a full year’s worth for accurate averaging. Taking Betty’s examples from above, we take the irregular expenses and convert them to an annual figure. This comes out at Looking at Betty’s regular expenses, we calculate them depending on their regularity. For her utilities, which are either bimonthly or quarterly, we add up the total yearly cost across the different amounts and then divide it by 52 weeks. (precise), and the fortnightly amounts just by two. If possible, we add a small buffer into the weekly amount to provide some coverage when things fluctuate slightly, or if we don’t quite have enough in there to cover the expenses the first time around while the system is getting set up. I highly recommend setting up as many of your expenses as you can to match your budget regularity. So, transfer This minimises your chances of accidentally spending money from your regular bills account because you forgot that your phone, health insurance and Spotify bills are all coming out the day before you get paid next week. After doing this step, Betty is left with Rather than adding your debts or emergency fund next, I recommend choosing your treats fund. Let me explain why. A common problem when sticking to a budget is that we aren’t giving ourselves permission to spend. In both financial counselling and financial coaching, clients would say, “I keep dipping into my savings/bills/expenses account and blowing it,” or “I can’t stick to the budget I set myself.” They all wanted to know how to change what they saw as a moral failing. I asked them how much money they give themselves to spend and 90 per cent of the time they said, “None, I can’t afford to be spending money on myself with these debts” or “Whatever’s left at the end”. In theory, that’s all good. But money was getting spent anyway, and it was getting spent hard. They would have this shame-spend cycle where every time money was spent when it “shouldn’t be”, they were miserable and swore to do better next time. Deprivation causes desperation. If you’re starting a new system, having a healthy dose of money to spend makes it far more enjoyable, and you’re more likely to succeed

BUDGETING FINANCE MONEY MANAGEMENT EXPENSES SAVINGS TREATS FINANCIAL FREEDOM PLANNING WEEKLY BUDGET

Australia Latest News, Australia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Leftovers Battle: Spoiled Sibling or Practical Saver?Two sisters, Jing and Lian, living together clash over their differing views on food waste and leftovers. Jing refuses to eat defrosted meals, while Lian advocates for batch cooking and freezing. This clash highlights the personal nature of food choices and the challenges of navigating differing preferences within a shared living space.

Leftovers Battle: Spoiled Sibling or Practical Saver?Two sisters, Jing and Lian, living together clash over their differing views on food waste and leftovers. Jing refuses to eat defrosted meals, while Lian advocates for batch cooking and freezing. This clash highlights the personal nature of food choices and the challenges of navigating differing preferences within a shared living space.

Read more »

Clean Energy: The Practical and Affordable Solution for AustraliaChris O'Keefe, national spokesperson for the Clean Energy Council, argues for clean energy as the most viable solution for Australia's energy needs. He highlights the affordability, speed, and sustainability of clean energy compared to nuclear power, emphasizing the need for practical solutions to bridge the gap left by retiring coal-fired power stations. O'Keefe also stresses the economic benefits of clean energy, creating jobs in regional areas and providing additional revenue streams for farmers.

Clean Energy: The Practical and Affordable Solution for AustraliaChris O'Keefe, national spokesperson for the Clean Energy Council, argues for clean energy as the most viable solution for Australia's energy needs. He highlights the affordability, speed, and sustainability of clean energy compared to nuclear power, emphasizing the need for practical solutions to bridge the gap left by retiring coal-fired power stations. O'Keefe also stresses the economic benefits of clean energy, creating jobs in regional areas and providing additional revenue streams for farmers.

Read more »

SBS News in Easy English 6 January 2025A daily five minute news wrap for English learners and people with disability.

SBS News in Easy English 6 January 2025A daily five minute news wrap for English learners and people with disability.

Read more »

Top 10 Easy Weeknight Meals of 2024Looking back on the year's culinary favorites, these 10 easy weeknight meals are sure to satisfy. From comforting soups and slow-cooked lamb shanks to flavorful stir-fries and hassle-free sausage dishes, there's something for everyone.

Top 10 Easy Weeknight Meals of 2024Looking back on the year's culinary favorites, these 10 easy weeknight meals are sure to satisfy. From comforting soups and slow-cooked lamb shanks to flavorful stir-fries and hassle-free sausage dishes, there's something for everyone.

Read more »

Easy Wholemeal Bread RecipeThis article provides a straightforward recipe for baking wholemeal bread. It includes tips on using white flour to achieve a lighter texture, the optional addition of vitamin C for a finer crumb, and instructions for kneading a soft dough.

Easy Wholemeal Bread RecipeThis article provides a straightforward recipe for baking wholemeal bread. It includes tips on using white flour to achieve a lighter texture, the optional addition of vitamin C for a finer crumb, and instructions for kneading a soft dough.

Read more »

SBS News in Easy English 10 January 2025A daily five minute news wrap for English learners and people with disability.

SBS News in Easy English 10 January 2025A daily five minute news wrap for English learners and people with disability.

Read more »