The developer is confident there is opportunity in the office market shakeout, as blue chip tenants chase high-quality workspace for their employees.

Already a subscriber?Industry super fund developer Cbus Property is going full steam ahead building a $1 billion tower Melbourne CBD tower with less than one third of its space pre-committed, confident that it will have few competitors for corporate tenants when completed at the end of 2026.which is taking 15,000 sq m, while law firm Baker McKenzie has just signed on for 3600 sq m.

“The logic behind it is that there is nothing else coming out of the ground by the time we are finished. The competition is very minimal, if any,” Cbus property chief executive Adrian Pozzo toldCbus Property is the development arm of the $85 billion industry fund which holds retirement savings for construction workers, employees in manufacturing, the media and elsewhere. Its property arm had a $6.

The Cbus Property chief hopes that “flight to quality” weighs in favour of a new building such as that at 435 Bourke Street, which among other thingsA key metric for developers, especially pertinent in a weak office market, is their ability to let space at economic rents, covering the cost of the building. For Cbus Property, building costs were locked in before construction inflation took off, giving it a better chance of securing those economic rents, even as the leasing market softened.

Cbus Property is in talks with at least six tenants who would account for 90 per cent of the space. But even if only half of them sign on, 50-60 per cent of the building will be leased, according to Mr Pozzo.

Australia Latest News, Australia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Rio Tinto’s reputation clean-up faces a $1b uranium testThe miner did well out of uranium in Kakadu for years – now it is paying for it. The prospect of writing a cheque to fund rehabilitation is raising questions.

Rio Tinto’s reputation clean-up faces a $1b uranium testThe miner did well out of uranium in Kakadu for years – now it is paying for it. The prospect of writing a cheque to fund rehabilitation is raising questions.

Read more »

Victoria is the fines capital, expected to rake in almost $1b this financial yearNo other Australian jurisdiction is as dependent on fines for cash, but the state government faces pressure to scale back its punitive approach to revenue-raising.

Victoria is the fines capital, expected to rake in almost $1b this financial yearNo other Australian jurisdiction is as dependent on fines for cash, but the state government faces pressure to scale back its punitive approach to revenue-raising.

Read more »

MMA Offshore: Energy transition story in Monday’s $1b buyoutThe last time vessel owner MMA Offshore hit the headlines, it was an offshore oil and gas services group going broke. Now it has a $1 billion bid, and investors can thank the energy transition.

MMA Offshore: Energy transition story in Monday’s $1b buyoutThe last time vessel owner MMA Offshore hit the headlines, it was an offshore oil and gas services group going broke. Now it has a $1 billion bid, and investors can thank the energy transition.

Read more »

MRM ASX: MMA Offshore recommends $1b takeover bidCyan Renewables said it would expand further into offshore wind projects after MMA Offshore agreed to accept a $1 billion takeover from the Asian private equity group.

MRM ASX: MMA Offshore recommends $1b takeover bidCyan Renewables said it would expand further into offshore wind projects after MMA Offshore agreed to accept a $1 billion takeover from the Asian private equity group.

Read more »

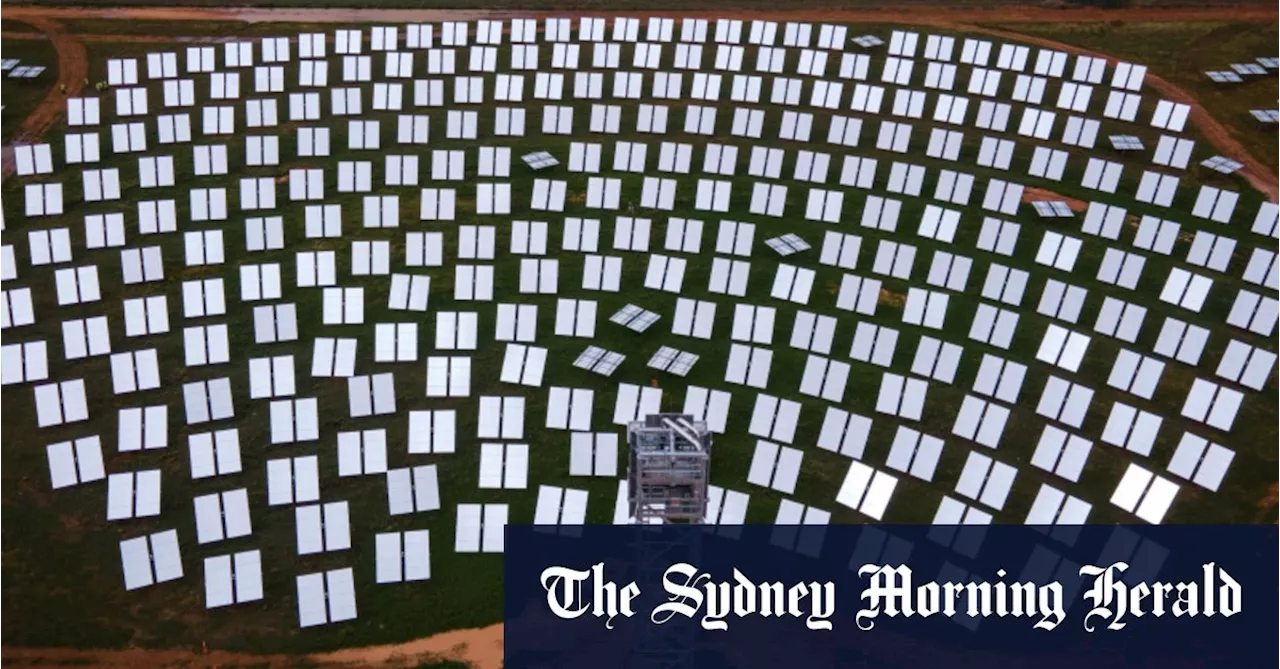

Energy transition: Anthony Albanese pours $1b into solar panel manufacturingThe Albanese government will dedicate $1 billion towards the domestic production of solar panels, including in coal-rich Hunter Valley.

Energy transition: Anthony Albanese pours $1b into solar panel manufacturingThe Albanese government will dedicate $1 billion towards the domestic production of solar panels, including in coal-rich Hunter Valley.

Read more »

Albanese’s $1b bet on Australian made solar panelsAustralia has the world’s highest uptake of rooftop solar panels with one in three households having them. However, only 1 per cent are manufactured locally.

Albanese’s $1b bet on Australian made solar panelsAustralia has the world’s highest uptake of rooftop solar panels with one in three households having them. However, only 1 per cent are manufactured locally.

Read more »