Investors disappointed after hoped-for policy plans by Beijing to stimulate economy did not materialise

Chinese stocks have suffered their worst fall in 27 years after efforts by Beijing to stimulate the world’s second-largest economy disappointed investors.

However, the hoped-for policy plans were not forthcoming. Instead, the NDRC officials mostly summarised September’s announcements and commented on the general economic situation. However, the markets remain higher than where they were a month ago, before the central bank and the politburo proposed a “package of incremental policies” to stabilise China’s ailing economy. The CSI 300 index is 7% higher than it was a year ago.

Australia Latest News, Australia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Why global investors made the wrong bet on a big Chinese stimulusChina’s sharemarkets and commodity prices soared over the past fortnight in response to a major monetary policy stimulus package and intense speculation that Beijing would follow up with fiscal stimulus this week. It hasn’t happened, or at least not yet.

Why global investors made the wrong bet on a big Chinese stimulusChina’s sharemarkets and commodity prices soared over the past fortnight in response to a major monetary policy stimulus package and intense speculation that Beijing would follow up with fiscal stimulus this week. It hasn’t happened, or at least not yet.

Read more »

Why global investors made the wrong bet on a big Chinese stimulusXi Jinping’s major fiscal stimulus package, which could have capitalised on the big bounce in the sharemarket, has so far failed to materialise.

Why global investors made the wrong bet on a big Chinese stimulusXi Jinping’s major fiscal stimulus package, which could have capitalised on the big bounce in the sharemarket, has so far failed to materialise.

Read more »

Why global investors made the wrong bet on a big Chinese stimulusXi Jinping’s major fiscal stimulus package, which could have capitalised on the big bounce in the sharemarket, has so far failed to materialise.

Why global investors made the wrong bet on a big Chinese stimulusXi Jinping’s major fiscal stimulus package, which could have capitalised on the big bounce in the sharemarket, has so far failed to materialise.

Read more »

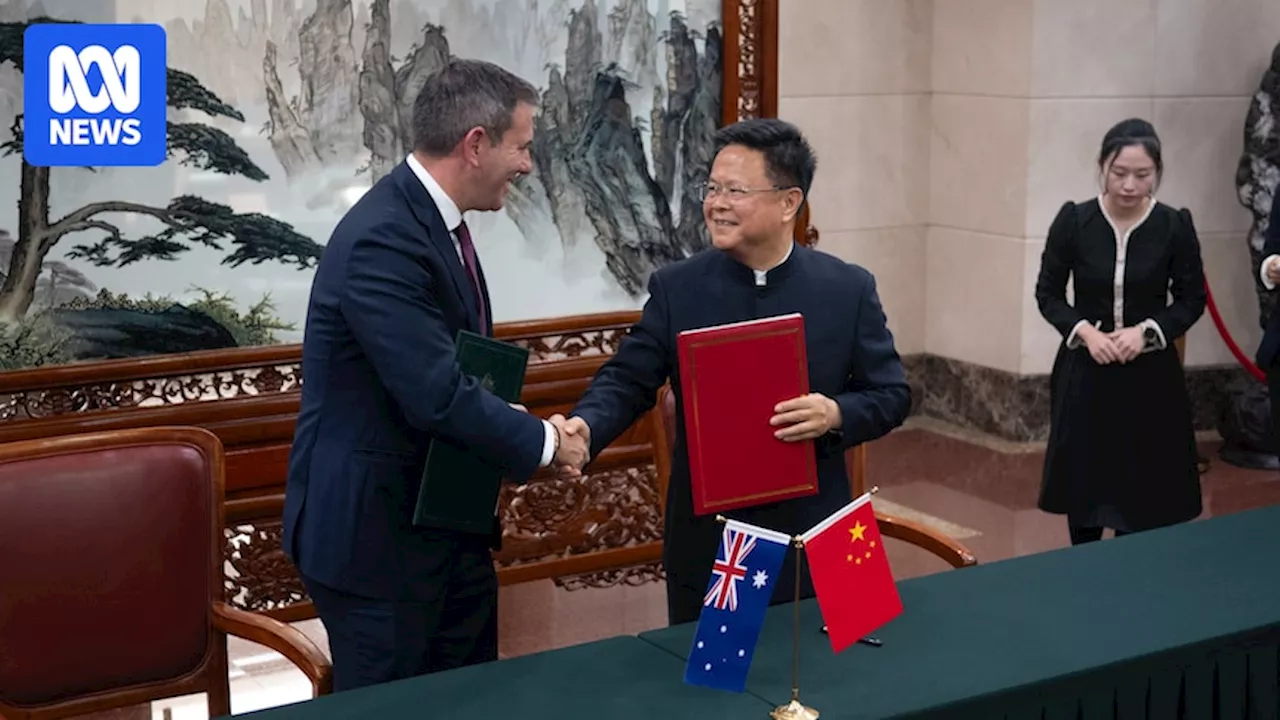

Treasurer Jim Chalmers visits Beijing for first Australia-China Strategic Economic Dialogue in seven yearsMr Chalmers is in Beijing to co-chair the first Australia-China Strategic Economic Dialogue in seven years, as well as to better understand the challenges facing the Chinese economy.

Treasurer Jim Chalmers visits Beijing for first Australia-China Strategic Economic Dialogue in seven yearsMr Chalmers is in Beijing to co-chair the first Australia-China Strategic Economic Dialogue in seven years, as well as to better understand the challenges facing the Chinese economy.

Read more »

Australian Experts Advise Investors to Ride Bitcoin Volatility for Long-Term GainsLeading Australian digital asset managers are advising investors to look past the current volatility in cryptocurrency markets and focus on tokens with proven track records. They believe that those who hold onto their investments through the fluctuations will be rewarded with significant long-term returns.

Australian Experts Advise Investors to Ride Bitcoin Volatility for Long-Term GainsLeading Australian digital asset managers are advising investors to look past the current volatility in cryptocurrency markets and focus on tokens with proven track records. They believe that those who hold onto their investments through the fluctuations will be rewarded with significant long-term returns.

Read more »

Investors stuck in ‘danger zone’ as era of rate cuts kicks offThe time of monetary easing has begun with the US Federal Reserve serving up a larger than expected 50 basis point cut to interest rates. What comes next will be crucial for markets.

Investors stuck in ‘danger zone’ as era of rate cuts kicks offThe time of monetary easing has begun with the US Federal Reserve serving up a larger than expected 50 basis point cut to interest rates. What comes next will be crucial for markets.

Read more »