Coinbase sees surging volumes for its ‘nano’ bitcoin futures product, fueled by retail traders

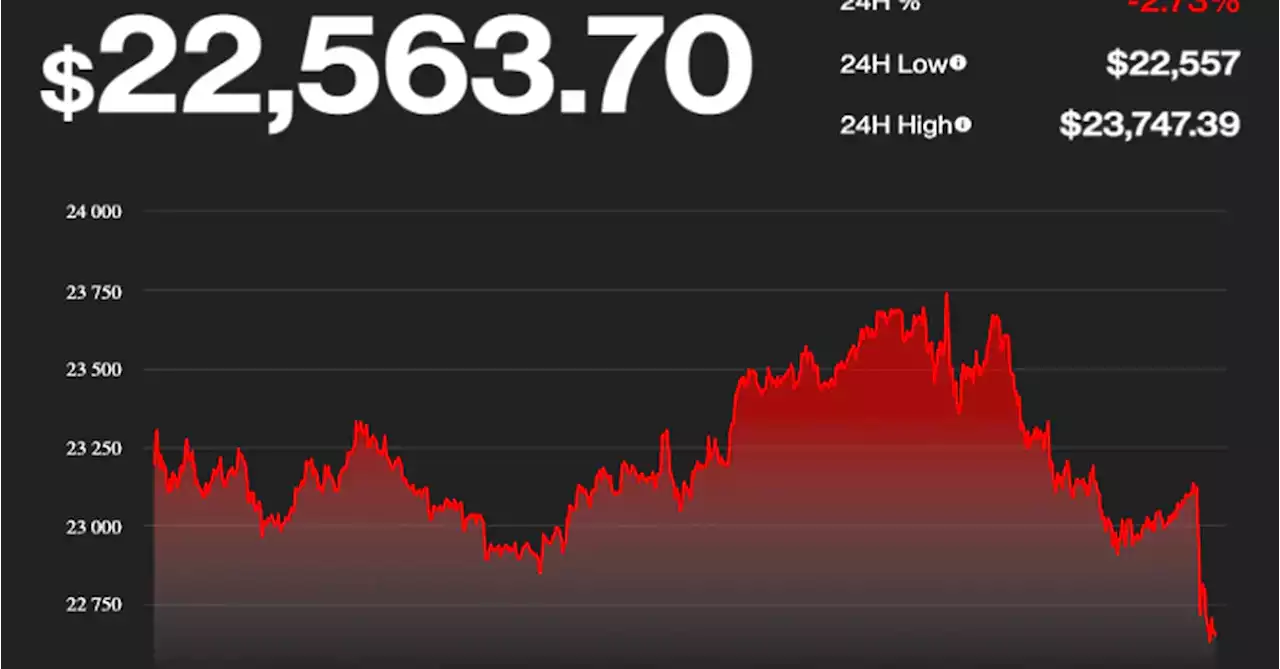

Coinbase’s nano bitcoin futures contract saw volumes hit records three consecutive days in the last week.Coinbase's spot trading volumes have collapsed from $200 billion in May 2021 to $59 billion in July. But its new derivatives unit is seeing new retail traders pour into its"nano" bitcoin futures product, which saw volumes hit records three straight days in the last week.

Coinbase launched its nano bitcoin futures product in June. The cash-settled futures contract represents 1/100th of a bitcoin and trades across a number of retail brokers including Wedbush, EdgeClear, and NinjaTrader. "It requires less upfront capital than traditional futures products and creates a real opportunity for significant expansion of retail participation in US regulated crypto futures markets," Boris Ilyesky, head of Coinbase Derivatives Exchange, said at the time of the product's launch.

Notional volumes for nano futures hit 217,045 on July 19 after several days of increasing, but data from Bloomberg shows that contract volumes declined to 117,493 on July 22. Volumes stood below 50,000 contracts traded per day for much of June and July. According to an email sent out by Coinbase's sales team, the firm saw a"surge in activity ever since retail broker partners started marketing/ promotional efforts last week.

Australia Latest News, Australia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

CoinDesk Podcast Network: THE HASH: Ex-Coinbase Manager Among 3 Arrested on Crypto Insider Trading Charges; Tesla Sells 75% of Its Bitcoin on Apple Podcasts“We talk so much about regulatory clarity, and I think we are going to start getting this clarity as this unfolds … we are going to see people being made examples of.” JennSanasie on a former Coinbase manager's arrest for insider trading.

CoinDesk Podcast Network: THE HASH: Ex-Coinbase Manager Among 3 Arrested on Crypto Insider Trading Charges; Tesla Sells 75% of Its Bitcoin on Apple Podcasts“We talk so much about regulatory clarity, and I think we are going to start getting this clarity as this unfolds … we are going to see people being made examples of.” JennSanasie on a former Coinbase manager's arrest for insider trading.

Read more »

Market Wrap: Bitcoin Finishes the Week in Positive Territory AgainMARKET WRAP: Bitcoin finishes 14% higher over the last 7 days and displays a shift between 90- and 30-day correlations with traditional markets. GWilliamsJr_CMT and JimmyHe32 report

Market Wrap: Bitcoin Finishes the Week in Positive Territory AgainMARKET WRAP: Bitcoin finishes 14% higher over the last 7 days and displays a shift between 90- and 30-day correlations with traditional markets. GWilliamsJr_CMT and JimmyHe32 report

Read more »

Crypto Exchanges Embrace Zero Fee Trading To Fight 67% Drop In VolumeBinance places a huge bet on free bitcoin trading to boost the visibility of its trading volume at the expense of the firm's profitability. Will other firms follow?

Crypto Exchanges Embrace Zero Fee Trading To Fight 67% Drop In VolumeBinance places a huge bet on free bitcoin trading to boost the visibility of its trading volume at the expense of the firm's profitability. Will other firms follow?

Read more »

Ex-Coinbase manager charged in crypto insider trading caseA former product manager at Coinbase Global, Ishan Wahi, and two others were charged Thursday in Manhattan with wire fraud in the first insider trading case involving cryptocurrency.

Ex-Coinbase manager charged in crypto insider trading caseA former product manager at Coinbase Global, Ishan Wahi, and two others were charged Thursday in Manhattan with wire fraud in the first insider trading case involving cryptocurrency.

Read more »

2 arrested in Seattle in Fed's first-ever crypto insider trading caseA former Coinbase product manager and his brother, along with a Houston man, were charged Thursday in what federal authorities described as the U.S. government’s first cryptocurrency insider trading case. FOX13

2 arrested in Seattle in Fed's first-ever crypto insider trading caseA former Coinbase product manager and his brother, along with a Houston man, were charged Thursday in what federal authorities described as the U.S. government’s first cryptocurrency insider trading case. FOX13

Read more »

Insider trading suspect gives consumers guidance on Coinbase blog, with his byline missingCoinbase has faced withering criticism on Twitter about its slowness to respond to the alleged insider trading, which was first pointed out by a cryptocurrency expert with the Twitter handle cobie in April.

Insider trading suspect gives consumers guidance on Coinbase blog, with his byline missingCoinbase has faced withering criticism on Twitter about its slowness to respond to the alleged insider trading, which was first pointed out by a cryptocurrency expert with the Twitter handle cobie in April.

Read more »