Credit Suisse on Monday said qualified investors have committed to buying 462 million new shares at a purchase price of 3.82 Swiss francs ($3.83), as it announced details of its capital hike.

The logo of Swiss bank Credit Suisse is seen in front of an office building in Zurich, Switzerland October 26, 2022. REUTERS/Arnd Wiegmannon Monday said qualified investors have committed to buying 462 million new shares at a purchase price of 3.82 Swiss francs , as it announced details of its capital hike.last week to tackle the biggest crisis in the company's history.

The price represented 94% of the volume weighted average price of Credit Suisse shares on Oct. 27 and 28, and will raise gross proceeds of 1.76 billion Swiss francs., giving it a 9.9% stake in Credit Suisse, the Swiss lender said. Existing investors meanwhile will get the chance to buy 889 million shares being offered at a price of 2.52 francs per share, with subscription rights corresponding to the size of their present stake.

It is expected that seven pre-emptive subscription rights will entitle their holder to purchase two new shares at a 32% discount on the reference price, Credit Suisse said. The gross proceeds of both capital increases is expected to be about 4 billion francs, the bank said.

Australia Latest News, Australia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

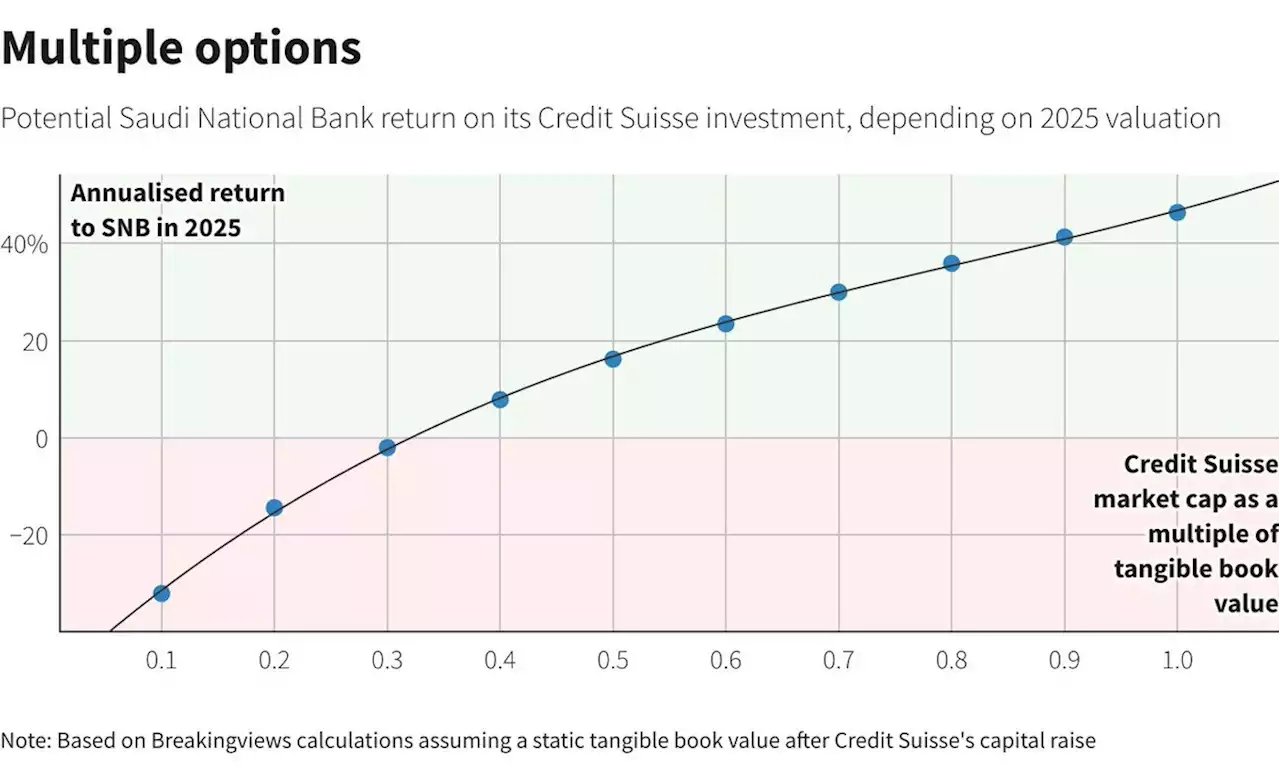

Saudi Credit Suisse deal is fair Buffett imitationThe kingdom’s biggest lender is ponying up $1.4 bln to help the weak bank raise capital. It’s not getting the sweet terms the Sage of Omaha extracted from Goldman in 2008 but the returns are still in his ballpark. And if Credit Suisse struggles, a breakup may limit the downside.

Saudi Credit Suisse deal is fair Buffett imitationThe kingdom’s biggest lender is ponying up $1.4 bln to help the weak bank raise capital. It’s not getting the sweet terms the Sage of Omaha extracted from Goldman in 2008 but the returns are still in his ballpark. And if Credit Suisse struggles, a breakup may limit the downside.

Read more »

USD/JPY to trade above 150.00 sustainably – Credit SuisseUSD/JPY is “only” around 1.5% stronger than it was at its peak just shy of 146.00 on 22 Sep when intervention started. Economists at Credit Suisse exp

USD/JPY to trade above 150.00 sustainably – Credit SuisseUSD/JPY is “only” around 1.5% stronger than it was at its peak just shy of 146.00 on 22 Sep when intervention started. Economists at Credit Suisse exp

Read more »

USD/BRL to remain confined between 5.50 and 5.00 in Q4 – Credit SuisseEconomists at Credit Suisse stick to their 5.00-5.50 Q4 target range for USD/BRL following Lula’s runoff vote victory. Risks of asymmetric expectation

USD/BRL to remain confined between 5.50 and 5.00 in Q4 – Credit SuisseEconomists at Credit Suisse stick to their 5.00-5.50 Q4 target range for USD/BRL following Lula’s runoff vote victory. Risks of asymmetric expectation

Read more »

S&P cuts Credit Suisse Group rating to one step above junk statusS&P Global Ratings has downgraded Credit Suisse Group's long-term credit rating to one step above junk bond status, citing 'material execution risks' in the Swiss bank's efforts to get back on solid ground after a series of scandals and losses.

S&P cuts Credit Suisse Group rating to one step above junk statusS&P Global Ratings has downgraded Credit Suisse Group's long-term credit rating to one step above junk bond status, citing 'material execution risks' in the Swiss bank's efforts to get back on solid ground after a series of scandals and losses.

Read more »

Breakingviews - Saudi Credit Suisse deal is fair Buffett imitationBank crisis trades have ranged from the terrific to terrible. At the positive end is Warren Buffett’s 2008 deal with Goldman Sachs . At the other is Abu Dhabi Investment Authority’s 2007 investment in Citigroup , which ended up in . Saudi National Bank is continuing the tradition, ponying up about $1.4 billion for a 9.9% stake in troubled Credit Suisse . Its returns may be closer to Buffett’s than its Gulf peer’s.

Breakingviews - Saudi Credit Suisse deal is fair Buffett imitationBank crisis trades have ranged from the terrific to terrible. At the positive end is Warren Buffett’s 2008 deal with Goldman Sachs . At the other is Abu Dhabi Investment Authority’s 2007 investment in Citigroup , which ended up in . Saudi National Bank is continuing the tradition, ponying up about $1.4 billion for a 9.9% stake in troubled Credit Suisse . Its returns may be closer to Buffett’s than its Gulf peer’s.

Read more »