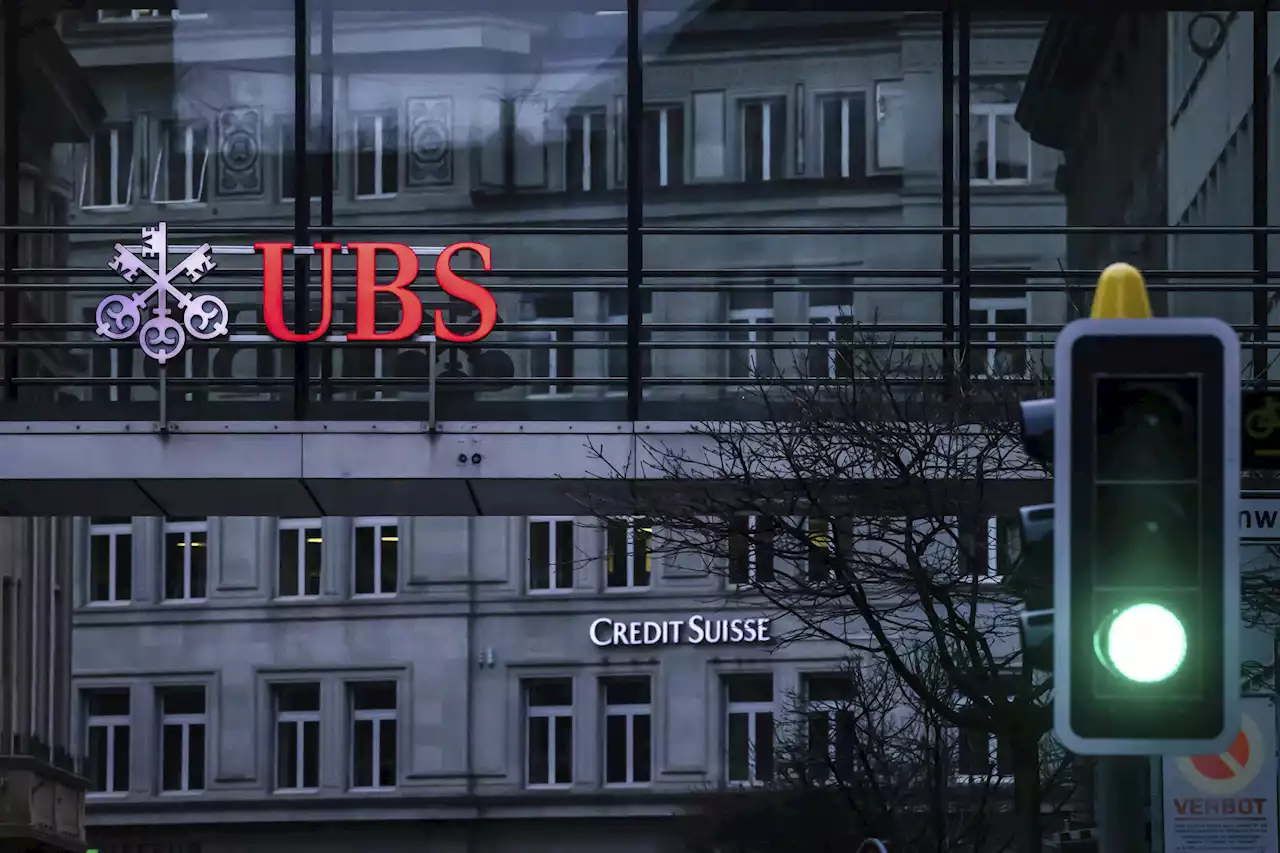

The UBS takeover of embattled rival Credit Suisse has shaken Switzerland’s self-image and dented its reputation as a global financial center, analysts say, warning that the country’s prosperity could grow too dependent on a single banking behemoth.

The uncertain future of a union of Switzerland’s two global banks comes at a thorny time for Swiss identity, built nearly as much on a self-image of finesse in finance as on know-how with chocolate, watchmaking and cheese.Regulators who helped orchestrate the $3.25 billion deal have a lot on their plates as UBS checks the books of its rival, cherry-picks the parts it wants and dispenses with the rest.

Such turmoil at the Switzerland’s second-largest bank, which also includes hedge fund losses and fines for failing to prevent money laundering by a Bulgarian cocaine ring, made it vulnerable as U.S. bank collapses stirred market upheaval this month.Christoph Blocher, a former government minister and power broker of the right-wing Swiss People’s Party, blasted the Credit Suisse-UBS deal as “very, very dangerous, not just for Switzerland or the United States, but the entire world.

“Rather than arranging the dissection of the last great ‘universal bank’ in this country — and let rival finance companies benefit — it’s above all necessary to roll out much greater control measures for the new UBS,” Bordier told the Tribune de Geneve newspaper. “That reputation has gone up in smoke, and it’s very hard to regain that reputation,” Marenzi said. “Unfortunately, a reputation that you built up over years and decades and maybe even centuries, you can destroy really quickly.”

Australia Latest News, Australia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

UBS may cut up to a third of jobs after Credit Suisse takeover, Tages-Anzeiger reportsThe bank created by the UBS takeover of Credit Suisse is poised to reduce its workforce by 20-30%, Swiss daily Tages-Anzeiger reported on Sunday, citing an unnamed senior UBS manager.

UBS may cut up to a third of jobs after Credit Suisse takeover, Tages-Anzeiger reportsThe bank created by the UBS takeover of Credit Suisse is poised to reduce its workforce by 20-30%, Swiss daily Tages-Anzeiger reported on Sunday, citing an unnamed senior UBS manager.

Read more »

Up to 30% of jobs to be cut by enlarged UBS, Tages-Anzeiger reportsThe bank created by the UBS takeover of Credit Suisse is poised to reduce its workforce by 20-30%, Swiss daily Tages-Anzeiger reported on Sunday, citing an unnamed senior UBS manager.

Up to 30% of jobs to be cut by enlarged UBS, Tages-Anzeiger reportsThe bank created by the UBS takeover of Credit Suisse is poised to reduce its workforce by 20-30%, Swiss daily Tages-Anzeiger reported on Sunday, citing an unnamed senior UBS manager.

Read more »

Credit Suisse takeover hits heart of Swiss banking, identityThe UBS takeover of embattled rival Credit Suisse has shaken Switzerland’s self-image and dented its reputation as a global financial center, analysts say.

Credit Suisse takeover hits heart of Swiss banking, identityThe UBS takeover of embattled rival Credit Suisse has shaken Switzerland’s self-image and dented its reputation as a global financial center, analysts say.

Read more »

Credit Suisse takeover hits heart of Swiss banking, identityAnalysts say the UBS takeover of embattled rival Credit Suisse has shaken Switzerland’s self-image and dented its reputation as a global financial center. They warn that the country’s prosperity could grow too dependent on a single banking behemoth. The uncertain future of a union of Switzerland’s two global banks comes at a thorny time for Swiss identity, built nearly as much on a self-image of finesse in finance as on know-how with chocolate, watchmaking and cheese. Incoming UBS chief Sergio Ermotti says Switzerland needs a strong globally significant bank if it wants to be a financial hub. He says the issue isn't “too big to fail' but 'too small to survive.”

Credit Suisse takeover hits heart of Swiss banking, identityAnalysts say the UBS takeover of embattled rival Credit Suisse has shaken Switzerland’s self-image and dented its reputation as a global financial center. They warn that the country’s prosperity could grow too dependent on a single banking behemoth. The uncertain future of a union of Switzerland’s two global banks comes at a thorny time for Swiss identity, built nearly as much on a self-image of finesse in finance as on know-how with chocolate, watchmaking and cheese. Incoming UBS chief Sergio Ermotti says Switzerland needs a strong globally significant bank if it wants to be a financial hub. He says the issue isn't “too big to fail' but 'too small to survive.”

Read more »

Credit Suisse takeover hits heart of Swiss banking, identityThe UBS takeover of embattled rival Credit Suisse has shaken Switzerland's self-image and dented its reputation as a global financial center, analysts say, warning that the country's prosperity could grow too dependent on a single banking behemoth.

Credit Suisse takeover hits heart of Swiss banking, identityThe UBS takeover of embattled rival Credit Suisse has shaken Switzerland's self-image and dented its reputation as a global financial center, analysts say, warning that the country's prosperity could grow too dependent on a single banking behemoth.

Read more »

Norwegian wealth fund seeks Credit Suisse boardroom shake-upNorges Bank Investment Management will vote against the re-election of Credit Suisse Chair Axel Lehmann and six other directors at the Swiss lender's annual general meeting on Tuesday, the Norwegian wealth fund said on its website.

Norwegian wealth fund seeks Credit Suisse boardroom shake-upNorges Bank Investment Management will vote against the re-election of Credit Suisse Chair Axel Lehmann and six other directors at the Swiss lender's annual general meeting on Tuesday, the Norwegian wealth fund said on its website.

Read more »