EUR/USD edges higher past 1.0750 as ECB garners more hawkish bets than Fed, German/US inflation eyed – by anilpanchal7 EURUSD Inflation ECB Fed RiskAversion

ls brace for the key day. That said, the major currency pair remains on the front foot at around 1.0760 during the early hours of Tuesday’s Asian session.

That said, the quote began the day on a front foot amid broad US Dollar weakness as markets keep expecting no rate hike from the US Federal Reserve . Challenges to sentiment, however, pared the EUR/USD pair’s daily gains during the US session after a jump in the United States Treasury bond yields joined fears that theeconomy isn’t immune to the slowdown, which in turn could probe the European Central Bank hawks soon, if not now.

As per the latest data from the US Treasury Department, a $240 billion deficit could be found, which in turn pushed the officials to issue more bonds. The same drives down the prices of traditional haven and propel the yields. It’s worth noting that the concerns about the Fed’s no rate hike and previously downbeat US data exert downside pressure on the Treasury bond coupons and the US Dollar.

Elsewhere, a study from the San Francisco Fed concluded that wage growth has a very small impact on inflation, which in turn raises doubts about the central bankers’ emphasis on wage cost numbers as a source of information to gauge inflation pressure. The same could allow the Fed to remain hawkish and offer a hawkish halt.

With that in mind, Former Fed vice chair Richard Clarida came out with comments that it may be more difficult to get inflation near 2% than in the past 15 years. Further, “Expect a hawkish skip this week,” Former President of Bosteon It should be noted that the recently downbeat Eurozone growth data and early signals for inflation haven’t been positive even if most of the

Australia Latest News, Australia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

EUR/USD grinds near mid-1.0700s as Fed vs. ECB play gains attentionEUR/USD renews intraday low near 1.0750 as it pares the first weekly gain in five amid cautious mood ahead of the key week comprising the European Cen

EUR/USD grinds near mid-1.0700s as Fed vs. ECB play gains attentionEUR/USD renews intraday low near 1.0750 as it pares the first weekly gain in five amid cautious mood ahead of the key week comprising the European Cen

Read more »

EUR/USD Price Analysis: Rising wedge lures Euro bears as Fed, ECB decisions loom, 1.0720 eyedEUR/USD takes offers to refresh intraday low as it prints mild losses near 1.0745 while extending the previous day’s fall amid early Monday. In doing

EUR/USD Price Analysis: Rising wedge lures Euro bears as Fed, ECB decisions loom, 1.0720 eyedEUR/USD takes offers to refresh intraday low as it prints mild losses near 1.0745 while extending the previous day’s fall amid early Monday. In doing

Read more »

EUR/USD to grind higher as Fed-ECB policy gap is set to narrow – SocGenEconomists at Société Générale analyze EUR/USD outlook ahead of a monumental week for monetary policy decisions. ECB statement and press conference to

EUR/USD to grind higher as Fed-ECB policy gap is set to narrow – SocGenEconomists at Société Générale analyze EUR/USD outlook ahead of a monumental week for monetary policy decisions. ECB statement and press conference to

Read more »

EUR/USD: Euro strength of the next few months should not last – CommerzbankEconomists at Commerzbank discuss EUR/USD direction depending on ECB and Fed policy outlooks. EUR/USD first up, then down We see upside potential for

EUR/USD: Euro strength of the next few months should not last – CommerzbankEconomists at Commerzbank discuss EUR/USD direction depending on ECB and Fed policy outlooks. EUR/USD first up, then down We see upside potential for

Read more »

EUR/USD Price Analysis: Rallies to near 1.0780 amid cheerful market mood, ECB-Fed policy in focusThe EUR/USD pair has displayed a vertical recovery from 1.0740 in the European session. The major currency pair has shifted into a bullish trajectory

EUR/USD Price Analysis: Rallies to near 1.0780 amid cheerful market mood, ECB-Fed policy in focusThe EUR/USD pair has displayed a vertical recovery from 1.0740 in the European session. The major currency pair has shifted into a bullish trajectory

Read more »

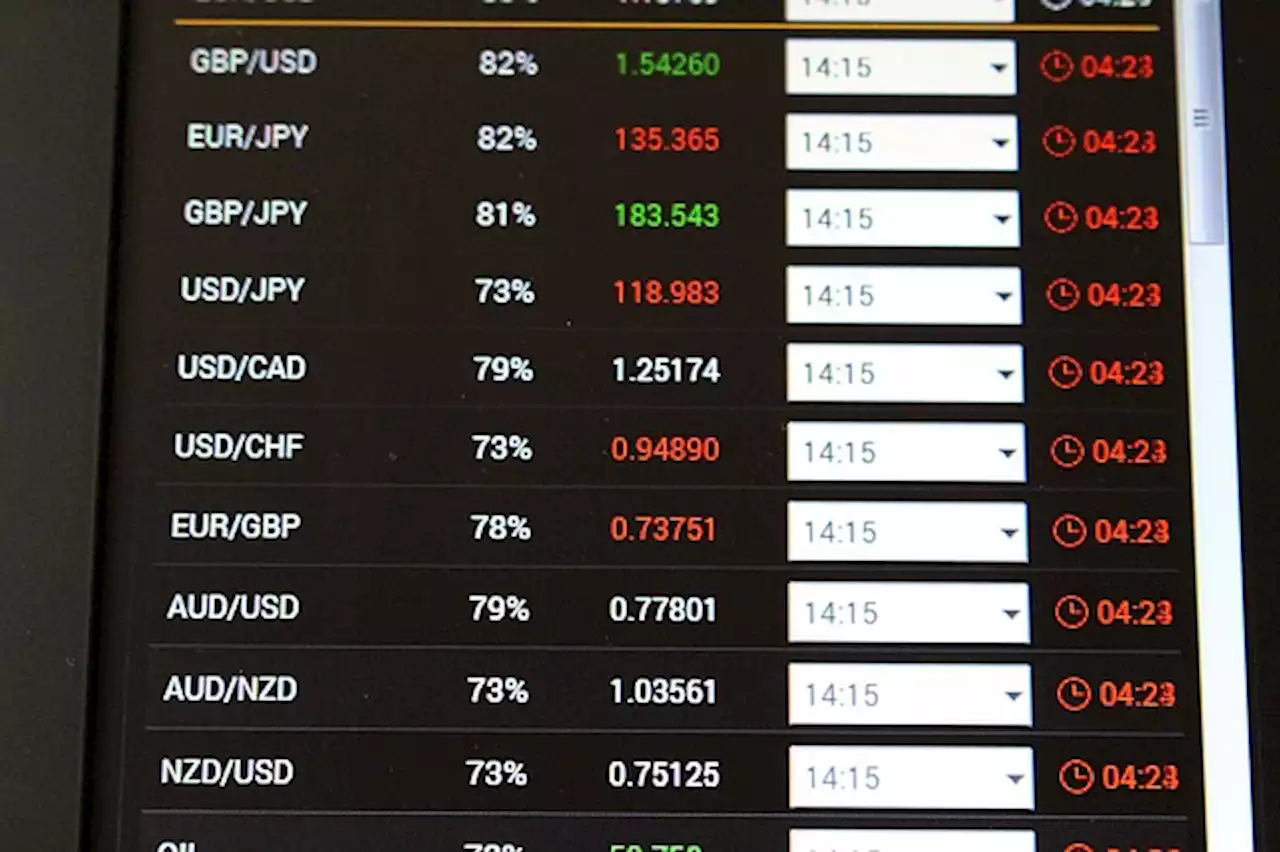

Pairs in Focus This Week \u2013 EUR/USD, GBP/USD, Gold, OilGet the Forex Forecast using fundamentals, sentiment, and technical position analyses for major pairs for the week of June 11th, 2022 here.

Pairs in Focus This Week \u2013 EUR/USD, GBP/USD, Gold, OilGet the Forex Forecast using fundamentals, sentiment, and technical position analyses for major pairs for the week of June 11th, 2022 here.

Read more »