EUR/USD resumes the upside above the 1.0500 yardstick By pabspiovano EURUSD Currencies Majors

ECB’s Fernandez-Bollo, de Guindos next on tap.EUR/USD up on dollar weakness, risk-on mood

In the US, the final Consumer Sentiment for the current month will grab all the attention seconded by May’sEUR/USD regains composure and advances further north of the 1.0500 mark amidst the mild improvement in the risk appetite trend in a week marked by broad-based choppy trading. : Fragmentation risks. Kickstart of the ECB hiking cycle in July? Asymmetric economic recovery post-pandemic in the euro bloc. Impact of the war in Ukraine on the region’s growth prospects.So far, spot is gaining 0.25% at 1.0543 and a breakout of 1.0605 would target 1.0623 en route to 1.0786 . On the other hand, the next support emerges at 1.0358 followed by 1.0348 and finally 1.0300 .

Australia Latest News, Australia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

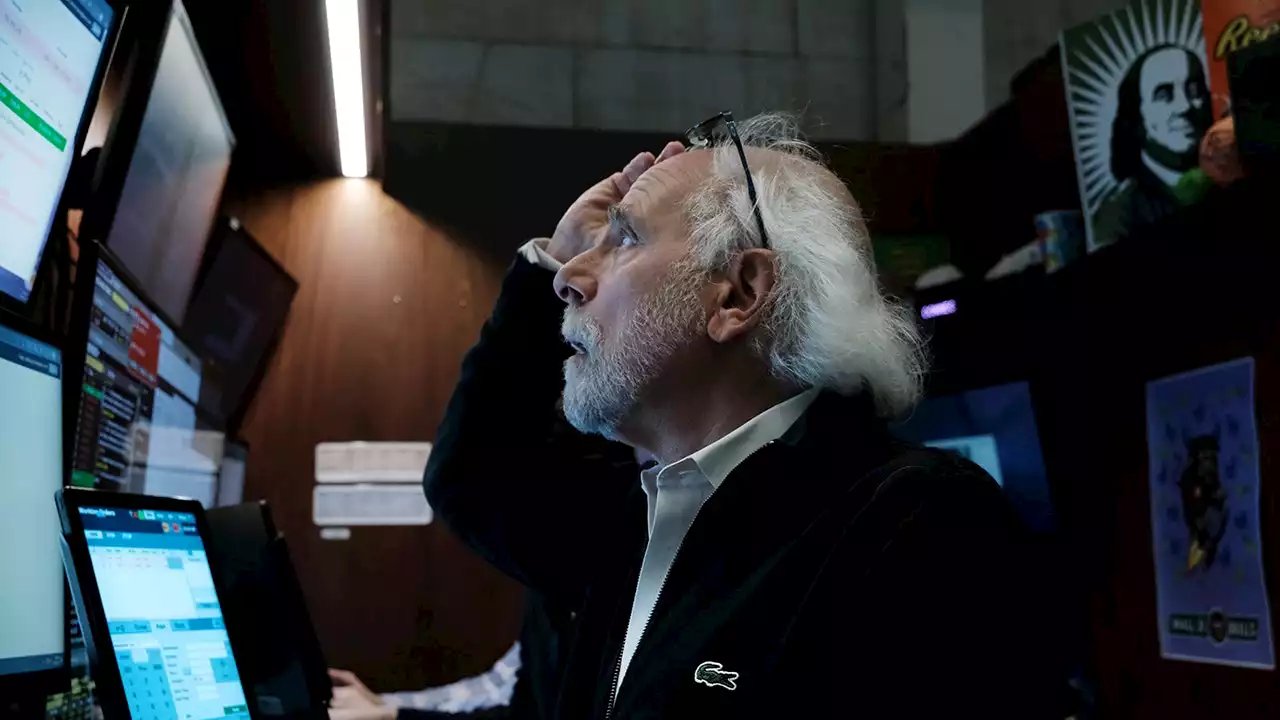

S&P 500 could plunge another 20% as recession risks rise: Morgan StanleyMorgan Stanley economists have warned the S&P 500 could tumble another 20% from current levels in coming months if the U.S. economy slides into a recession.

S&P 500 could plunge another 20% as recession risks rise: Morgan StanleyMorgan Stanley economists have warned the S&P 500 could tumble another 20% from current levels in coming months if the U.S. economy slides into a recession.

Read more »

S\u0026P 500 Forecast: Attempts Recovery Rally on TuesdayThe S&P 500 did rally a bit on Tuesday, showing signs of life again, but at this point it’s likely that we will continue to cease selling pressure eventually. forex stocks indices

S\u0026P 500 Forecast: Attempts Recovery Rally on TuesdayThe S&P 500 did rally a bit on Tuesday, showing signs of life again, but at this point it’s likely that we will continue to cease selling pressure eventually. forex stocks indices

Read more »

EUR/USD: Bears step in and force a breach of 1.0500The single currency loses the grip and motivates EUR/USD to breaches the key support at 1.0500 the figure. EUR/USD: Weekly upside capped above 1.0600

EUR/USD: Bears step in and force a breach of 1.0500The single currency loses the grip and motivates EUR/USD to breaches the key support at 1.0500 the figure. EUR/USD: Weekly upside capped above 1.0600

Read more »

EUR/USD Forex Signal: Inverted C\u0026H and Rising Wedge PatternsThe EUR/USD pair tilted upwards as the Federal Reserve testified before Congress.

EUR/USD Forex Signal: Inverted C\u0026H and Rising Wedge PatternsThe EUR/USD pair tilted upwards as the Federal Reserve testified before Congress.

Read more »

PMIs eyed as EUR/USD rebounds from supportUS Federal Reserve Chair Jerome Powell was in the spotlight on Wednesday, testifying on the Semi-Annual Monetary Policy Report before the Senate Banki

PMIs eyed as EUR/USD rebounds from supportUS Federal Reserve Chair Jerome Powell was in the spotlight on Wednesday, testifying on the Semi-Annual Monetary Policy Report before the Senate Banki

Read more »