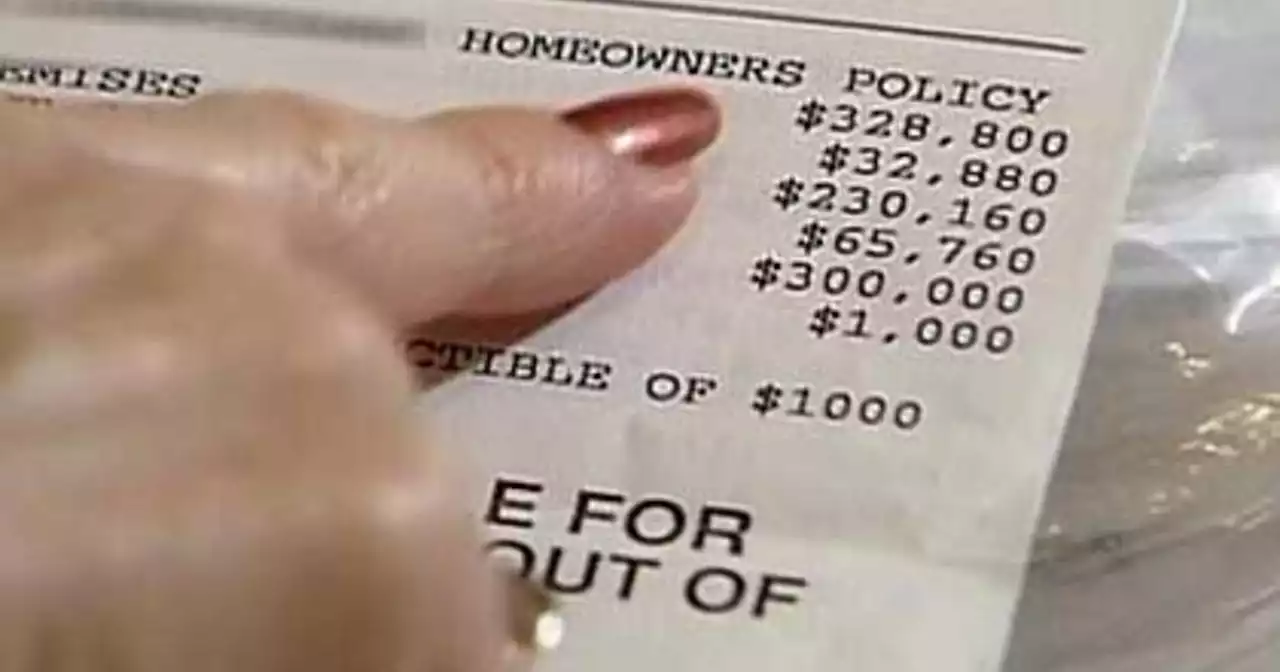

Florida has become a hotbed for people migrating from other states in recent years, but as the population has increased, so has the average price of homeowners' insurance premiums.

Earlier this week, Farmers Insurance announced it would discontinue various home, auto, and umbrella policies in the state, citing a need to"effectively manage risk exposure." The move is likely to complicate the Florida homeowners insurance market, which is already in turmoil, even as lawmakers pursue aggressive action to stabilize the market.

Mark Friedlander, the director of corporate communications for the Insurance Information Institute, said the dramatic rising costs of premiums for homeowners insurance is unique to the Sunshine State but not due to the threat of hurricanes. "The property insurance market has been extremely unstable, even today, we have 18 Florida residential insurers — smaller companies — that are on a watchlist of the Florida insurance regulator because of concerns over their financial health," Friedlander said.

Friedlander did applaud action by elected officials in Florida for taking action against two of the drivers of the crisis, but he said the crisis will not be over in short order because of how long the market has been in turmoil. Jeremy Redfern, the governor's press secretary, pointed to the action by DeSantis and the Florida legislature in the past three years to curb the excessive litigation that has plagued the insurance marketplace in the state.

He also pointed to legislation from a special session in December 2022, SB 2-A, which eliminated one-way attorney fees for property insurance claims, among other reforms to help stabilize the Florida insurance market.

Australia Latest News, Australia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

AAA pulls back from offering insurance in Florida, following FarmersAAA will not renew the auto and home insurance policies for some customers in Florida, joining a growing list of insurers exiting the Sunshine State amid a growing risk of natural disasters.

AAA pulls back from offering insurance in Florida, following FarmersAAA will not renew the auto and home insurance policies for some customers in Florida, joining a growing list of insurers exiting the Sunshine State amid a growing risk of natural disasters.

Read more »

State Farm doubles down on Florida after Farmers Insurance pulls backState Farm Insurance says it has no plans to leave Florida after competitor Farmers Insurance became the latest insurer to reduce coverage in the state.

State Farm doubles down on Florida after Farmers Insurance pulls backState Farm Insurance says it has no plans to leave Florida after competitor Farmers Insurance became the latest insurer to reduce coverage in the state.

Read more »

Crisis continues: AAA Insurance set to drop ‘small percentage’ of Florida homeownersAAA Insurance says it will be issuing non-renewals for a select number of homeowners in Florida, adding to the ongoing property insurance crisis in the state.

Crisis continues: AAA Insurance set to drop ‘small percentage’ of Florida homeownersAAA Insurance says it will be issuing non-renewals for a select number of homeowners in Florida, adding to the ongoing property insurance crisis in the state.

Read more »

Legal challenge against San Jose’s gun insurance law dealt serious blowSan Jose became the first city in America last year to require gun owners carry liability insurance.

Legal challenge against San Jose’s gun insurance law dealt serious blowSan Jose became the first city in America last year to require gun owners carry liability insurance.

Read more »

Insurance may not cover birth control drug Opill without prescriptionWomen could face barriers to obtain Opill because health insurance is not currently required to cover birth control without a prescription.

Insurance may not cover birth control drug Opill without prescriptionWomen could face barriers to obtain Opill because health insurance is not currently required to cover birth control without a prescription.

Read more »

HOA Homefront — Tips regarding 'bare walls' property insuranceQuite recently two of the largest residential property insurance companies announced major cutbacks in California.

HOA Homefront — Tips regarding 'bare walls' property insuranceQuite recently two of the largest residential property insurance companies announced major cutbacks in California.

Read more »