Federal Reserve lending to banks eased further in the latest week, signaling that while the absolute levels of emergency credit remain high, financial sector strains which started a month ago are continuing to ease.

As of Wednesday, Fed loans to banks via its discount window facility stood at $67.6 billion, from $69.7 billion on April 5, Fed data released on Thursday showed. Loans via the newly createdmoved to $71.8 billion, from the prior week's $79 billion, while "other credit" tied to the Federal Deposit Insurance Corporation's efforts to deal with failed banks ticked down to $172.6 billion, from $174.6 billion on April 5.

When the loans from the three programs are added together, credit extended to banks by the Fed stood at $312 billion on Wednesday, down from $323.3 billion on April 5. While the absolute amount of lending remains high and outstrips emergency lending at the peak of the financial crisis in 2008, total lending has been moving lower since the $343.7 billion peak on March 22.

The moved down in lending "is consistent with ongoing improvement in bank liquidity, especially as falling rates have likely decreased unrealized losses on bank portfolios," TD Securities analysts said. "We will be watching Friday's bank deposit data for further confirmation that outflows have subsided, though we expect pressure on banks to persist in coming months."

The Fed also said in its data that borrowing from its facility for central banks and other foreign official accounts eased a bit further and stood at $30 billion on Wednesday, from $40 billion the week before. The Fed does not reveal which foreign institutions are using its

Australia Latest News, Australia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Powell faces tough road maintaining independent Federal ReserveFederal Reserve Chairman Powell faces a tough road fending off politicians who like easy money, maintaining stability in the banking system and lowering inflation to 2%.

Powell faces tough road maintaining independent Federal ReserveFederal Reserve Chairman Powell faces a tough road fending off politicians who like easy money, maintaining stability in the banking system and lowering inflation to 2%.

Read more »

How will US Consumer Price Index impact Federal Reserve monetary policy?The Consumer Price Index (CPI) data release for March, published by the US Bureau of Labor Statistics (BLS), is scheduled for April 12 at 12:30 GMT. T

How will US Consumer Price Index impact Federal Reserve monetary policy?The Consumer Price Index (CPI) data release for March, published by the US Bureau of Labor Statistics (BLS), is scheduled for April 12 at 12:30 GMT. T

Read more »

Federal Reserve staff projects 'mild recession' after banking sector turmoilFederal Reserve officials anticipated that the recent collapse of Silicon Valley Bank was likely to weigh on inflation and the broader U.S. economy, with central bank staff forecasting a 'mild recession' later this year.

Read more »

A 'mild' recession is now likely this year, Federal Reserve saysFallout from the U.S. banking crisis is likely to tilt the economy into recession later this year, according to Federal Reserve documents.

A 'mild' recession is now likely this year, Federal Reserve saysFallout from the U.S. banking crisis is likely to tilt the economy into recession later this year, according to Federal Reserve documents.

Read more »

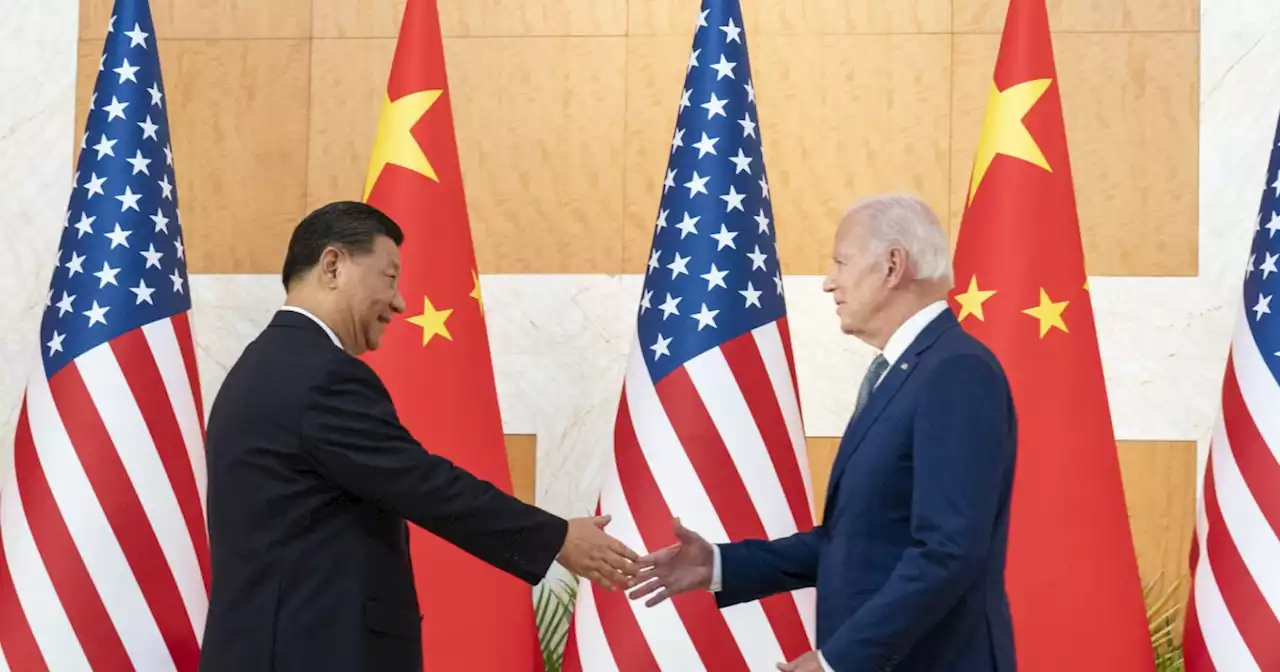

Will Biden's foreign policy undo all the Federal Reserve's progress on disinflation?While higher than the Federal Reserve's goal of 2%, March's consumer price index rose by 5% over the past year, a modest deceleration and less than expected. While core inflation rose 5.6% over the past year thanks to some troubling acceleration in recent months, supply chain solutions to food and…

Will Biden's foreign policy undo all the Federal Reserve's progress on disinflation?While higher than the Federal Reserve's goal of 2%, March's consumer price index rose by 5% over the past year, a modest deceleration and less than expected. While core inflation rose 5.6% over the past year thanks to some troubling acceleration in recent months, supply chain solutions to food and…

Read more »