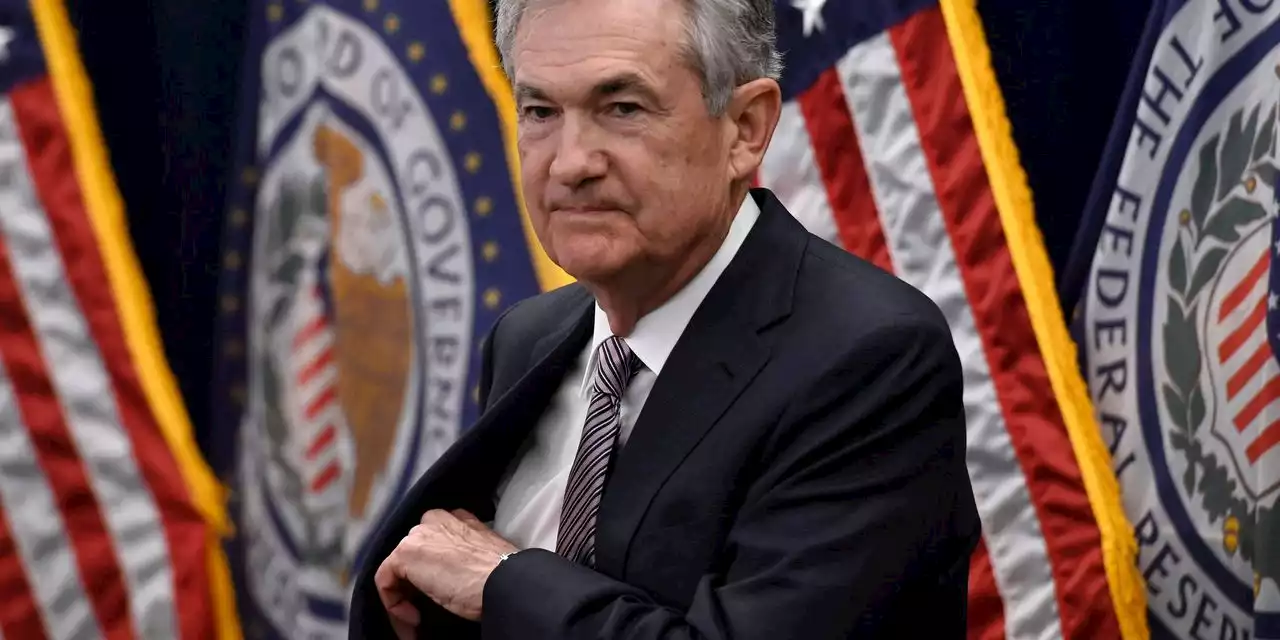

Federal Reserve policymakers on Wednesday are expected to deliver the biggest U.S. interest-rate hike in decades, along with forecasts for more hefty rate hikes this year, their best guesses for how quickly inflation could subside, and at what cost to jobs.

Fed watchers expect a rate hike of 0.75 percentage point, the first such increase since 1994. This would lift the Fed's short-term target policy rate to a range of 1.5% and 1.75%.Register now for FREE unlimited access to Reuters.comThe Fed will also release updated projections for economic growth, inflation, unemployment and interest rates for the next several years from all 18 central bankers.

"Getting in front of the problem is always better than being behind the curve," Piper Sandler economists Roberto Perli and Benson Durham wrote, adding that a bigger move now makes it less likely the Fed will have to do more later, but also raises the likelihood of a recession next year. Powell also said he expects the Fed's fight against inflation to be painful, though he has repeatedly sought to assure Americans the Fed will try to slow the economy and inflation without boosting unemployment too sharply from its current healthy level of 3.6%.

Australia Latest News, Australia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

JP Morgan, Goldman economists now expect Fed to raise rates by 75 basis points on WednesdayEconomists at JP Morgan and Goldman Sachs said in client notes Monday that they now expect the Federal Reserve to raise its policy rate by 75 basis points on Wednesday. Or could it even be 100?

JP Morgan, Goldman economists now expect Fed to raise rates by 75 basis points on WednesdayEconomists at JP Morgan and Goldman Sachs said in client notes Monday that they now expect the Federal Reserve to raise its policy rate by 75 basis points on Wednesday. Or could it even be 100?

Read more »

Recession fears grow as Fed mulls amping up fight against inflationThe Fed is poised to send a message that it has the worst inflation in 40 years under control. But many investors and economists are taking a less reassuring signal from the central bank: A recession could come as early as this year.

Recession fears grow as Fed mulls amping up fight against inflationThe Fed is poised to send a message that it has the worst inflation in 40 years under control. But many investors and economists are taking a less reassuring signal from the central bank: A recession could come as early as this year.

Read more »

Fed Likely to Consider 0.75-Percentage-Point Rate Rise This WeekA string of troubling inflation reports is likely to lead Federal Reserve officials to consider surprising markets with a larger-than-expected interest-rate increase at their meeting this week.

Fed Likely to Consider 0.75-Percentage-Point Rate Rise This WeekA string of troubling inflation reports is likely to lead Federal Reserve officials to consider surprising markets with a larger-than-expected interest-rate increase at their meeting this week.

Read more »

EUR/USD sees cushion below 1.0400, downside looks likely ahead of Fed and ECB LagardeThe EUR/USD pair is witnessing a minor cushion marginally below 1.0400 in the Asian session, however, more downside is still favored amid broader stre

EUR/USD sees cushion below 1.0400, downside looks likely ahead of Fed and ECB LagardeThe EUR/USD pair is witnessing a minor cushion marginally below 1.0400 in the Asian session, however, more downside is still favored amid broader stre

Read more »

USD/JPY faces barricades around 134.40 as DXY skids, Fed and BOJ in focusThe USD/JPY pair has faced some offers while overstepping the critical resistance of 134.40 in the Asian session. The asset is oscillating in a narrow

USD/JPY faces barricades around 134.40 as DXY skids, Fed and BOJ in focusThe USD/JPY pair has faced some offers while overstepping the critical resistance of 134.40 in the Asian session. The asset is oscillating in a narrow

Read more »

Jim Cramer: Why we're buying stocks heading into Wednesday's big Fed decisionOn Tuesday, we will begin to put to the money to work that we have saved on the sidelines.

Jim Cramer: Why we're buying stocks heading into Wednesday's big Fed decisionOn Tuesday, we will begin to put to the money to work that we have saved on the sidelines.

Read more »