With inflation continuing to run hotter than expected, the Federal Reserve is showing no signs of backing down on its aggressive monetary policy, according to notes from the Fed's policy-setting committee released Wednesday.

“Bullard is one of the more hawkish [Fed officials], so if he thinks we only have a little ways to go here, the peak in rates might be properly priced” into stock prices, Oanda analyst Ed Moya explained in a Wednesday note.

The 25-basis-point hike earlier this month followed a half-point increase in December, itself preceded by four consecutive 75-basis-point hikes, each the largest individual jumps in nearly three decades. The slowdown came as data showed inflation was in fact easing, though prices cooled slower than expected last month. The latest inflation readingBank of America and Goldman Sachs to up their projections for the Fed to raise rates by 25 basis points at its next three meetings to a peak of 5.

Australia Latest News, Australia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

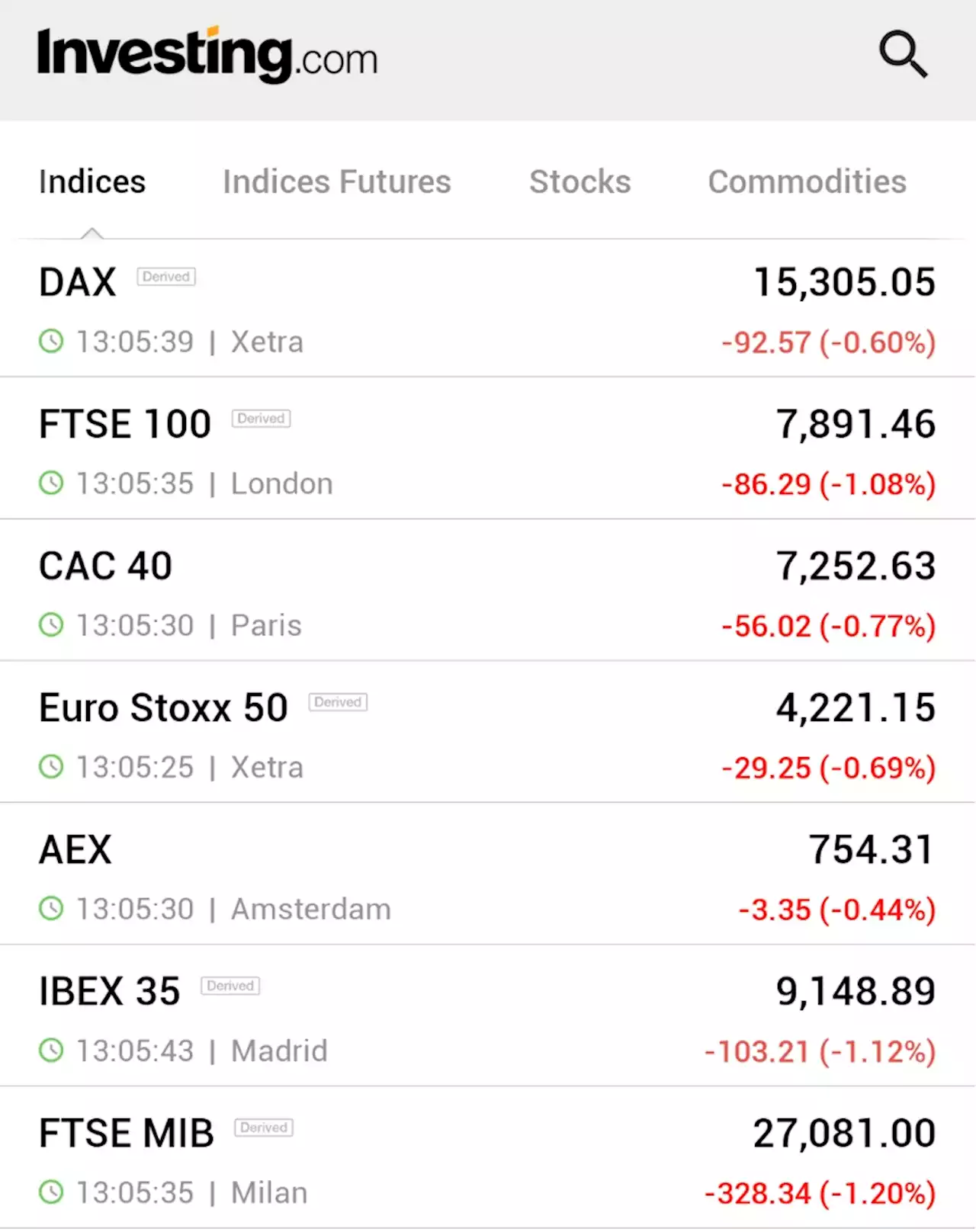

European stocks head for lower open as markets await latest Fed minutesEuropean markets are heading for a lower open Wednesday as investors await the minutes from the U.S. Federal Reserve's latest monetary policy meeting.

European stocks head for lower open as markets await latest Fed minutesEuropean markets are heading for a lower open Wednesday as investors await the minutes from the U.S. Federal Reserve's latest monetary policy meeting.

Read more »

European stocks lower; German inflation remains high ahead of Fed minutes By Investing.com⚠️BREAKING: *EUROPEAN STOCKS SLUMP ACROSS THE CONTINENT AS GERMAN INFLATION REMAINS HIGH, KEEPING PRESSURE ON THE ECB - 🇪🇺🇩🇪🇫🇷🇮🇹🇪🇸🇬🇧

European stocks lower; German inflation remains high ahead of Fed minutes By Investing.com⚠️BREAKING: *EUROPEAN STOCKS SLUMP ACROSS THE CONTINENT AS GERMAN INFLATION REMAINS HIGH, KEEPING PRESSURE ON THE ECB - 🇪🇺🇩🇪🇫🇷🇮🇹🇪🇸🇬🇧

Read more »

S&P closes lower as Fed minutes fail to halt losing runThe S&P 500 extended its losing streak to four sessions as Wall Street closed broadly down on Wednesday, with traders cautious despite the latest guidance on rate policy from the U.S. central bank showing few surprises.

S&P closes lower as Fed minutes fail to halt losing runThe S&P 500 extended its losing streak to four sessions as Wall Street closed broadly down on Wednesday, with traders cautious despite the latest guidance on rate policy from the U.S. central bank showing few surprises.

Read more »

Fed officials back ongoing rate hikes to quell above-target inflation: Fed minutes By Investing.com*FED OFFICIALS BACK ONGOING RATE HIKES TO QUELL ABOVE-TARGET INFLATION: FED MINUTES

Fed officials back ongoing rate hikes to quell above-target inflation: Fed minutes By Investing.com*FED OFFICIALS BACK ONGOING RATE HIKES TO QUELL ABOVE-TARGET INFLATION: FED MINUTES

Read more »

Doubling down? Strategist who revels in challenging the consensus sticks by her call for 8% fed-funds rateDominique Dwor-Frecaut, a former associate with the New York Fed, says the Fed needs to hike the fed-funds rate to 8% to stabilize inflation.

Doubling down? Strategist who revels in challenging the consensus sticks by her call for 8% fed-funds rateDominique Dwor-Frecaut, a former associate with the New York Fed, says the Fed needs to hike the fed-funds rate to 8% to stabilize inflation.

Read more »

Wall St set for lower open as Walmart, Home Depot forecasts disappointWall Street's main stock indexes were set to open lower on Tuesday as retailers Walmart and Home Depot delivered a double blow to traders returning after a long weekend amid worries that interest rates will remain higher for longer.

Wall St set for lower open as Walmart, Home Depot forecasts disappointWall Street's main stock indexes were set to open lower on Tuesday as retailers Walmart and Home Depot delivered a double blow to traders returning after a long weekend amid worries that interest rates will remain higher for longer.

Read more »