Forex Today: Comments from Fed officials to drive US Dollar's action – by eren_fxstreet Currencies Majors Macroeconomics Commodities CryptoCurrencies

snapped a three-day winning streak on Tuesday after having fluctuated wildly with the initial reaction to FOMC Chairman Jerome Powell's comments on the policy outlook. In the absence of high-impact macroeconomic data releases, comments from Fed officials, including New York Fed President Williams, Atlanta Fed President Bostic and Minneapolis Fed President Kashkari, will be watched closely by market participants on Wednesday.

In an interview with The Economic Club of Washington, D.C., Powell said that the latest jobs report was certainly stronger than anyone expected and reiterated that they will probably need to do further interest rate increases. The chairman also noted that he expects 2023 to be a year of 'significant declines' in inflation. "We may need to do more if we continue to get strong labour market or higher inflation reports," Powell concluded.

Meanwhile, US President Joe Biden said in his second State of the Union address that he proposes to quadruple the tax on corporate stock buybacks and called on Congress to pass his proposal for a billionaire minimum tax. Wall Street's main indexes showed no reaction to these comments and registered strong daily gains following the uninspiring start to the week.

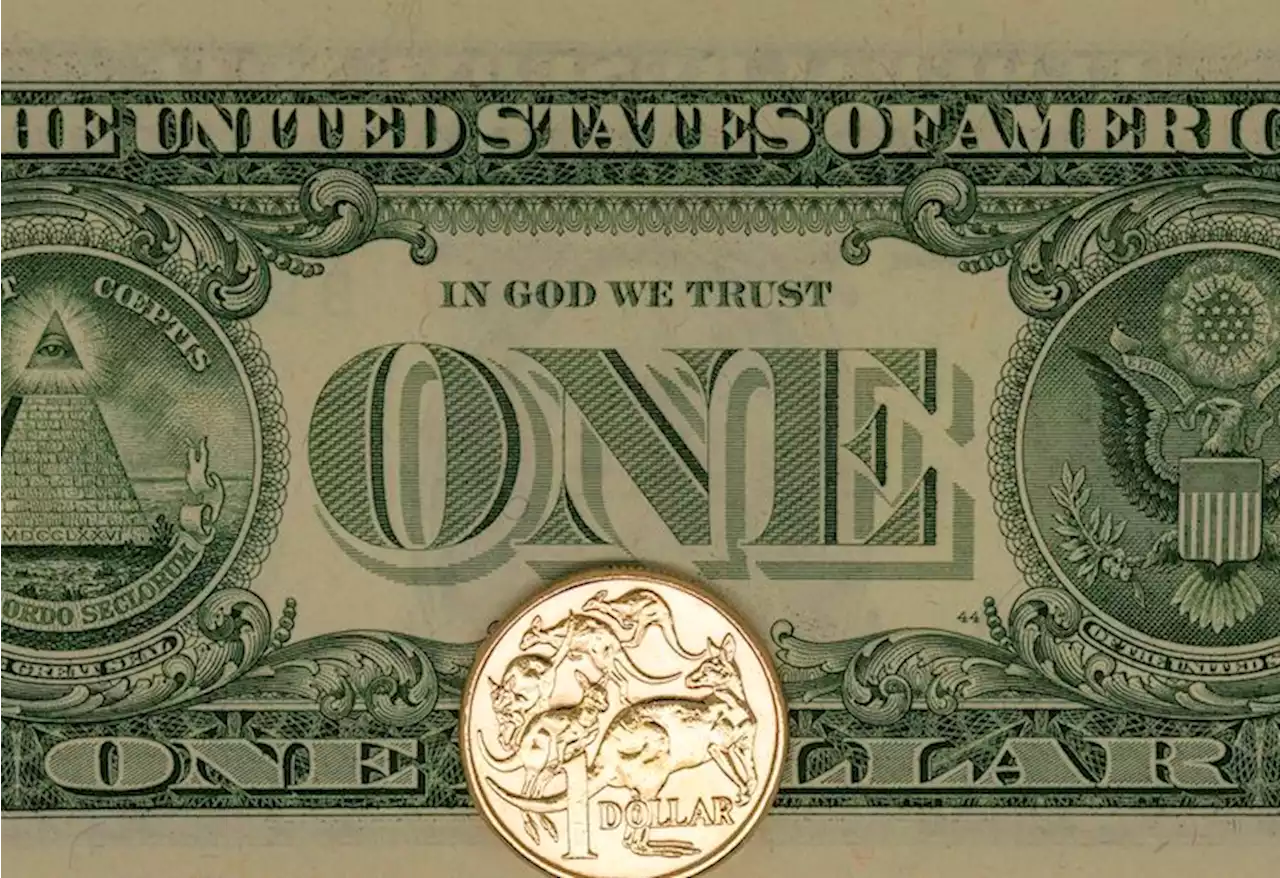

During the Asian trading hours, Fitch Ratings announced that it revised 2023 Gross Domestic Product Growth for China to 5% from 4.1%. "We believe the economic recovery will be primarily consumption-led, as households re-engage in activities previously hampered by health controls," Fitch elaborated. US stock index futures trade virtually unchanged early Wednesday and the benchmark 10-year US Treasury bond yield posts small daily losses at around 3.65%.dropped to its lowest level since January 9 at 1.0667 on Tuesday but managed to close the day above 1.0700 with the US Dollar struggling to preserve its strength in the late American session. The pair trades marginally higher on the day early Wednesday but stays below 1.0750.

Australia Latest News, Australia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Forex Today: US Dollar clings to last week's recovery gainsHere is what you need to know on Monday, February 6: Markets have started the new week in a calm manner and the US Dollar manages to stay resilient ag

Forex Today: US Dollar clings to last week's recovery gainsHere is what you need to know on Monday, February 6: Markets have started the new week in a calm manner and the US Dollar manages to stay resilient ag

Read more »

Forex Today: US Dollar strengthens in a risk-averse environmentWhat you need to take care of on Tuesday, February 7: The US Dollar extended its Friday rally to fresh February highs against most major rivals, fuele

Forex Today: US Dollar strengthens in a risk-averse environmentWhat you need to take care of on Tuesday, February 7: The US Dollar extended its Friday rally to fresh February highs against most major rivals, fuele

Read more »

Forex Today: US Dollar buyers not willing to give upWhat you need to take care of on Wednesday, February 8: The US Dollar ended the day mixed across the FX board. The American currency extended its Febr

Forex Today: US Dollar buyers not willing to give upWhat you need to take care of on Wednesday, February 8: The US Dollar ended the day mixed across the FX board. The American currency extended its Febr

Read more »

Forex Today: Yen Falls on Amamiya Governorship RumourYen Tumbles on Report Dove Amamiya to be BoJ Governor; Stocks Lower as Sentiment Persists; RBA Expected to Hike Rates

Forex Today: Yen Falls on Amamiya Governorship RumourYen Tumbles on Report Dove Amamiya to be BoJ Governor; Stocks Lower as Sentiment Persists; RBA Expected to Hike Rates

Read more »

Forex Today: Aussie surges on hawkish RBA, eyes on central bank speakForex Today: Aussie surges on hawkish RBA, eyes on central bank speak – by eren_fxstreet Currencies Majors Macroeconomics Commodities CryptoCurrencies

Forex Today: Aussie surges on hawkish RBA, eyes on central bank speakForex Today: Aussie surges on hawkish RBA, eyes on central bank speak – by eren_fxstreet Currencies Majors Macroeconomics Commodities CryptoCurrencies

Read more »

Forex Today: RBA Hikes Rates, Sees \u201CFurther Increases\u201DAussie Gains on RBA Hawkish Tilt; Stocks Firmer Ahead of Powell Speaking.

Forex Today: RBA Hikes Rates, Sees \u201CFurther Increases\u201DAussie Gains on RBA Hawkish Tilt; Stocks Firmer Ahead of Powell Speaking.

Read more »