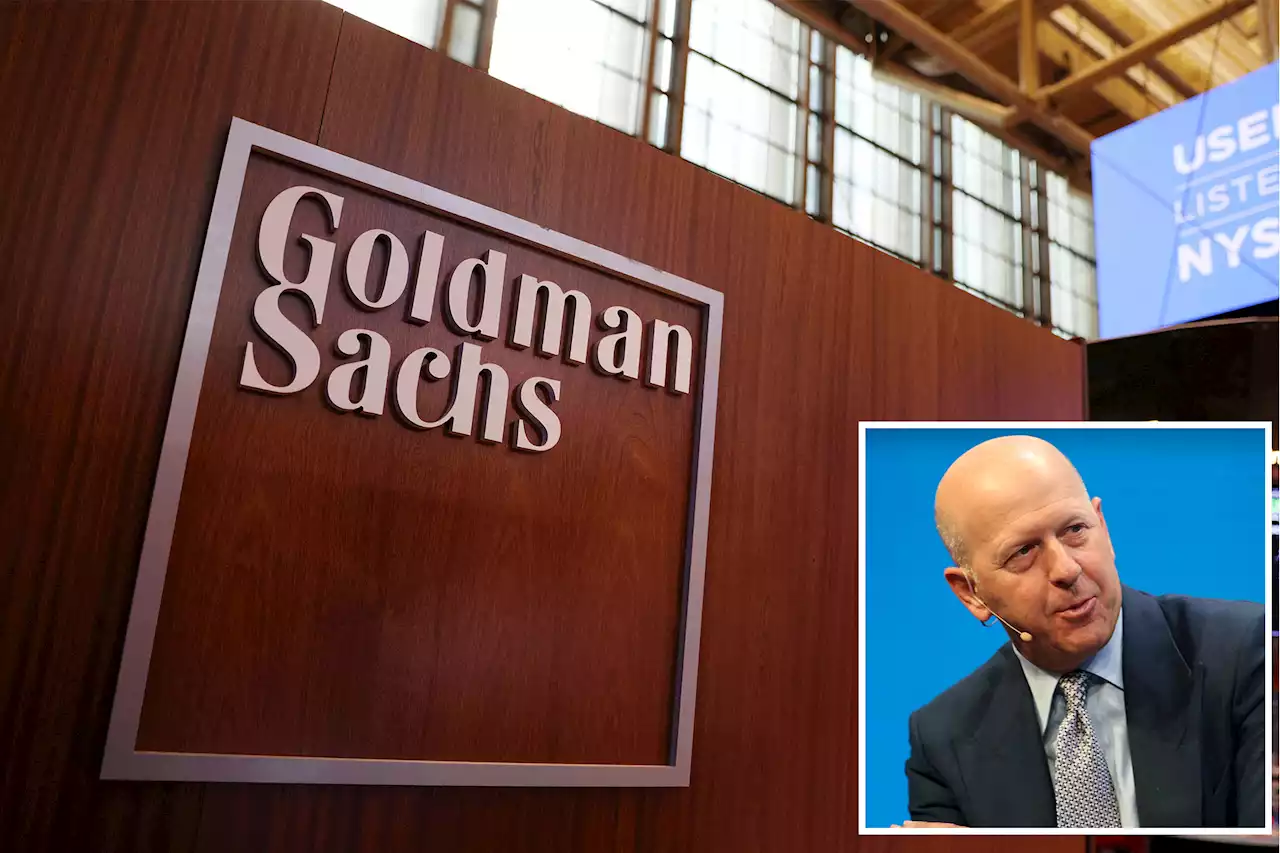

Solomon, who recently laid off more than 3,200 workers in what was dubbed “David’s Demolition Day,” was pounded with questions from Wall Street analysts about the bank’s str…

but did not elaborate on any options. The consumer banking division has lost more than $3 billion since 2020.

In one heated exchange, Wells Fargo bank analyst Mike Mayo asked why Solomon didn’t just “call it a day” and close down the consumer business entirely. Solomon emphasized the bank would continue to focus on its core franchises — and “would’ve said more if there was more to say.”

Australia Latest News, Australia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Goldman Sachs bankers bristle at CEO David Solomon’s pay ahead of yearly ‘Investor Day’As David Solomon lays out his vision for the Wall Street giant at the Tuesday shindig, many are still chafing over their disappointing year-end payouts — and fixing the blame on their part-ti…

Goldman Sachs bankers bristle at CEO David Solomon’s pay ahead of yearly ‘Investor Day’As David Solomon lays out his vision for the Wall Street giant at the Tuesday shindig, many are still chafing over their disappointing year-end payouts — and fixing the blame on their part-ti…

Read more »

Goldman Sachs boss David Solomon warns the inflation fight is far from overGoldman Sachs boss David Solomon warns the fight against inflation is nowhere near over – because the US jobs market still looks so strong

Read more »

Why Goldman's consumer ambitions failed, and what it means for CEO David SolomonAs Goldman's Marcus morphed from a side project to a focus for investors, the business expanded and ultimately buckled under the weight of Solomon's ambitions.

Why Goldman's consumer ambitions failed, and what it means for CEO David SolomonAs Goldman's Marcus morphed from a side project to a focus for investors, the business expanded and ultimately buckled under the weight of Solomon's ambitions.

Read more »

Goldman Sachs CEO says having 'very tight' job market makes cooling inflation 'very hard'Goldman Sachs’ CEO, David Solomon, offered insights on the labor market and efforts to cool inflation in the U.S during a recent podcast episode put out by his company.

Goldman Sachs CEO says having 'very tight' job market makes cooling inflation 'very hard'Goldman Sachs’ CEO, David Solomon, offered insights on the labor market and efforts to cool inflation in the U.S during a recent podcast episode put out by his company.

Read more »

Goldman's Solomon on inflation, recession, ChatGPT, M&A, energy, ChinaGoldman CEO David Solomon warns of stubborn US inflation, calms fears of a deep recession, and talks ChatGPT and AI in a new interview. Here are the 9 best quotes.

Read more »

USD/JPY: The Yen weakness to stay limited – Goldman SachsEconomists at Goldman Sachs outlined their view on the Japanese Yen, in the face of the incoming Bank of Japan (BoJ) Governor Kazuo Ueda and hawskish

USD/JPY: The Yen weakness to stay limited – Goldman SachsEconomists at Goldman Sachs outlined their view on the Japanese Yen, in the face of the incoming Bank of Japan (BoJ) Governor Kazuo Ueda and hawskish

Read more »