Households and businesses are bracing for another blow when the Reserve Bank meets on Melbourne Cup Day with new governor Michele Bullock widely expected to hike rates.

With markets and economists widely expecting the RBA to raise the cash rate at its Melbourne Cup Day meeting, households and businesses are bracing for further pain.

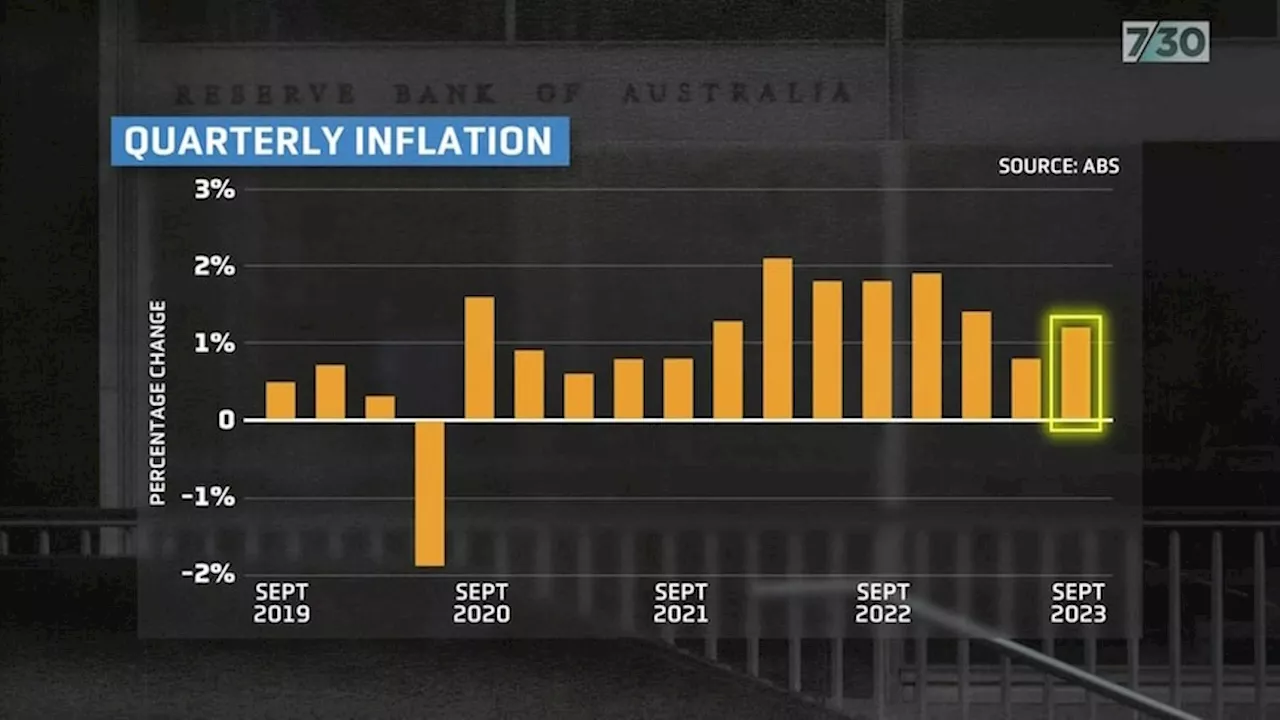

NAB chief economist Alan Oster said concerns of inflation remaining higher for longer would likely lead the RBA board to lift the cash rate. “The critical question is whether it can plausibly argue that inflation will still fall back to its target band by the second half of 2025,” Mr Bloxham said. But households are facing a painful squeeze as the central bank has ratcheted up interest rates 12 times since May last year.

“I was hoping that we had hit the very peak but with October’s inflation figures coming in higher than expected it, it’s inevitable we will see a rise tomorrow on Cup day.

Australia Latest News, Australia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Reserve Bank interest rate: Jim Chalmers shores up Michele Bullock’s inflation-fighting authorityThat’s a helpful development ahead of Tuesday’s RBA board meeting and amid concerns over political pressure not to lift interest rates further.

Reserve Bank interest rate: Jim Chalmers shores up Michele Bullock’s inflation-fighting authorityThat’s a helpful development ahead of Tuesday’s RBA board meeting and amid concerns over political pressure not to lift interest rates further.

Read more »

RBA interest rates: stars align for the Australian dollar ahead of Reserve Bank meetingThe $A held above US65¢ on Monday bolstered by a weak US dollar and expectations of the first interest rate rise in Australia since June.

RBA interest rates: stars align for the Australian dollar ahead of Reserve Bank meetingThe $A held above US65¢ on Monday bolstered by a weak US dollar and expectations of the first interest rate rise in Australia since June.

Read more »

RBA interest rates: Melbourne Cup Day rate rise will leave Reserve Bank isolatedThe Reserve Bank stands alongside the Bank of Japan as the only G7 central banks where markets have locked in forecasts for further rate increases.

RBA interest rates: Melbourne Cup Day rate rise will leave Reserve Bank isolatedThe Reserve Bank stands alongside the Bank of Japan as the only G7 central banks where markets have locked in forecasts for further rate increases.

Read more »

Will the Reserve Bank raise the interest rate again?Trusted and independent source of local, national and world news. In-depth analysis, business, sport, weather and more.

Will the Reserve Bank raise the interest rate again?Trusted and independent source of local, national and world news. In-depth analysis, business, sport, weather and more.

Read more »

Mortgage holders brace for Cup Day blow from Reserve BankMost economists have tipped the bank board to lift the cash rate by 25 basis points, from 4.1 per cent to 4.35 per cent, when it meets ahead of the iconic race.

Mortgage holders brace for Cup Day blow from Reserve BankMost economists have tipped the bank board to lift the cash rate by 25 basis points, from 4.1 per cent to 4.35 per cent, when it meets ahead of the iconic race.

Read more »