Property prices are falling in two in five suburbs, offering house hunters better bang for their buck. But as rising rates hit borrowing power, some have to compromise further to buy their next home.

Home values fell across more than 40 per cent of capital city house and unit markets over the June quarter.

But many buyers still have to compromise when searching for their next home, experts say, because of cuts to borrowing capacity and a pullback in the number of homes listed for sale, reducing their level of choice. This was limited to buyers whose borrowing capacity had remained relatively unchanged, despite three consecutive interest rate hikes — that lifted the cash rate from a record low of 0.1 per cent to 1.35 per cent — and rising living expenses.“If you’ve gone back to the bank and they’ve said we’re not going to lend you as much money … those folks are having to reassess what it is they can buy. They may have to go further out, or reassess the size of property or [the quality].

CoreLogic economist Kaytlin Ezzy said: “Signs of a slowdown and falls in value were already evident before the rate rises, but are now becoming more widespread across Sydney and Melbourne, and beginning to impact the more expensive areas of Brisbane, Canberra and Hobart.” Although property prices are declining, some house hunters still have inflated expectations about what they could secure for their budget, said Sydney buyer’s agent Hamada Alameddine of BuyerX. Others were spot on in their expectations, but a lack of suitable stock, and rising interest rates, meant their property wishlist and search area had started to change.

The lag time in vendors adjusting their price expectations to meet the market also meant some buyers had to take their reduced borrowing capacity elsewhere, Jones said, swapping a suburb like Bronte for Coogee or Randwick.

Australia Latest News, Australia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Treasurer Jim Chalmers speaks at Parliament House | 7NEWSConcern for the global economy is growing according to treasurer JEChalmers. Rising inflation and interest rates, food and energy insecurity and debt are the main concerns of countries around the world. auspol 7NEWS

Treasurer Jim Chalmers speaks at Parliament House | 7NEWSConcern for the global economy is growing according to treasurer JEChalmers. Rising inflation and interest rates, food and energy insecurity and debt are the main concerns of countries around the world. auspol 7NEWS

Read more »

Warning over house-sitting after Australian deported from USMadolline Gourley had a pet-and-house-sitting holiday planned in Canada and the US, but was put on a plane back to Australia five hours after arriving.

Warning over house-sitting after Australian deported from USMadolline Gourley had a pet-and-house-sitting holiday planned in Canada and the US, but was put on a plane back to Australia five hours after arriving.

Read more »

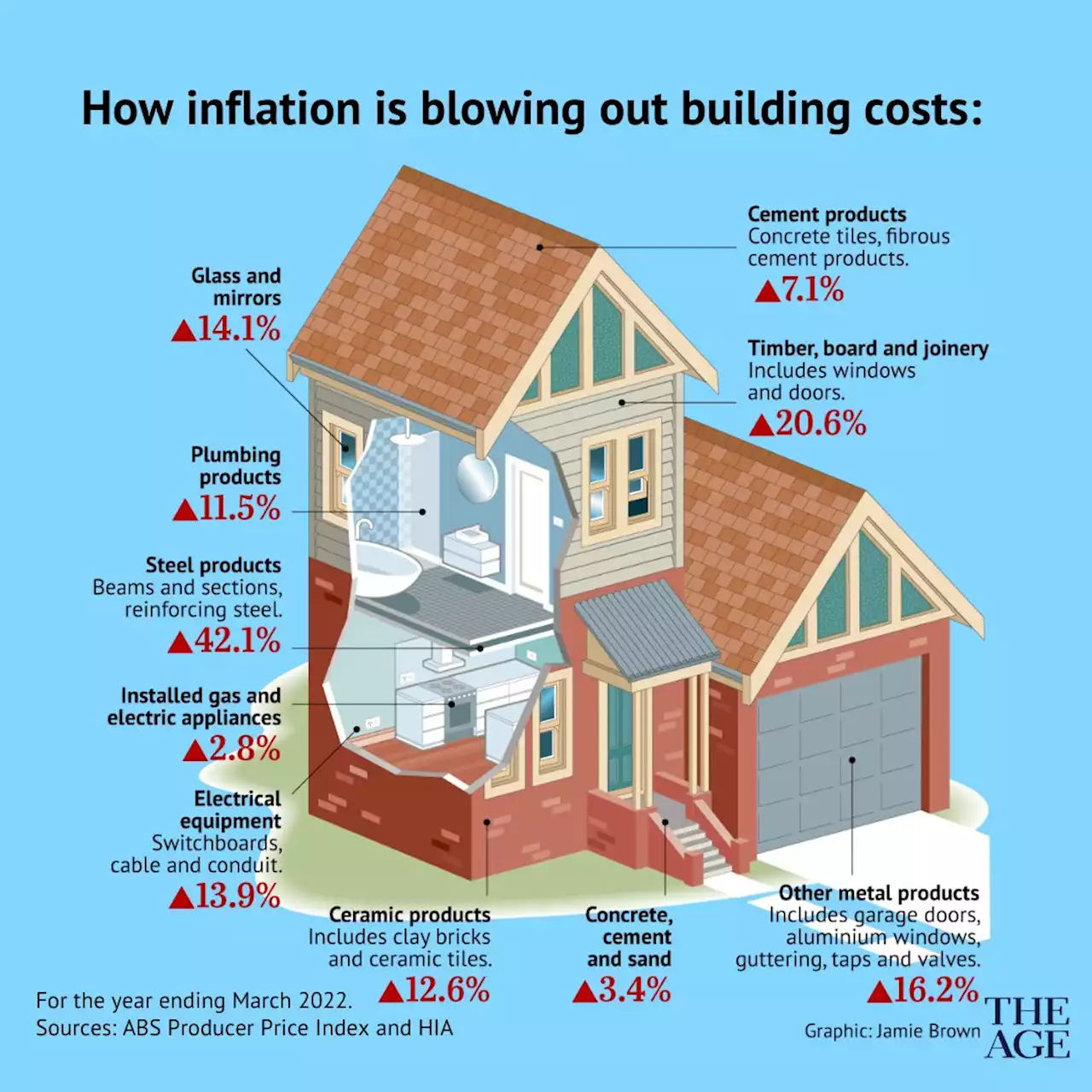

The house prices that are still rising: How inflation is blowing out building costsThe cost of building a new house is rising as almost every category of building material becomes more expensive.

The house prices that are still rising: How inflation is blowing out building costsThe cost of building a new house is rising as almost every category of building material becomes more expensive.

Read more »

The house prices that are still rising: How inflation is blowing out building costsAlmost every category of building materials has become more expensive – and the soaring coasts are at odds with the falling prices of the established housing market. | TawarRazaghi

The house prices that are still rising: How inflation is blowing out building costsAlmost every category of building materials has become more expensive – and the soaring coasts are at odds with the falling prices of the established housing market. | TawarRazaghi

Read more »

The house prices that are still rising: How inflation is blowing out building costsThe cost of building a new house is rising as almost every category of building material becomes more expensive.

The house prices that are still rising: How inflation is blowing out building costsThe cost of building a new house is rising as almost every category of building material becomes more expensive.

Read more »

The house prices that are still rising: How inflation is blowing out building costsAlmost every category of building materials has become more expensive, Australian Bureau of Statistics figures show. Here's how inflation is blowing out construction costs: | TawarRazaghi

The house prices that are still rising: How inflation is blowing out building costsAlmost every category of building materials has become more expensive, Australian Bureau of Statistics figures show. Here's how inflation is blowing out construction costs: | TawarRazaghi

Read more »