Housing affordability in Australia is at its worst, with experts divided on the best solutions. While some argue lowering house prices is key, others warn against significant falls that could damage the economy. The debate centers on the balance between supporting existing homeowners and making housing accessible to first-time buyers and renters.

Lowering house prices is the best way to make housing more affordable, but experts say “heartless” major parties have almost completely discarded the approach.

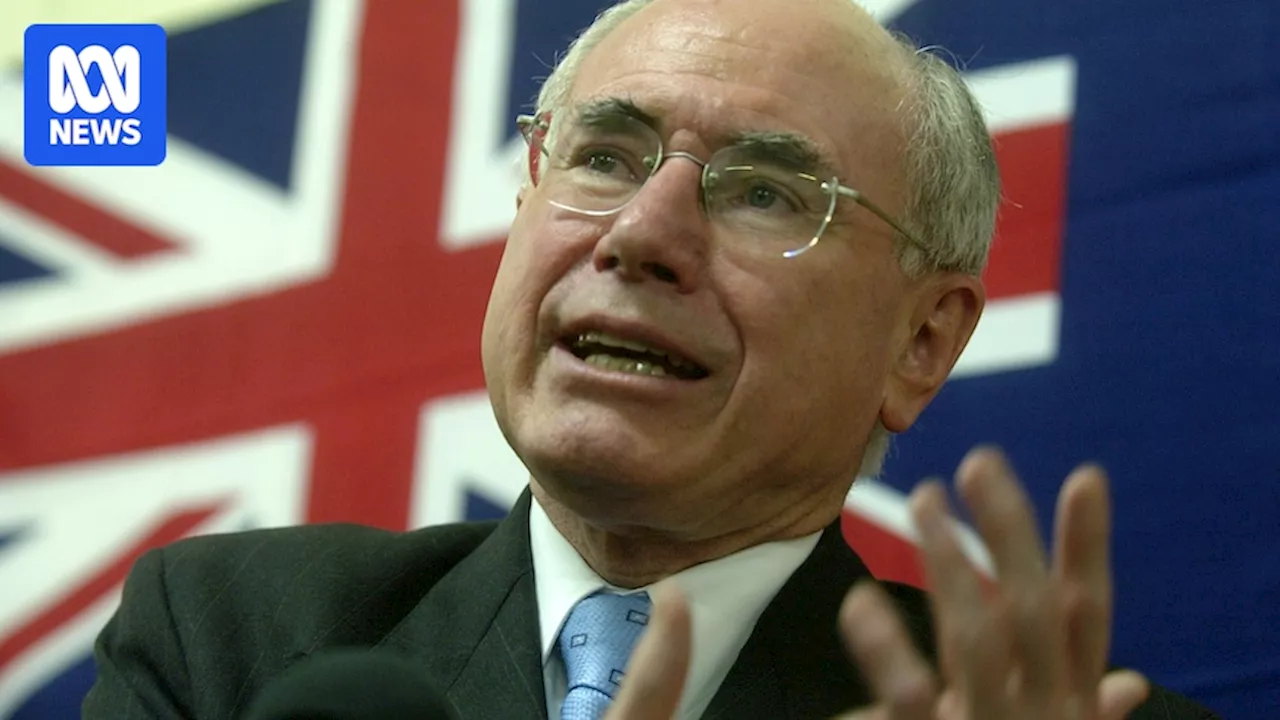

It was former Liberal prime minister John Howard who famously said in 2004 that no one had ever stopped him in the street to complain about the value of their house going up. “So, in order to make housing more affordable, we could increase wages … or we could ensure wages could grow at whatever pace they do, but we establish a mechanism to make house prices go down.”

“Out of this 64 per cent of people, 74 per cent live in a house they own or have a mortgage on. So of the voting core, only 26 per cent are renters and potential home buyers. The vast majority have no interest in prices going down.” AMP deputy chief economist Diana Mousina agreed that falling prices could help affordability but said the falls needed to make a difference – about 30 per cent – would damage the economy.

“If and when I came to sell my house, and the price was lower, I’d be selling my house to buy somewhere else, so the value of that house would be lower,” he said. “It’s not clear that I’d really be worse off.

HOUSING AFFORDABILITY HOUSE PRICES ECONOMY GOVERNMENT POLICY RENTERS

Australia Latest News, Australia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Housing Affordability Crisis: Average Household Can Only Afford $513,000 HomeA recent study by CoreLogic reveals that the average Australian household can only afford a home worth up to $513,000, leaving the majority of properties out of reach. Despite falling property prices due to high interest rates, the steep hurdle of affordability persists for first-home buyers. The study found that a household with a $100,000 income and a 20% deposit could only afford a $513,000 mortgage, significantly lower than the median house values in major cities like Sydney and Melbourne. This limited affordability is impacting the housing market, with even high-wealth households experiencing a decline in demand.

Housing Affordability Crisis: Average Household Can Only Afford $513,000 HomeA recent study by CoreLogic reveals that the average Australian household can only afford a home worth up to $513,000, leaving the majority of properties out of reach. Despite falling property prices due to high interest rates, the steep hurdle of affordability persists for first-home buyers. The study found that a household with a $100,000 income and a 20% deposit could only afford a $513,000 mortgage, significantly lower than the median house values in major cities like Sydney and Melbourne. This limited affordability is impacting the housing market, with even high-wealth households experiencing a decline in demand.

Read more »

Declassified Documents Reveal 2004 Cabinet Discussions on Iraq War, Housing AffordabilityNewly released cabinet files from 2004 shed light on Australia's involvement in the Iraq War, geopolitical concerns, and the growing issue of housing affordability.

Declassified Documents Reveal 2004 Cabinet Discussions on Iraq War, Housing AffordabilityNewly released cabinet files from 2004 shed light on Australia's involvement in the Iraq War, geopolitical concerns, and the growing issue of housing affordability.

Read more »

Australia's Housing Market Slows Due to Affordability ConcernsAustralia's property market is experiencing a slowdown driven by a widening gap between income, borrowing capacity, and home values. The dip is expected to be short-lived but highlights affordability challenges for many Australians.

Australia's Housing Market Slows Due to Affordability ConcernsAustralia's property market is experiencing a slowdown driven by a widening gap between income, borrowing capacity, and home values. The dip is expected to be short-lived but highlights affordability challenges for many Australians.

Read more »

Australia's Housing Market Slows Down Amidst Affordability ConcernsAustralia's housing market experienced a slowdown in December, with home values dipping 0.1%. CoreLogic attributes this downturn to a widening gap between income, borrowing capacity, and home values, exacerbated by slowing economic growth and persistent high interest rates. The report suggests this dip might be short-lived.

Australia's Housing Market Slows Down Amidst Affordability ConcernsAustralia's housing market experienced a slowdown in December, with home values dipping 0.1%. CoreLogic attributes this downturn to a widening gap between income, borrowing capacity, and home values, exacerbated by slowing economic growth and persistent high interest rates. The report suggests this dip might be short-lived.

Read more »

Spain Imposes 100% Tax on Non-EU Real Estate Purchases to Combat Housing CrisisSpain introduces unprecedented tax on foreign real estate buyers to address alarming housing affordability gap.

Spain Imposes 100% Tax on Non-EU Real Estate Purchases to Combat Housing CrisisSpain introduces unprecedented tax on foreign real estate buyers to address alarming housing affordability gap.

Read more »

Housing Crisis Tops Australian Business Leaders' ConcernsKPMG's annual survey of Australian business leaders reveals that the nation's housing crisis is the biggest social issue impacting their operations. Nearly half of the surveyed executives believe the lack of progress on housing affordability poses a threat to businesses, as employees struggle to find affordable accommodation, impacting their ability to work and commute. The survey ranks housing affordability as the top social challenge, highlighting its growing impact on the workforce.

Housing Crisis Tops Australian Business Leaders' ConcernsKPMG's annual survey of Australian business leaders reveals that the nation's housing crisis is the biggest social issue impacting their operations. Nearly half of the surveyed executives believe the lack of progress on housing affordability poses a threat to businesses, as employees struggle to find affordable accommodation, impacting their ability to work and commute. The survey ranks housing affordability as the top social challenge, highlighting its growing impact on the workforce.

Read more »