In December, US 10-year Treasuries were seen yielding 2 per cent, JPMorgan said stocks would rise 5 per cent, and Goldman said bitcoin could hit $US100,000.

has ended one of the most powerful equity bull markets and sent safe-haven government bonds and other assets spiralling. The SP 500 is down 23 per cent, 10-year rates stand at 3.23 per cent and bitcoin has shed more than half its value.

“This is absolutely the end of TINA for the foreseeable future” said James Athey, investment director at abrdn in London. “With 8 per cent inflation not much is attractive on a real basis.”Even Jerome Powell, the US central bank chairman, didn’t see the turbulence that was coming from inflation. He expected price gains to decline to levels closer to the Fed’s longer-run goal of 2 per cent by the end of 2022.

Stocks and bonds together are on track for their worst quarter ever. Meanwhile, credit markets have also taken a battering.So far this year the worldwide pool of the safest corporate debt has shed more than $900 billion, marking its worst first half of a year on record, according to Bloomberg index data. Measures of corporate credit risk are also spiking, with default swaps insuring the debt of Europe’s high-grade firms sitting at the highest since April 2020.

Australia Latest News, Australia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Stock markets plunge again as flurry of interest rate hikes fuels recession fearsInvestors wary as other central banks follow US Federal Reserve in raising borrowing costs

Stock markets plunge again as flurry of interest rate hikes fuels recession fearsInvestors wary as other central banks follow US Federal Reserve in raising borrowing costs

Read more »

Crypto crash could be just getting startedThe crypto market built on cheap money looks set for an epic collapse as central banks warn to prepare for steep rate rises.

Crypto crash could be just getting startedThe crypto market built on cheap money looks set for an epic collapse as central banks warn to prepare for steep rate rises.

Read more »

Attack of the hawks: seven days that killed the easy money eraAround the world, central banks that flooded the money with cheap funds for over a decade are in a rapid, uncomfortable and dramatic retreat.

Attack of the hawks: seven days that killed the easy money eraAround the world, central banks that flooded the money with cheap funds for over a decade are in a rapid, uncomfortable and dramatic retreat.

Read more »

We face a global economic crisis. And no one knows what to do about itCentral banks rode to the rescue of nervous investors for years. But now they are raising rates just as the world economy spirals downwards

We face a global economic crisis. And no one knows what to do about itCentral banks rode to the rescue of nervous investors for years. But now they are raising rates just as the world economy spirals downwards

Read more »

Nasdaq paces Wall Street rebound, oil tumblesUS stocks appeared set to end the week on a positive note. The US listed shares of BHP and Rio fell. Iron ore dropped. $A slides below US70¢.

Nasdaq paces Wall Street rebound, oil tumblesUS stocks appeared set to end the week on a positive note. The US listed shares of BHP and Rio fell. Iron ore dropped. $A slides below US70¢.

Read more »

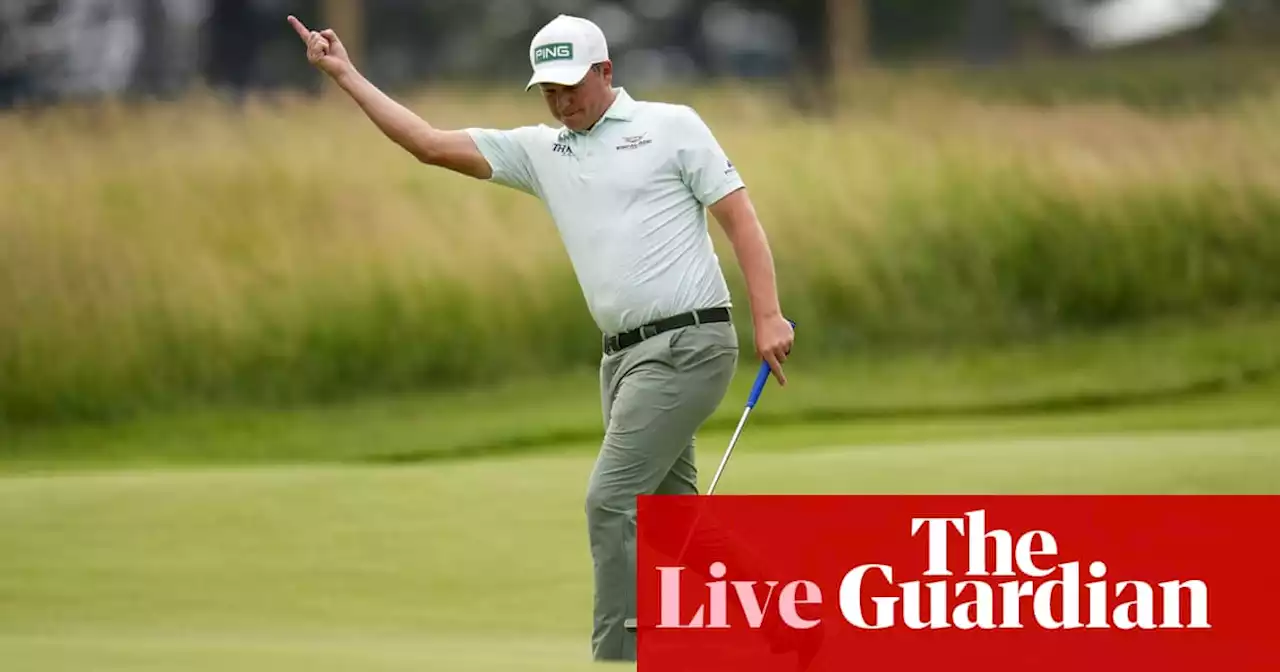

US Open golf 2022: second round – live!Will Rory McIlroy continue his title challenge on day two of the US Open at Brookline? Join Scott Murray

US Open golf 2022: second round – live!Will Rory McIlroy continue his title challenge on day two of the US Open at Brookline? Join Scott Murray

Read more »