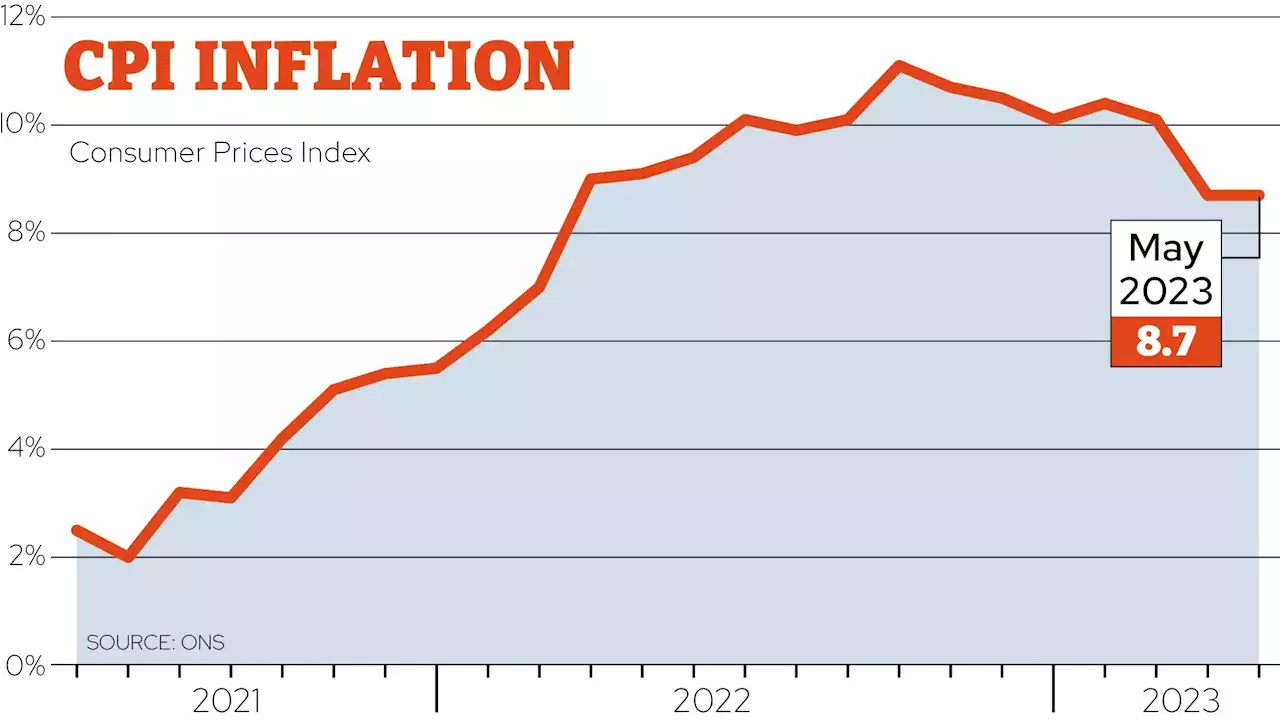

UK inflation has remained 8.7 per cent, which means the costs of goods are still increasing at the same rate as they were in April luciemheath explains what it means for your money

has remained 8.7 per cent, which means the costs of goods are still increasing at the same rate as they were in April.

Economists believed CPI would fall to 8.4 per cent in May, however the figure has remained the same as it was in April, showing the inflation remains stubbornly high in the UK. The latest figures mean British households were paying on average 8.7 per cent per cent more for goods and services, including food, fuel and energy, in May this year than they were during the same month last year.

Despite the slowing rate of inflation, the figure is still high and there is still concern around the costs facing British households, in particular food costs.

Australia Latest News, Australia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

UK inflation rate remains unchanged at 8.7% in May – what it means for youTHE UK’s rate of inflation remained the same in May from the month before, the latest official figures show. The Consumer Price Index level of inflation was frozen at 8.7%, the same as in Apr…

UK inflation rate remains unchanged at 8.7% in May – what it means for youTHE UK’s rate of inflation remained the same in May from the month before, the latest official figures show. The Consumer Price Index level of inflation was frozen at 8.7%, the same as in Apr…

Read more »

Inflation has experienced a rocky road over the last 50 years!The media today, through its many facets and antennae, is more influential than at any time in living memory. Courtesy of social media nothing escapes their attention.

Inflation has experienced a rocky road over the last 50 years!The media today, through its many facets and antennae, is more influential than at any time in living memory. Courtesy of social media nothing escapes their attention.

Read more »

Grocery inflation eases to 'slowest monthly rate this year'The third consecutive monthly easing in grocery inflation is welcome but no cause for celebration as the rate remains the sixth highest recorded in the past 15 years.

Grocery inflation eases to 'slowest monthly rate this year'The third consecutive monthly easing in grocery inflation is welcome but no cause for celebration as the rate remains the sixth highest recorded in the past 15 years.

Read more »

UK grocery inflation eases for third month, Kantar data shows\n\t\t\tKeep abreast of significant corporate, financial and political developments around the world.\n\t\t\tStay informed and spot emerging risks and opportunities with independent global reporting, expert\n\t\t\tcommentary and analysis you can trust.\n\t\t

Read more »

Pressure on Bank of England to hike interest rates to 5% despite expected dip in inflation📈 The Bank of England is under pressure to raise interest rates by as much 0.5% to 5 per cent this week in a fresh headache for Rishi Sunak as he faces a political backlash over the spike in mortgage costs

Pressure on Bank of England to hike interest rates to 5% despite expected dip in inflation📈 The Bank of England is under pressure to raise interest rates by as much 0.5% to 5 per cent this week in a fresh headache for Rishi Sunak as he faces a political backlash over the spike in mortgage costs

Read more »