'Was the Bank of England right to raise inflation rates again?' Oxford Economies's senior advisor Michael Saunders thinks so, here's why 👇 📺 Sky 501, Virgin 602, Freeview 233 and YouTube

Inflation should 'fall sharply' over coming months, Bank of England says

"On the other hand, inflation could surprise to the upside, particularly if wage rises remain elevated, suggesting further rate rises.""The MPC has again been driven to raise rates by stubbornly high inflation, ongoing strength in wage growth and better-than-expected activity," she said. We've been reporting on how savers are being urged to make sure they shop around for the best deals on their bank accounts - especially now the Base rate has risen again.

But that is the paradox facing the economy at the moment. On the one hand, the outlook for the country as a whole is considerably rosier than it was only a few months ago. If you follow these forecasts you may recall that late last year the Bank said that the UK economy might well face the longest recession in modern history.

Yet for those households who do not benefit from these financial cushions, life is tough - and getting tougher. Only around a third of the eventual"pain" of higher interest rates have yet been felt, because most mortgage payers have yet to refix their loans onto higher rates. But that will happen for millions in the coming months.

The Bank's Monetary Policy Committee said there would be no recession this year, upgrading its economic growth forecasts by more than in any of its previous reports. It is a dramatic change from only a few months ago, when it was predicting the longest-lived recession in modern British history. However, it still only results in relatively lacklustre economic growth this year and next.

The vote to change interest rates was split, with seven members voting for the quarter percentage point increase but two MPC members, Silvana Tenreyro and Swati Dhingra, voting to leave them unchanged.

Australia Latest News, Australia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

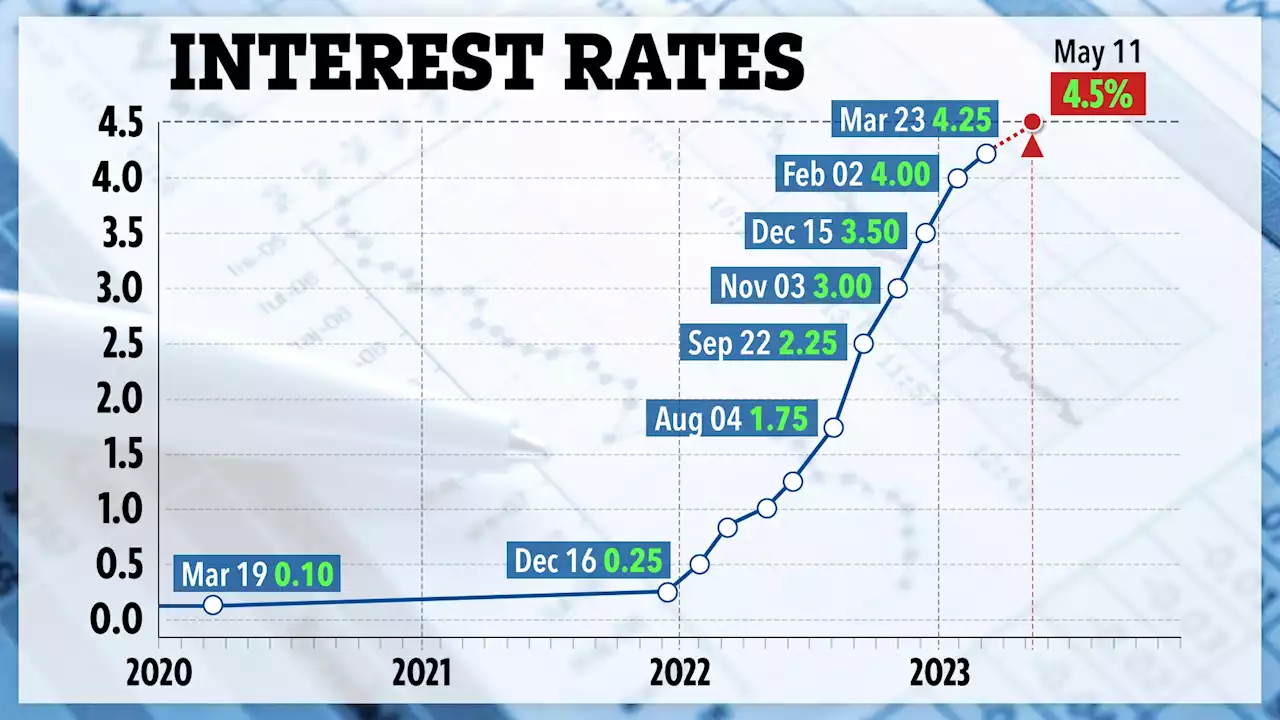

Bank of England hikes interest rates to 4.5% - its highest level since 2008BREAKING: Britain’s interest rates have risen to 4.5%, the Bank of England's highest level since 2008.

Bank of England hikes interest rates to 4.5% - its highest level since 2008BREAKING: Britain’s interest rates have risen to 4.5%, the Bank of England's highest level since 2008.

Read more »

Mortgage warning for millions as Bank of England hikes interest rates AGAINMILLIONS of homeowners will face higher mortgage repayments after the Bank of England hiked interest rates again. The central bank’s base rate has increased from 4.25% to 4.5%. The rate is us…

Mortgage warning for millions as Bank of England hikes interest rates AGAINMILLIONS of homeowners will face higher mortgage repayments after the Bank of England hiked interest rates again. The central bank’s base rate has increased from 4.25% to 4.5%. The rate is us…

Read more »

What the Bank of England's interest rate announcement this week means for youEconomists are concerned that the Base Rate could rise to the same levels it was at during the 2008 financial crisis

What the Bank of England's interest rate announcement this week means for youEconomists are concerned that the Base Rate could rise to the same levels it was at during the 2008 financial crisis

Read more »

Bank of England to impose another interest rate hike as UK inflation proves stubbornFinancial markets and economists have priced in another rate rise today and their focus will be on the Bank's updated forecasts for signs that a pause lies ahead.

Bank of England to impose another interest rate hike as UK inflation proves stubbornFinancial markets and economists have priced in another rate rise today and their focus will be on the Bank's updated forecasts for signs that a pause lies ahead.

Read more »

‘We will not change Bank of England’s inflation target’ Treasury ministers vowFinancial watchdogs facing benchmarks to keep City competitive amid claims of 'unaccountable' regulators

‘We will not change Bank of England’s inflation target’ Treasury ministers vowFinancial watchdogs facing benchmarks to keep City competitive amid claims of 'unaccountable' regulators

Read more »

Martin Lewis warns savers to check rate to avoid being ripped offYou may be able to get four times the amount of interest with a different bank

Martin Lewis warns savers to check rate to avoid being ripped offYou may be able to get four times the amount of interest with a different bank

Read more »