This article provides financial advice regarding the best investment options for a godson's future, considering tax implications and market volatility. It delves into the challenges of investing for minors, explores insurance bonds as a suitable solution, and offers guidance on managing cash reserves and utilizing bring-forward superannuation contributions.

A reader inquires about the best way to invest money for their godson's future, considering the punitive tax rules associated with investing for children. They are exploring two options: opening a trust account to buy shares or a traditional bank account. The reader acknowledges that accessing a large sum of money at 18 might be too young and prefers to have the funds available at 25.

They are particularly concerned about the high tax rates on child-owned investments, which can reach 66 percent on income over $416 per year. The article recommends investing in insurance bonds as the most suitable option. Tax on investment earnings within the bond is paid at 30 percent, eliminating further tax obligations on the annual tax return. Moreover, funds can be transferred to the godson free of capital gains tax (CGT) at a chosen time.Addressing the reader's query about managing market volatility, the article emphasizes the importance of long-term investment and maintaining at least three years' worth of expenses in cash. This serves as a buffer against potential downturns, preventing the need to sell growth assets at unfavorable times. The article clarifies that keeping three years' expenses in cash doesn't necessarily mean a savings account and suggests considering regular income sources like rental income and share dividends. The reader, at 71 with a substantial superannuation balance, seeks advice on whether keeping their accumulation account is beneficial. Considering their low income and minimal withdrawals from the pension account, the article suggests maintaining the accumulation account until they cease earning income. Lastly, the article addresses the bring-forward non-concessional superannuation contributions, emphasizing that notification to the ATO or superannuation fund is not required. The ATO will automatically reconcile contributions with the cap under the bring-forward rule.

Investing Children's Finances Insurance Bonds Tax Planning Superannuation Market Volatility

Australia Latest News, Australia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Best Investment Options for a GodsonThis article explores various investment strategies for a godson, considering factors like tax implications and long-term growth. It recommends insurance bonds as a tax-efficient option and provides guidance on managing cash reserves for emergencies.

Best Investment Options for a GodsonThis article explores various investment strategies for a godson, considering factors like tax implications and long-term growth. It recommends insurance bonds as a tax-efficient option and provides guidance on managing cash reserves for emergencies.

Read more »

The Wiggles and Bonds launch limited-edition country-inspired collection for little cowgirls and cowboys7NEWS brings you the latest local news from Australia and around the world. Stay up to date with all of the breaking sport, politics, entertainment, finance, weather and business headlines. Today's news, live updates & all the latest breaking stories from 7NEWS.

The Wiggles and Bonds launch limited-edition country-inspired collection for little cowgirls and cowboys7NEWS brings you the latest local news from Australia and around the world. Stay up to date with all of the breaking sport, politics, entertainment, finance, weather and business headlines. Today's news, live updates & all the latest breaking stories from 7NEWS.

Read more »

Hirokazu Kore-eda's 'Asura' Explores the Shifting Tides of Family BondsHirokazu Kore-eda's latest series, 'Asura', delves into the complexities of familial relationships through the lens of infidelity. Set in 1979 Tokyo, the series follows four adult sisters as they grapple with their father's long-standing mistress. Kore-eda, known for his poignant portrayals of family dynamics, masterfully weaves together multiple storylines while capturing the intimate nuances of their interactions.

Hirokazu Kore-eda's 'Asura' Explores the Shifting Tides of Family BondsHirokazu Kore-eda's latest series, 'Asura', delves into the complexities of familial relationships through the lens of infidelity. Set in 1979 Tokyo, the series follows four adult sisters as they grapple with their father's long-standing mistress. Kore-eda, known for his poignant portrayals of family dynamics, masterfully weaves together multiple storylines while capturing the intimate nuances of their interactions.

Read more »

North Queensland Floods: Thousands Face Insurance Woes After Devastating DownpoursSevere flooding across north Queensland has left thousands of residents and businesses grappling with extensive damage and insurance uncertainties. The Insurance Council of Australia reports nearly 5,000 claims, with the number expected to rise as floodwaters recede. Many are facing difficulties securing insurance coverage, highlighting concerns about the adequacy of existing disaster relief schemes.

North Queensland Floods: Thousands Face Insurance Woes After Devastating DownpoursSevere flooding across north Queensland has left thousands of residents and businesses grappling with extensive damage and insurance uncertainties. The Insurance Council of Australia reports nearly 5,000 claims, with the number expected to rise as floodwaters recede. Many are facing difficulties securing insurance coverage, highlighting concerns about the adequacy of existing disaster relief schemes.

Read more »

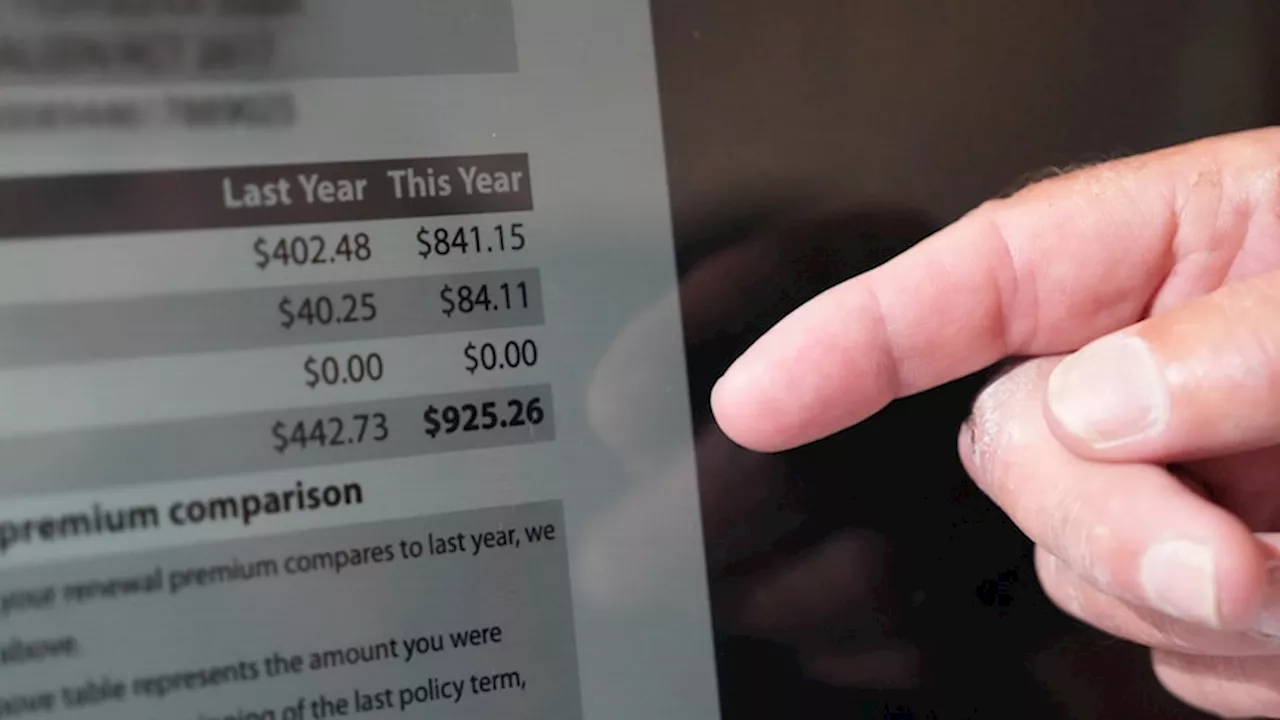

Can you fight back against insurance hikes?We all find the cost of insurance too high, but have you ever thought to actually fight against big hikes to your premium? A growing number of Australians are trying just that, with limited success.

Can you fight back against insurance hikes?We all find the cost of insurance too high, but have you ever thought to actually fight against big hikes to your premium? A growing number of Australians are trying just that, with limited success.

Read more »

Income Protection Insurance: Is It Worth It?This article explores the importance of income protection insurance, its benefits, and considerations when choosing a policy. It compares group insurance through superannuation with retail policies, highlighting key differences such as coverage, premiums, and financial implications. The article emphasizes the need for personalized advice based on individual circumstances.

Income Protection Insurance: Is It Worth It?This article explores the importance of income protection insurance, its benefits, and considerations when choosing a policy. It compares group insurance through superannuation with retail policies, highlighting key differences such as coverage, premiums, and financial implications. The article emphasizes the need for personalized advice based on individual circumstances.

Read more »