The IRS is warning current tax filers should be concerned about tax preparers filing false returns for their clients. MORE ⬇️

PHOENIX — The tax filing deadline is about a month away. Meanwhile, Dan Zimmerman is still trying to get answers about a tax return from years ago.He sent another check, ended up with a $1,000 overpayment, and has been getting promises but no action from the IRS ever since.In 2021, only 11% of callers got through. It was just 13% in 2022.IRS Special Agent Brian Watson says about 85% of calls to the IRS are answered now.

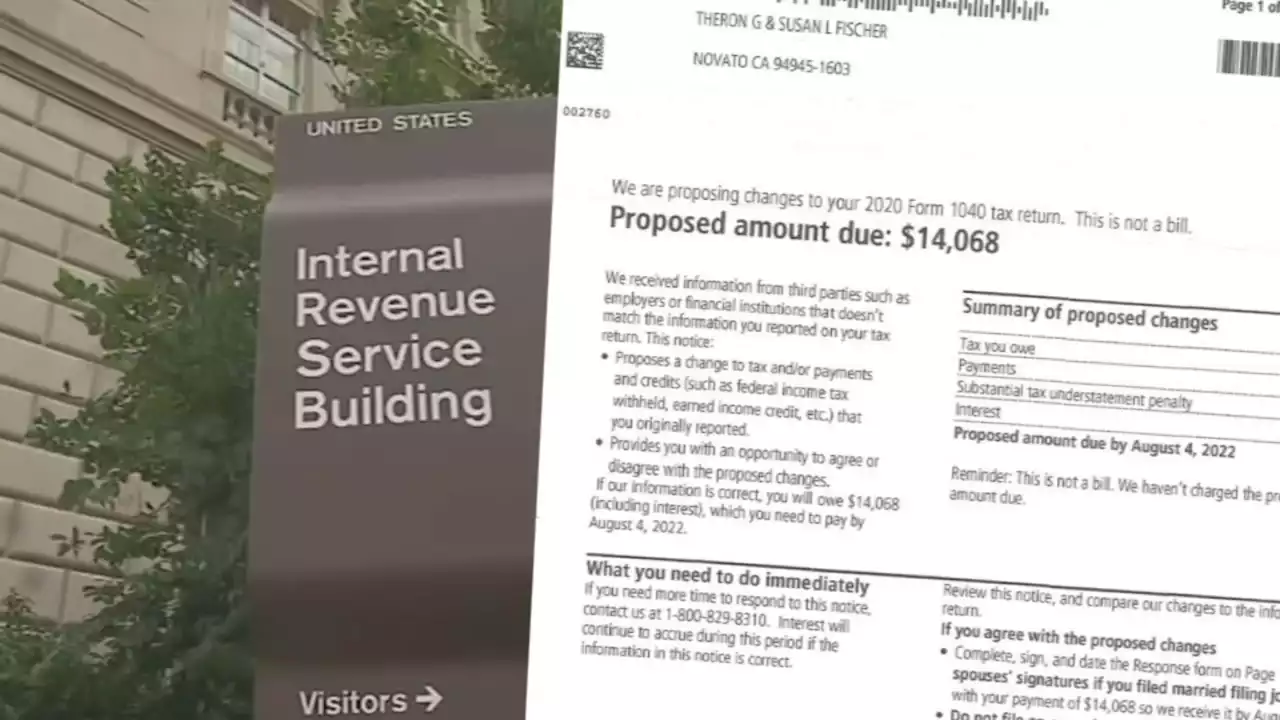

Many of those calls are about refunds, but Watson says current filers should have another concern: cheating tax preparers.Watson says, by far, most preparers are doing things correctly but he is finding some preparers putting false information on returns, like a fake business. "The preparer will create a business, say photography, and that business will have a loss. That loss offsets W2 income so the overall income is reduced, which increases the refund," Watson says."When people get big refunds, they tell their friends and that gets people in the door so they can charge more," he says.

Australia Latest News, Australia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

IRS to crack down on income earned by third-party sellers on eBay, Amazon and other sitesIf you're among the nearly 4 million people who sell items on Ebay, Amazon or Etsy, the IRS is watching you.

IRS to crack down on income earned by third-party sellers on eBay, Amazon and other sitesIf you're among the nearly 4 million people who sell items on Ebay, Amazon or Etsy, the IRS is watching you.

Read more »

Officer who killed George Floyd pleads guilty in tax caseDerek Chauvin pleaded guilty to aiding and abetting, failing to file tax returns to the state of Minnesota for the years 2016 and 2017.

Officer who killed George Floyd pleads guilty in tax caseDerek Chauvin pleaded guilty to aiding and abetting, failing to file tax returns to the state of Minnesota for the years 2016 and 2017.

Read more »