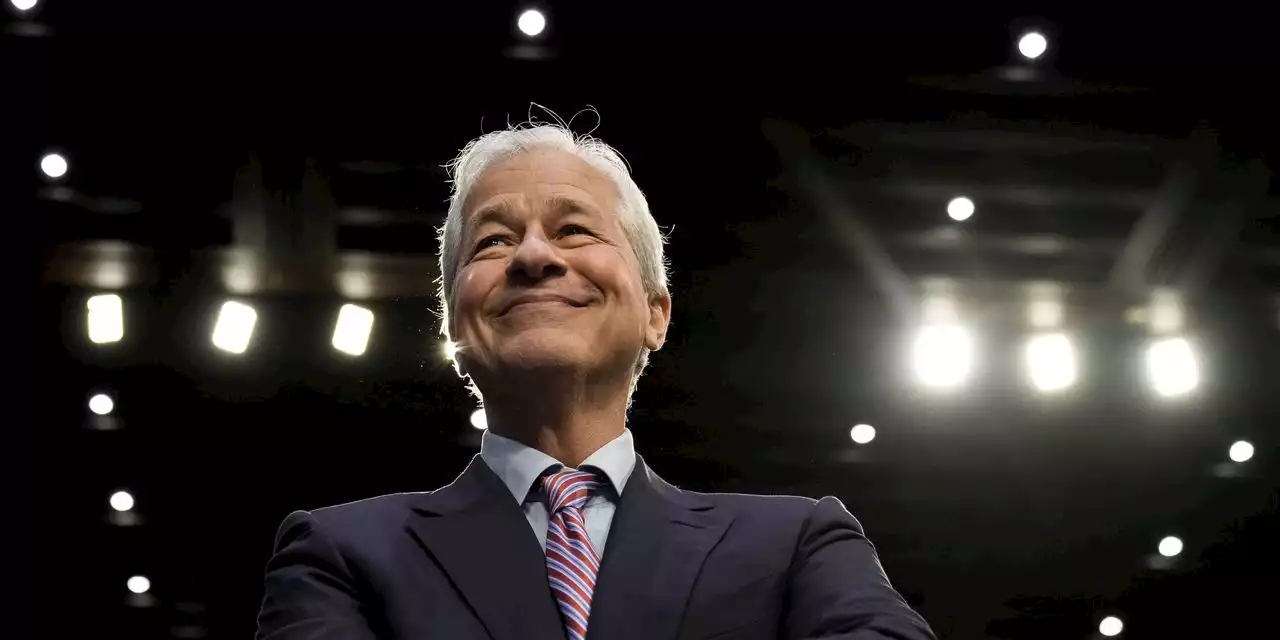

JPMorgan CEO Jamie Dimon warned the Federal Reserve could be forced to raise interest rates further in a 'worst-case' scenario.

Investors need to be prepared for 7% interest rates and most of them aren’t. That’s the stark warning from JPMorgan Chase CEO Jamie Dimon over potential risks for the U.S. economy.

“Going from zero to 5% caught some people off guard, but no one would have taken 5% out of the realm of possibility. I am not sure if the world is prepared for 7%,” Dimon said in an interview with the Times of India. “If they are going to have lower volumes and higher rates, there will be stress in the system. We urge our clients to be prepared for that kind of stress,” he said.

Australia Latest News, Australia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Jamie Dimon on interest rates: 'I am not sure the world is prepared for 7%'Jamie Dimon throws down a new hawkish interest-rate number.

Jamie Dimon on interest rates: 'I am not sure the world is prepared for 7%'Jamie Dimon throws down a new hawkish interest-rate number.

Read more »

'We have dealt with recessions before': Jamie Dimon says geopolitics is the world's biggest riskJPMorgan Chase & Co. CEO Jamie Dimon says geopolitics in light of Russia's invasion in Ukraine is the biggest risk is a much larger risk than high inflation or a U.S. recession.

'We have dealt with recessions before': Jamie Dimon says geopolitics is the world's biggest riskJPMorgan Chase & Co. CEO Jamie Dimon says geopolitics in light of Russia's invasion in Ukraine is the biggest risk is a much larger risk than high inflation or a U.S. recession.

Read more »

Jamie Dimon says India optimism is 'completely justified'JPMorgan Chase Chairman and CEO Jamie Dimon struck a bullish tone at the India Investor Summit.

Jamie Dimon says India optimism is 'completely justified'JPMorgan Chase Chairman and CEO Jamie Dimon struck a bullish tone at the India Investor Summit.

Read more »

Dimon warns that the Fed could still raise interest rates sharply from here“I am not sure if the world is prepared for 7%,” he told The Times of India in an interview.

Dimon warns that the Fed could still raise interest rates sharply from here“I am not sure if the world is prepared for 7%,” he told The Times of India in an interview.

Read more »

Jamie Dimon Warns Fed Rate Could Reach 7%. What’s Worrying the JPMorgan CEO.JPMorgan CEO Jamie Dimon warned the Federal Reserve could be forced to raise interest rates further in a 'worst-case' scenario.

Jamie Dimon Warns Fed Rate Could Reach 7%. What’s Worrying the JPMorgan CEO.JPMorgan CEO Jamie Dimon warned the Federal Reserve could be forced to raise interest rates further in a 'worst-case' scenario.

Read more »

Digital World, Real WorldThe psychological and social effects of digital technology

Digital World, Real WorldThe psychological and social effects of digital technology

Read more »