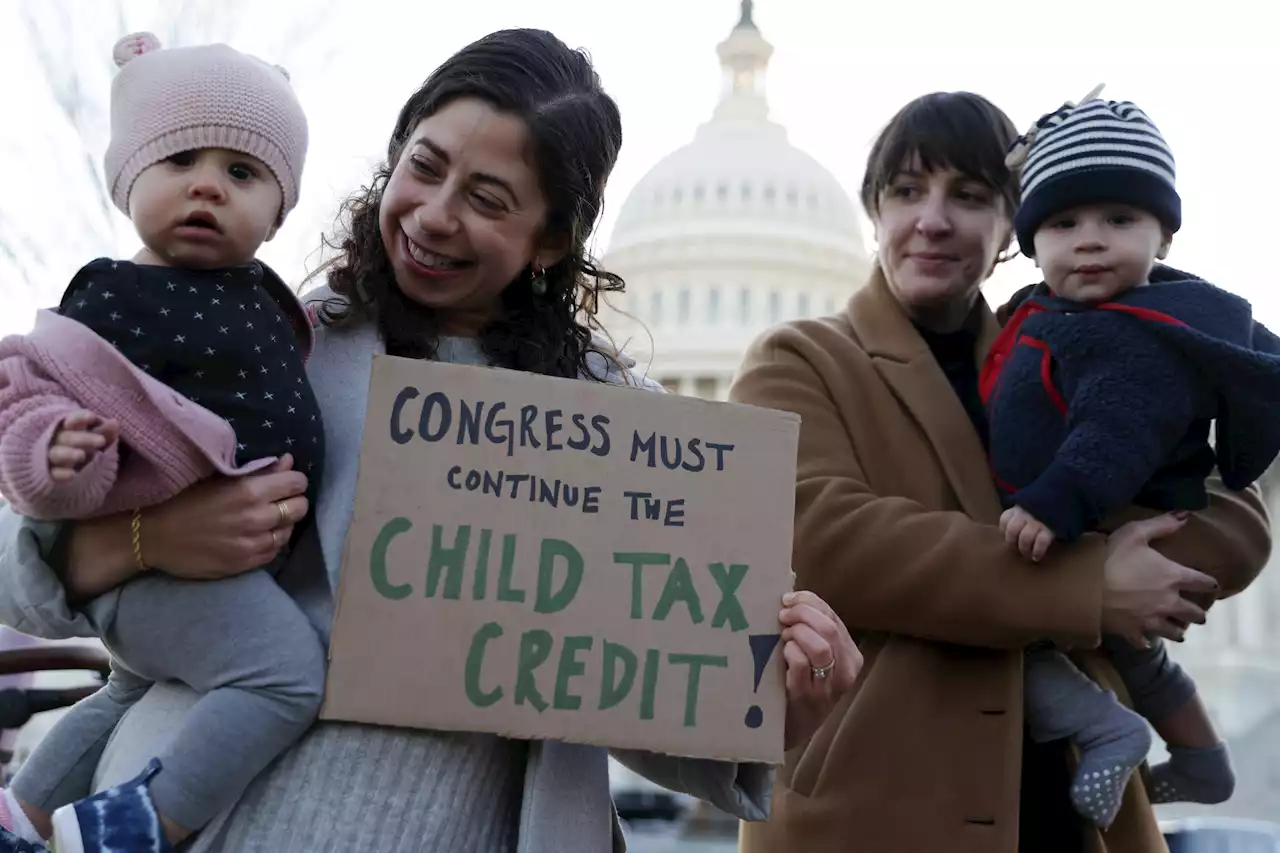

This month will be the first time since July that parents won’t be able to rely on the child tax credit.

found that between 3 and 3.8 million children were kept from poverty because of the payments from July to November, at which point the monthly child poverty rate had dropped by 29 percent. The most significant impacts were on Black and Latinx children. By November, Black child poverty had shrunk by 26 percent, and the Latinx child poverty rate was down 30 percent, the center found.

“Being a single mom and living check to check — actually day to day, for me — just being able to have that reassurance that it was coming on the 15th [of every month], it made me stress out a lot less,” McKinnie said. “I knew that we would have groceries and it would be OK for me to go grocery shopping and get everything that we needed.”

That sign-up process was cumbersome: The application was confusing, available only in English and did not come in a mobile phone version . A new portal in partnership with tech nonprofit Code for America became widely available in September, offering a simplified application that was mobile-friendly and available in Spanish.

“What we have shown is that this population can be reached, but it’s going to take time to get to everyone,” he said. On the ground, agencies helping people sign up for the credit reported a wide swath of problems, including tax forms that were filled out incorrectly by reputable organizations, absent parents who were wrongfully claiming the children instead, and credits that were marked as “issued” even though parents never received the money.

Katie Walden and her family saw the upcoming arrival of the credit as an opportunity. Her husband had spent the pandemic trucking to keep the family afloat, work that was on a contract basis, low paid and required punishingly long hours. With the credit coming, they could afford for him to take a lower-paying job that was more stable, they thought.

“It’s just that demoralizing thing every time you have to ask for help, and we wouldn’t have had to ask for help if it would have worked out,” Walden said.The future of the child tax credit seems to hinge on two major proposed changes to the policy: the introduction of a work requirement and a lower income cap.

The former version of the child tax credit had income minimums for parents to qualify, which rose depending on how many kids were in the family. That resulted in about a third of children not accessing the credit, including half of all Black and Latinx kids whose parents were more likely to fail to meet the income requirements.

Curran argues that the central point of the program was to help kids, regardless of parent’s income status. As the pandemic has shown, that income status can also swing quickly and suddenly.

Australia Latest News, Australia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Saturday marks first month of no Child Tax Credit payment for familiesSaturday, Jan. 15, marks the first month since summer 2021 that more than 1.2 million Ohio families will not receive a monthly child tax credit payment.

Saturday marks first month of no Child Tax Credit payment for familiesSaturday, Jan. 15, marks the first month since summer 2021 that more than 1.2 million Ohio families will not receive a monthly child tax credit payment.

Read more »

‘We’re drowning’: Parents fear what’s coming with end of child tax creditAs COVID-19 cases continue to surge due to the highly contagious omicron variant, parents face uncertaintly with end of child tax credit advance payments.

‘We’re drowning’: Parents fear what’s coming with end of child tax creditAs COVID-19 cases continue to surge due to the highly contagious omicron variant, parents face uncertaintly with end of child tax credit advance payments.

Read more »

Millions of families won't get child tax credit for first time in six monthsMillions of families will not receive the monthly child tax credit payments this weekend for the first time in six months as the program expired at the end of last year.

Millions of families won't get child tax credit for first time in six monthsMillions of families will not receive the monthly child tax credit payments this weekend for the first time in six months as the program expired at the end of last year.

Read more »

Monthly child tax credit to stop this weekend: What families should knowMillions of families who received a monthly payment from the IRS through the expanded child tax credit are facing their first month since July without cash from the federal program, even as inflation soars to the highest level in a generation.

Monthly child tax credit to stop this weekend: What families should knowMillions of families who received a monthly payment from the IRS through the expanded child tax credit are facing their first month since July without cash from the federal program, even as inflation soars to the highest level in a generation.

Read more »

Goodbye ‘Godsend': Expiration of Child Tax Credits Hits HomeFor the first time in half a year, families on Friday are going without a monthly deposit from the child tax credit.

Goodbye ‘Godsend': Expiration of Child Tax Credits Hits HomeFor the first time in half a year, families on Friday are going without a monthly deposit from the child tax credit.

Read more »

Goodbye 'godsend': Families going without monthly deposit as child tax credit program expiresFor the first time in half a year, families on Friday are going without a monthly deposit from the child tax credit.

Goodbye 'godsend': Families going without monthly deposit as child tax credit program expiresFor the first time in half a year, families on Friday are going without a monthly deposit from the child tax credit.

Read more »