Regular people must pay an inheritance tax of 40% on any part of an estate valued above 325,000 pounds (about $374,000). But Prime Minister John Major said in 1993 that assets passed from sovereigns to successors aren't subject to the inheritance tax.

In 1993, Queen Elizabeth II and her heir, then-Prince Charles, reached a deal with the government in which they agreed to voluntarily pay taxes — but to be exempt from an inheritance tax. Mother and son are seen here in 2019 in London., but he won't have to pay the U.K.'s inheritance tax on the massive wealth he inherits from his late mother, Queen Elizabeth II. That's because of a deal the royals made with the government nearly 30 years ago.

Regular citizens must pay the standard inheritance tax rate of 40% on any part of an estate that's valued above a threshold of 325,000 pounds . There areBut under an agreement with the monarchy that then-Prime Minister John MajorThe exemption was part of a broader tax deal As Charles becomes king — at a time when the U.K. government and its constituents are struggling to cope with an, soaring food prices and a troubled health care system — the arrangement is now under fresh scrutiny.

At the time, Major warned of"the danger of the assets of the monarchy being salami-sliced away by capital taxation through generations, thus changing the nature of the institution in a way that few people in this country would welcome." In the 1993 deal, both Queen Elizabeth II and Charles agreed to pay a personal income tax, after reaching out to the government to ask how they might voluntarily pay taxes.But he also stated,"In the unique circumstances of an hereditary monarchy, special arrangements are needed for inheritance tax."Queen Elizabeth II's death does more than trigger Charles becoming king.

Australia Latest News, Australia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

People divided over King Charles III not having to pay any estate taxWhile some called the plans an 'absolute disgrace' others dismissed such complaints and suggested there is 'no appetite for a Republic.'

People divided over King Charles III not having to pay any estate taxWhile some called the plans an 'absolute disgrace' others dismissed such complaints and suggested there is 'no appetite for a Republic.'

Read more »

President Biden speaks with King Charles III for 1st time since queen’s deathPresident Biden and Charles last met in person in November at a climate summit. The two also met last June.

President Biden speaks with King Charles III for 1st time since queen’s deathPresident Biden and Charles last met in person in November at a climate summit. The two also met last June.

Read more »

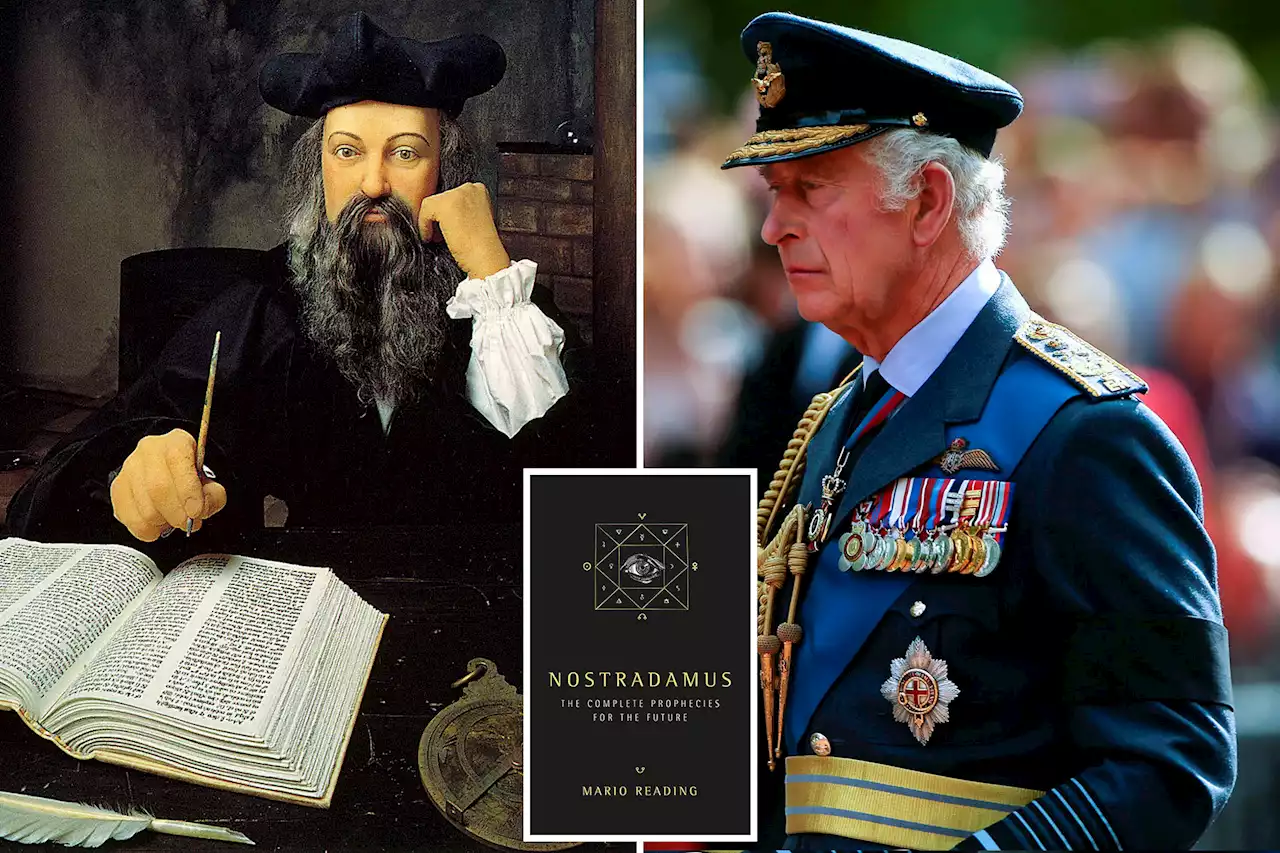

King Charles III to abdicate, this unexpected royal to rule instead: Nostradamus predictionTexts from Nostradamus have been interpreted to mean that a dark horse could soon replace the newly crowned king.

King Charles III to abdicate, this unexpected royal to rule instead: Nostradamus predictionTexts from Nostradamus have been interpreted to mean that a dark horse could soon replace the newly crowned king.

Read more »