Most emerging market currencies will continue to struggle against the mighty dollar over the coming year as the U.S. Federal Reserve finally delivers expected aggressive policy tightening, according to a Reuters poll of FX strategists.

Central banks in emerging market economies have been bracing for this for months by hiking their benchmark interest rates. But the actual moment when the Fed delivers half-point rate increases and rapid balance sheet reduction still matters.

Even currencies which have been dragged higher by the ongoing commodity cycle and their respective central banks' policy tightening, like the Brazilian real and the South African rand , were forecast to give up about half of those gains in a year.The Mexican peso - a classic emerging market foreign exchange hedge — is expected to lose more than three times its gains for this year in 12 months.

"A particular risk to EMFX is that as the Fed starts to deliver rate hikes, further upside in U.S. yields could be primarily driven more by real yields than breakeven inflation"While most emerging market currencies have managed to escape the onslaught of the Fed's policy tightening relatively unscathed, the Russian rouble and the Turkish lira were notable exceptions.

The Russian currency is driven by export-focused companies selling foreign currency and low activity of importers. But analysts warned the recent rouble rally won't last.

Australia Latest News, Australia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

GBP/USD Technical Analysis: Trying to Stay Above 1.30It is noticeable that the GBP/USD currency pair is trying, in light of the strength of the US dollar, to avoid a collapse below the support 1.3000.

GBP/USD Technical Analysis: Trying to Stay Above 1.30It is noticeable that the GBP/USD currency pair is trying, in light of the strength of the US dollar, to avoid a collapse below the support 1.3000.

Read more »

Gold Technical Analysis: Strong Movement AheadDespite the strength of the US dollar, gold markets stabilized after three weeks of decline, posting a rise of 0.36% despite the upcoming interest rate hike in the market.

Gold Technical Analysis: Strong Movement AheadDespite the strength of the US dollar, gold markets stabilized after three weeks of decline, posting a rise of 0.36% despite the upcoming interest rate hike in the market.

Read more »

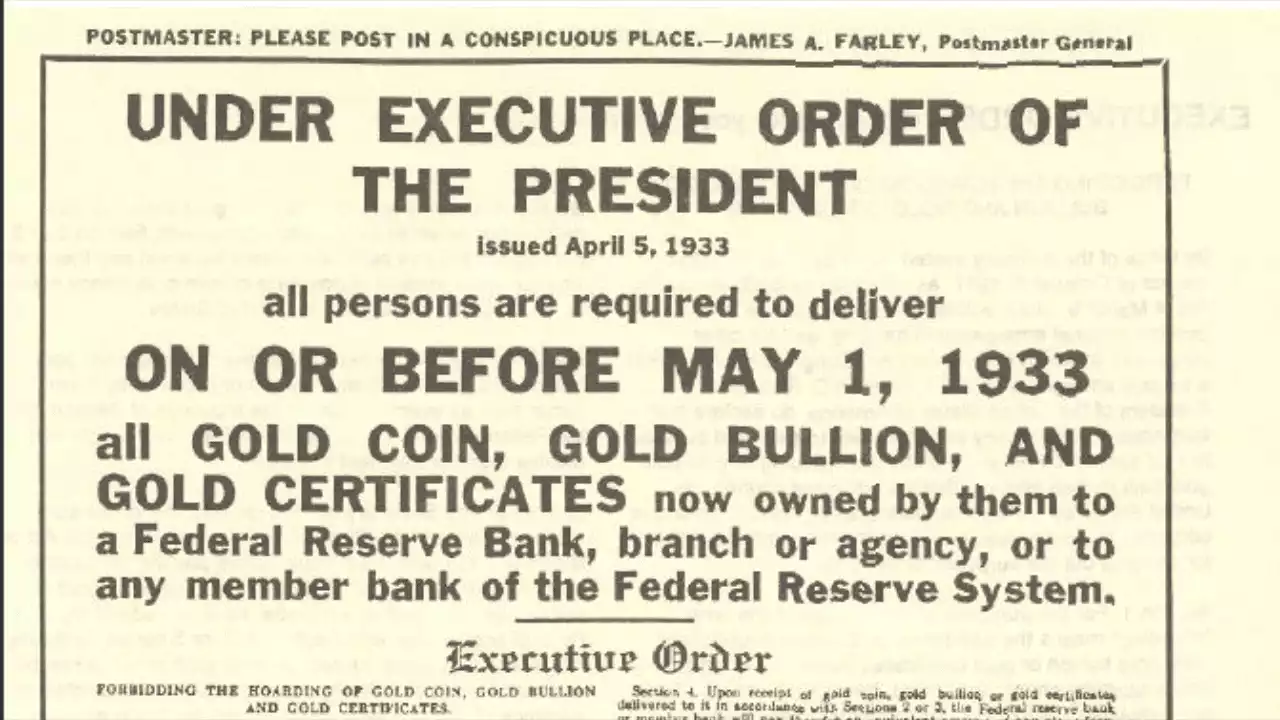

Could the Government Confiscate Gold Again? A Look at Today's 'Emergencies' and Revisiting Executive Order 6102 – Featured Bitcoin NewsWhile the U.S. dollar’s strength is being examined, many have questioned whether or not the U.S. government will confiscate gold again.

Could the Government Confiscate Gold Again? A Look at Today's 'Emergencies' and Revisiting Executive Order 6102 – Featured Bitcoin NewsWhile the U.S. dollar’s strength is being examined, many have questioned whether or not the U.S. government will confiscate gold again.

Read more »

EUR/USD Technical Analysis: Interest Rates Increase LossesThe US Federal Reserve confirmed that it is ready to raise US interest rates strongly during the year, and thus the strength of the US dollar increased.

EUR/USD Technical Analysis: Interest Rates Increase LossesThe US Federal Reserve confirmed that it is ready to raise US interest rates strongly during the year, and thus the strength of the US dollar increased.

Read more »

GBP/USD pops and drops on the release of the hawkish FOMC minutesGBP was the strongest currency immediately after the release of the Federal Open Market Committee minutes, popping to 1.3107 before dropping to post m

GBP/USD pops and drops on the release of the hawkish FOMC minutesGBP was the strongest currency immediately after the release of the Federal Open Market Committee minutes, popping to 1.3107 before dropping to post m

Read more »

Silver Price Analysis: XAG/USD subdued near $24.50 pre-Fed minutes release as bears eye $24.00 support zoneSpot silver (XAG/USD), whilst continuing to trend gradually to the downside as US yields and the US dollar continues to advance ahead of the release o

Silver Price Analysis: XAG/USD subdued near $24.50 pre-Fed minutes release as bears eye $24.00 support zoneSpot silver (XAG/USD), whilst continuing to trend gradually to the downside as US yields and the US dollar continues to advance ahead of the release o

Read more »