From the early backers of Nvidia to those that have recently jumped on the bandwagon, Wall Street is betting the AI rally has further to run.

Already a subscriber?William Low can pinpoint the moment he realised that investment firm – Nikko Asset Management – was missing out on the start of something huge for the market.

From that point, Low began re-shuffling the global equities fund to bolster its exposure to artificial intelligence, and to what he describe as the “picks and shovels” of the sector. So they bought chip design software manufacturer Synopsys in June, added Nvidia in August, bought Meta in October followed by chipmaker Broadcom at the end of the year.While the fund, branded in Australia as the Yarra Global Share Fund, has undershot the MSCI All Countries World Index by 3.

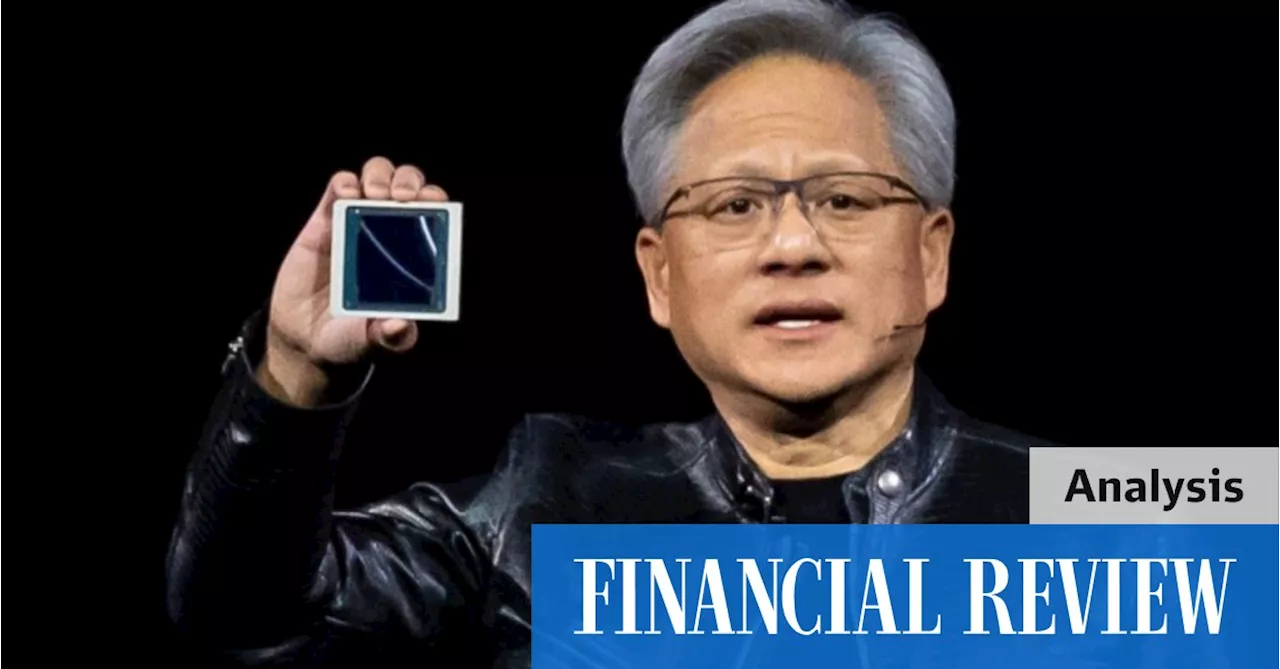

In contrast to Nikko’s late arrival on the AI scene, US investment giant T. Rowe Price bought Nvidia’s shares during the pandemic in 2021 amid the boom in cryptocurrency, data centres and gaming.T. Rowe’s $US8.9 billion global growth strategy then sold its holding in the US summer of 2021 due to Nvidia’s “extreme valuation”. Less than a year later, the team visited Silicon Valley for the launch of ChatGPT in November 2022, and met Nvidia’s chief executive Jensen Huang.

Citi this week doubled down on its “significantly long” position in global technology stocks, and remains overweight to the US, Taiwanese, Korean and Japanese equity markets due to their heavy exposure to the sector. BlackRock also this week reiterated its “overweight” exposure to US stocks and the AI theme, noting that recent central bank activity has given markets the “thumbs up” to stay upbeat.and solid corporate earnings supporting “cheery” sentiment which keeps the firm pro-risk over the next six to 12 months.

Australia Latest News, Australia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Wall Street: Nvidia plummets to levels not seen since earlier this weekHow the $US200 billion intraday tumble in market value is met could prove key as to how fast a pullback in US equities is approaching.

Wall Street: Nvidia plummets to levels not seen since earlier this weekHow the $US200 billion intraday tumble in market value is met could prove key as to how fast a pullback in US equities is approaching.

Read more »

Nvidia: what’s so good about the tech firm’s new AI superchip?US firm hopes to lead in artificial intelligence and other sectors – and has built a model that could control humanoid robots

Nvidia: what’s so good about the tech firm’s new AI superchip?US firm hopes to lead in artificial intelligence and other sectors – and has built a model that could control humanoid robots

Read more »

What Nvidia has launched, and why so many people careEveryone knows that Nvidia is the most important company in the AI world right now, but what did it actually release on Tuesday, and what does it do?

What Nvidia has launched, and why so many people careEveryone knows that Nvidia is the most important company in the AI world right now, but what did it actually release on Tuesday, and what does it do?

Read more »

Nvidia: The three risks lurking beneath the AI tech rallySigns that the gains in artificial intelligence darlings like Nvidia have hit a speed bump are adding to concern of the risks lurking beneath the surge in the sharemarket.

Nvidia: The three risks lurking beneath the AI tech rallySigns that the gains in artificial intelligence darlings like Nvidia have hit a speed bump are adding to concern of the risks lurking beneath the surge in the sharemarket.

Read more »

Nvidia CEO Jensen Huang’s annual conference shows we should be excited and afraid about AINvidia’s announcement of even faster AI computer chips underscores how rapidly this technology will change the way we work and live. Be warned.

Nvidia CEO Jensen Huang’s annual conference shows we should be excited and afraid about AINvidia’s announcement of even faster AI computer chips underscores how rapidly this technology will change the way we work and live. Be warned.

Read more »

Nvidia unveils new ‘super chip’ in push to extend AI dominanceChief executive Jensen Huang claimed the company’s new Blackwell chips are substantially more powerful than its already market-leading AI ones.

Nvidia unveils new ‘super chip’ in push to extend AI dominanceChief executive Jensen Huang claimed the company’s new Blackwell chips are substantially more powerful than its already market-leading AI ones.

Read more »