Investors have priced in quarter-point hikes from the Federal Reserve and European Central Bank, so focus will be on what will be said about future rate hikes.

The benchmarks rose 1.5% and 2.2% respectively last week, their fourth straight of week of gain, as supply is expected to tighten following OPEC+ cuts.

Rising interest rates have dampened investments and strengthened the greenback, making dollar-denominated commodities more expensive for holders of other currencies. Market participants also expect Beijing to implement targeted stimulus measures to support its flagging economy, likely boosting oil demand in the world's No. 2 consumer.to support the oil market are sufficient for now and the group is "only a phone call away" if any further steps are needed.

Australia Latest News, Australia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Russian central bank hikes rates as Ukraine war sparks ruble, labor crisesInsider tells the global tech, finance, markets, media, healthcare, and strategy stories you want to know.

Read more »

Central Bank of Russia Discusses Digital Ruble Integration With Other Countries – News Bitcoin NewsGovernor of the Bank of Russia, Elvira Nabiullina, stated many countries were already developing their digital currencies and that the bank was discussing integrating the digital ruble with these.

Central Bank of Russia Discusses Digital Ruble Integration With Other Countries – News Bitcoin NewsGovernor of the Bank of Russia, Elvira Nabiullina, stated many countries were already developing their digital currencies and that the bank was discussing integrating the digital ruble with these.

Read more »

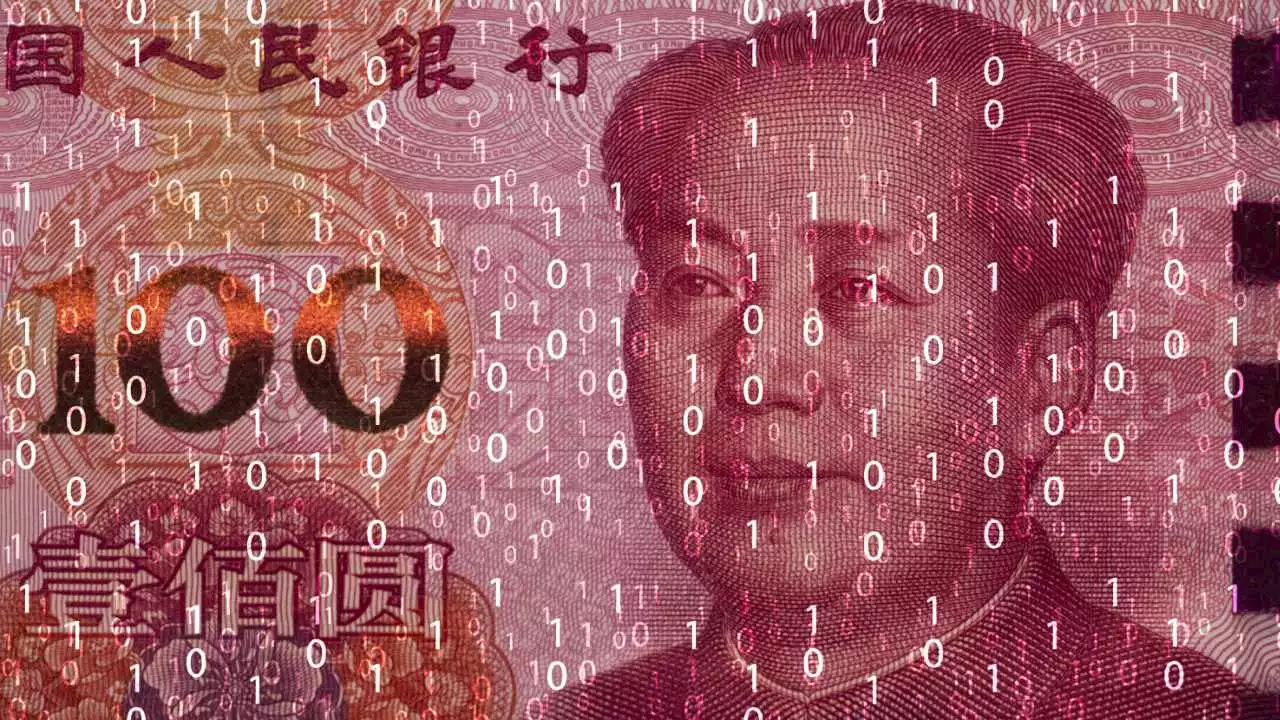

China's Central Bank: Digital Yuan Transactions Reach $250 Billion – Featured Bitcoin NewsChina’s central bank has revealed that digitalyuan transactions reached 1.8 trillion yuan ($250 billion) at the end of June. RMB yuan CBDC

China's Central Bank: Digital Yuan Transactions Reach $250 Billion – Featured Bitcoin NewsChina’s central bank has revealed that digitalyuan transactions reached 1.8 trillion yuan ($250 billion) at the end of June. RMB yuan CBDC

Read more »

Nigerian central bank adds NFC upgrade to eNaira for contactless paymentsAdoption challenges have persisted since Nigeria launched the eNaira in 2021, prompting innovative features like NFC tech and programmability to boost usage.

Nigerian central bank adds NFC upgrade to eNaira for contactless paymentsAdoption challenges have persisted since Nigeria launched the eNaira in 2021, prompting innovative features like NFC tech and programmability to boost usage.

Read more »

Oil rally takes a breather ahead of Fed, ECB rate hikesOil prices eased on Monday as traders await more rate hike cues from U.S. and European central banks, with tightening supply and hopes for Chinese stimulus underpinning Brent at $80 a barrel.

Oil rally takes a breather ahead of Fed, ECB rate hikesOil prices eased on Monday as traders await more rate hike cues from U.S. and European central banks, with tightening supply and hopes for Chinese stimulus underpinning Brent at $80 a barrel.

Read more »