The OPEC oil cartel and allied producers including Russia are not changing their targets for shipping oil to the global economy. The decision comes amid uncertainty about the impact of new Western sanctions against Russia.

Average gas prices have fallen for U.S. drivers in recent days to $3.41 per gallon, according to motoring club federation AAA.

To prevent a sudden loss of Russian crude, the price cap allows shipping and insurance companies to transport Russian oil to non-Western nations at or below that threshold. Most of the globe’s tanker fleet is covered by insurers in the G-7 or EU.Russia would likely try to evade the cap by organizing its own insurance and using the world’s shadowy fleet of off-the-books tankers, as Iran and Venezuela have done, but that would be costly and cumbersome, analysts say.

Facing those uncertainties for the global oil market, OPEC oil ministers led by Saudi Arabia could leave production levels unchanged or cut output again to keep prices from declining further. Low prices mean less revenue for governments of producing nations. Maintaining OPEC production targets makes sense because “right now I think they see the market as adequately priced, adequately supplied, and there’s no reason to rock the boat,” said Gary Peach, oil markets analyst with Energy Intelligence.The G-7 price cap could prompt Russia to retaliate and take oil off the market. But the cap of $60 a barrel is near the current price of Russian oil, meaning Moscow could continue to sell while rejecting the cap in principle.

“If Russia ends up taking off more oil than about a million barrels per day, then the world becomes short on oil, and there would need to be an offset somewhere, whether that’s from OPEC or not,” said Jacques Rousseau, managing director at Clearview Energy Partners. “That’s going to be the key factor — is to figure out how much Russian oil is really leaving the market.”

Australia Latest News, Australia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

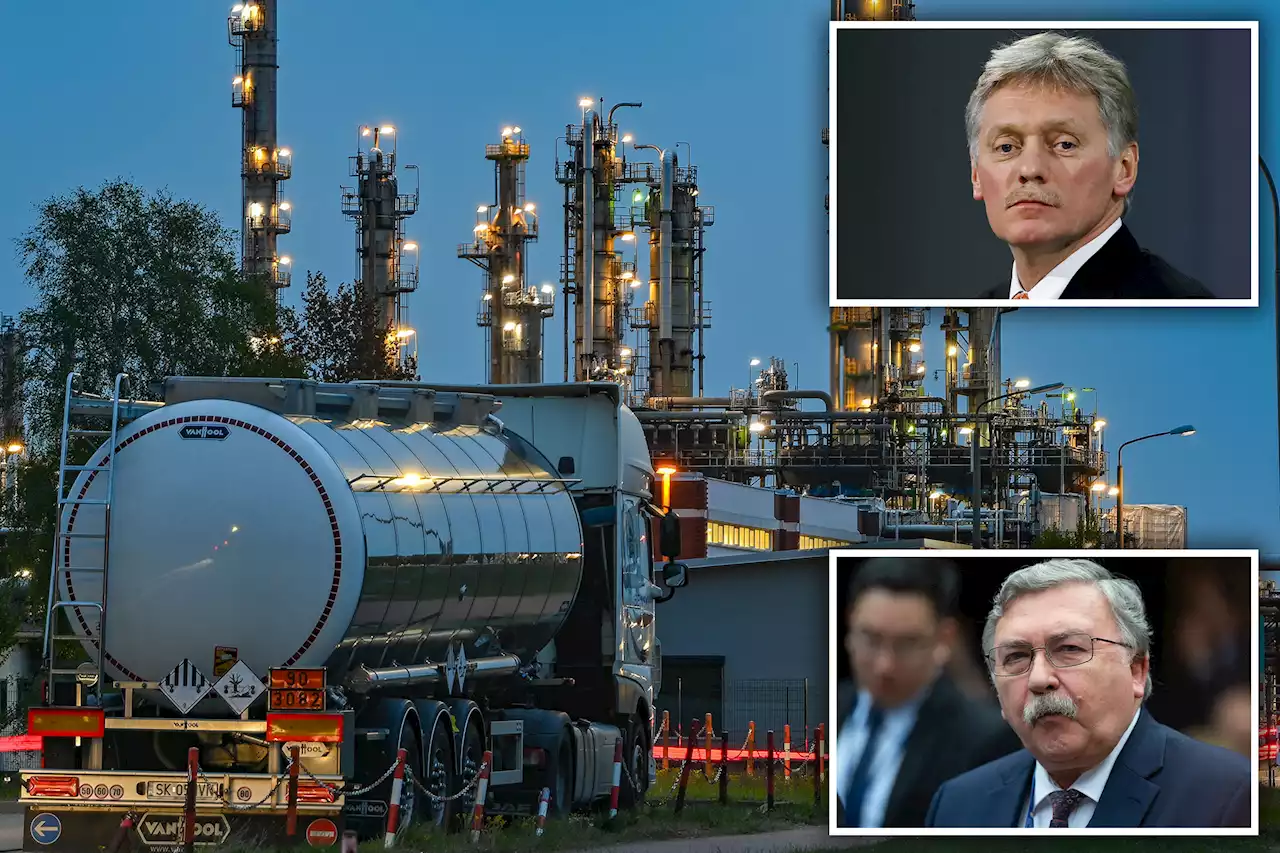

Russia threatens oil cut off after rejecting Western-set price capRussia is threatening to stop supplying Western allies of Ukraine with oil after rejecting a proposed price cap of $60 per barrel.

Russia threatens oil cut off after rejecting Western-set price capRussia is threatening to stop supplying Western allies of Ukraine with oil after rejecting a proposed price cap of $60 per barrel.

Read more »

OPEC+ Keeps Oil Curbs Despite Russia Price CapOPEC+ said it will stick to its oil-output cuts amid mounting concerns over Covid lockdowns in China and uncertainty over Russia’s ability to export crude

OPEC+ Keeps Oil Curbs Despite Russia Price CapOPEC+ said it will stick to its oil-output cuts amid mounting concerns over Covid lockdowns in China and uncertainty over Russia’s ability to export crude

Read more »

OPEC+ Gathers to Decide Output, With Russia Oil-Price Cap LoomingDelegates and analysts said members of the group have been discussing three scenarios—keeping production the same, cutting output a little or even raising levels.

OPEC+ Gathers to Decide Output, With Russia Oil-Price Cap LoomingDelegates and analysts said members of the group have been discussing three scenarios—keeping production the same, cutting output a little or even raising levels.

Read more »

OPEC+ oil producers face uncertainty over Russian sanctionsThe Saudi-led OPEC oil cartel and allied producing countries, including Russia, are expected to decide how much oil to supply to the global economy amid weakening demand in China and uncertainty about the impact of new Western sanctions against Russia that could take significant amounts of oil off the market.

OPEC+ oil producers face uncertainty over Russian sanctionsThe Saudi-led OPEC oil cartel and allied producing countries, including Russia, are expected to decide how much oil to supply to the global economy amid weakening demand in China and uncertainty about the impact of new Western sanctions against Russia that could take significant amounts of oil off the market.

Read more »

OPEC+ seen heading for oil policy rollover, cut not ruled outOPEC+ is likely to stick to its current oil output target when it meets on Sunday, two OPEC+ sources said on Friday, although some say a further output cut is not completely off the table given concern about economic growth and demand.

OPEC+ seen heading for oil policy rollover, cut not ruled outOPEC+ is likely to stick to its current oil output target when it meets on Sunday, two OPEC+ sources said on Friday, although some say a further output cut is not completely off the table given concern about economic growth and demand.

Read more »

Western allies move to cap the price of Russian oil at $60 a barrelAfter months of lobbying by the United States and days of fraught negotiations, Ukraine’s allies are closer to implementing a plan to cap the price of Russian oil starting next week.

Western allies move to cap the price of Russian oil at $60 a barrelAfter months of lobbying by the United States and days of fraught negotiations, Ukraine’s allies are closer to implementing a plan to cap the price of Russian oil starting next week.

Read more »