Once upon a time, Americans’ income-tax payments were a matter of public record

This transcript was prepared by a transcription service. This version may not be in its final form and may be updated.

Ron Shafer: Well, I write these articles and at certain times of the year I look for something that might be related and gotten to see just a sentence that once tax returns were public, I said what? So I went and looked it up and on the Newspaper Club and sure enough,Ron Shafer: I was a reporter and an editor at the Wall Street Journal for nearly 40 years and was The Washington political features editor and writer of the former page one column, the Washington Wire.

Ron Shafer: Federal income tax was established in 1913, and I don't think anybody thought about making it public at that time. They were just starting the income tax.Ron Shafer: Well, there was a rise of a lot of wealthy people at the time. One of them being the Vanderbilts, who had started building railroads and John Rockefeller who had Standard Oil and he was making tons of money, and Henry Ford had started the Ford Motor Company.

Ron Shafer: And the liberals in Congress said, "Well, okay, we'll go along with you, but we want to make it, so that all the tax payments are made public.". And that was the compromise to cut the top tax rate. I think it went from 58%, the top rate, to 46%, but they got this opening to create a public disclosure of all income taxes, which Coolidge and his Treasury Secretary hated, but they wanted the legislation.

Ron Shafer: Some newspapers didn't want to publish the tax returns, because it included not only the richest people in the country, it included everybody. So Joe the plumber down the street, his neighbors would all know what he's paid on his income taxes last year. Ron Shafer: One was The Washington Post and the biggest taxpayer in Washington actually was the publisher of The Washington Post, but they also printed, on their front page, the names of local residents starting with the letter A: the barber, the grocer, just about anybody. This is what actually the opponents of the law used to try to counter these disclosures, saying that it was hurting just the average person who didn't deserve to get all this kind of publicity.

Ron Shafer: William Ripley Jr. in Chicago, the chewing gum guy, his taxes went from $865,000, that was in terms of today's dollars, to only 44,000 in terms of today day dollars, because it said he had written off losses over the past 10 years. So the public saw that the rich people were paying taxes, but they also had loopholes that them to not pay as much as they might have otherwise.

Ron Shafer: Well, the law was basically undone, because of pressure from Andrew Mellon, the Secretary of the Treasury, the wealthy Pittsburgh banking family member. Republicans controlled Congress at this point, and Coolidge was able to get through a legislation to cut the top individual tax rate and we've never looked back.

Stephanie Kelton: Welcome back to The Best New Ideas in Money. Before the break, we went back to the 1920s to learn about the brief time that taxes were public record. The law was abandoned after two years, but a century later, the idea that there should be more transparency when it comes to taxes hasn't gone away.

Andrew Keshner: What was happening was the press was raising questions on his tax liability and how much he was paying on his taxes, and he said, well, take a look at this. Andrew Keshner: Because of the transparency problems in understanding where all the money is coming from, it's difficult to pinpoint how big the gap is between what's owed and what's paid. But one thing is for certain, is that it's a huge number. This tax gap thing, there's many different numbers out there. The IRS said that between 2014 and 2016, they estimated the gap to be $496 billion.

Stephanie Kelton: That bill is one we've mentioned on the show before, the Inflation Reduction Act passed back in August. A lot was packed into that law and one part of it was allocating $80 billion to the IRS over the course of a decade. As Keshner notes, over half the funding is set aside to increase enforcement, which the Biden administration has said will focus on corporations and households making over $400,000 a year.

Charles Passy: For 2019, The Tax Foundation estimates that the top 1% of taxpayers paid on average a little more than 25% in federal income tax. They say that's more than seven times higher than what taxpayers in the bottom 50% paid. Andrew Keshner: Your tax return can reveal a lot about you. There's tax breaks for medical expenses, there's tax breaks for gambling losses. There's even the number of dependence you have. And what if someone were to look at your return and say, "Oh wow, you had $50,000 in medical expenses. What happened to you?". That would be more than a little uncomfortable or looking at, "Oh wow, you had a lot of gambling losses there.".

Australia Latest News, Australia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

New Pew poll shows Americans are not confident in cryptoA new Pew Research poll shows the majority of Americans just don't trust crypto, with more than two-thirds lacking confidence in the assets.

New Pew poll shows Americans are not confident in cryptoA new Pew Research poll shows the majority of Americans just don't trust crypto, with more than two-thirds lacking confidence in the assets.

Read more »

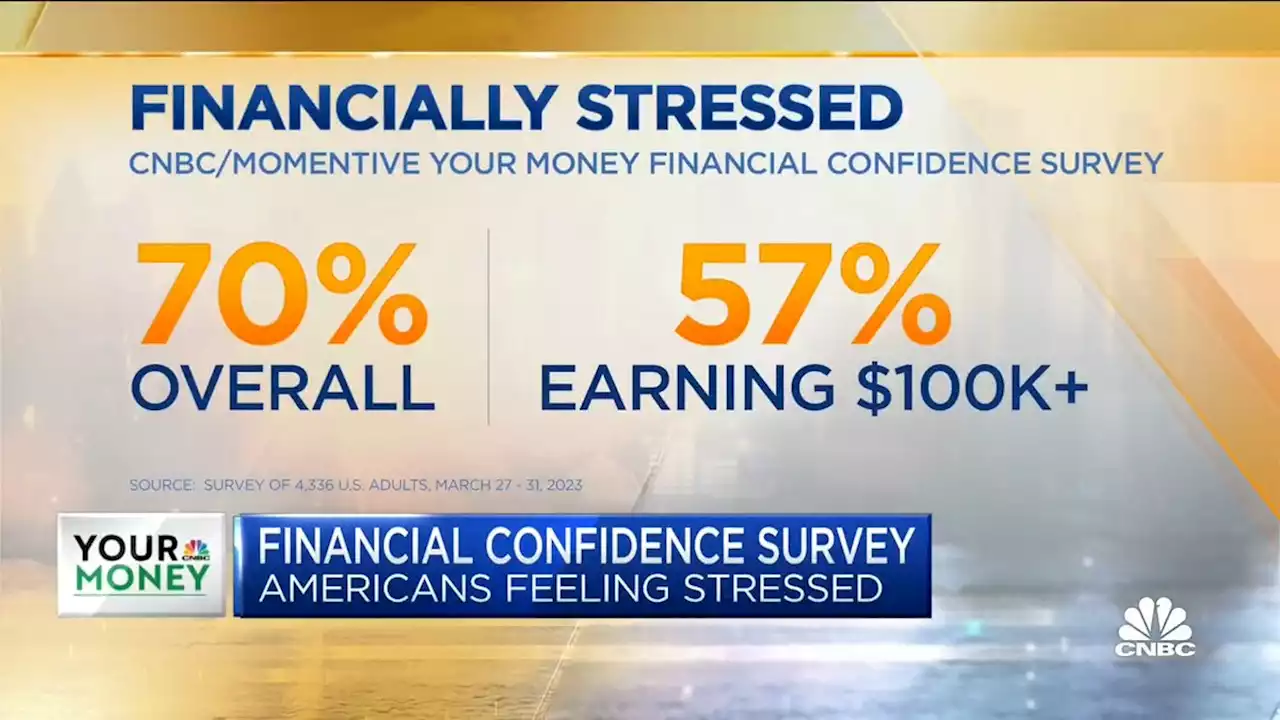

70% of Americans are feeling financially stressed, new CNBC survey finds70% of Americans are feeling financially stressed, according to a new CNBC survey conducted in partnership with MomentiveAI. sharon_epperson has the details.

70% of Americans are feeling financially stressed, new CNBC survey finds70% of Americans are feeling financially stressed, according to a new CNBC survey conducted in partnership with MomentiveAI. sharon_epperson has the details.

Read more »

As the U.S. and China clash over Taiwan, Taiwanese Americans face an anxious new normalThe conflict between the U.S. and China over Taiwan's sovereignty is political theater with drastic consequences.

As the U.S. and China clash over Taiwan, Taiwanese Americans face an anxious new normalThe conflict between the U.S. and China over Taiwan's sovereignty is political theater with drastic consequences.

Read more »

The best iPhone 14 Pro cases: 15 best ones you can buy | Digital TrendsYour iPhone 14 Pro is a big, beautiful hunk of metal and glass. Be sure to protect it with some of the bestcases available. We suggest a few here.

The best iPhone 14 Pro cases: 15 best ones you can buy | Digital TrendsYour iPhone 14 Pro is a big, beautiful hunk of metal and glass. Be sure to protect it with some of the bestcases available. We suggest a few here.

Read more »

The Best Graduation Gifts to Stock a New KitchenGive recent grads what they really need: the essential tools, ingredients, and appliances to nourish themselves and others.

The Best Graduation Gifts to Stock a New KitchenGive recent grads what they really need: the essential tools, ingredients, and appliances to nourish themselves and others.

Read more »