Ian Macfarlane says recent mortgage borrowers at risk of being squeezed by higher interest rates should not prevent the central bank from raising rates to the level needed. RBA rates

Former Reserve Bank of Australia governor Ian Macfarlane says recent mortgage borrowers at risk of being squeezed by higher interest rates should not prevent the central bank from raising rates to the appropriate level, as it tries to slow the economy and dampen inflation.

While he did not express a firm view on how high the cash rate would rise, Macfarlane said the RBA’s decisions on interest rates could not be “held hostage” by the most recent or marginal borrowers. “But I think the central point I want to make is that you can’t allow the marginal mortgage borrower to determine the central bank’s ability to change interest rates. They can’t be really held hostage by the most recent mortgage borrower.”

The former RBA official, who is also a former director of ANZ Bank, pointed out many Australians with mortgages were ahead on their repayments, and said that in the past households had tended to “grin and bear it” when home loan rates increased.“They continue to service their mortgage. They cut back elsewhere - they have to cut back elsewhere, but they continue to service their mortgages. That’s one of the reasons why we have extraordinarily low incidence of mortgage delinquency,” he said.

Australia Latest News, Australia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

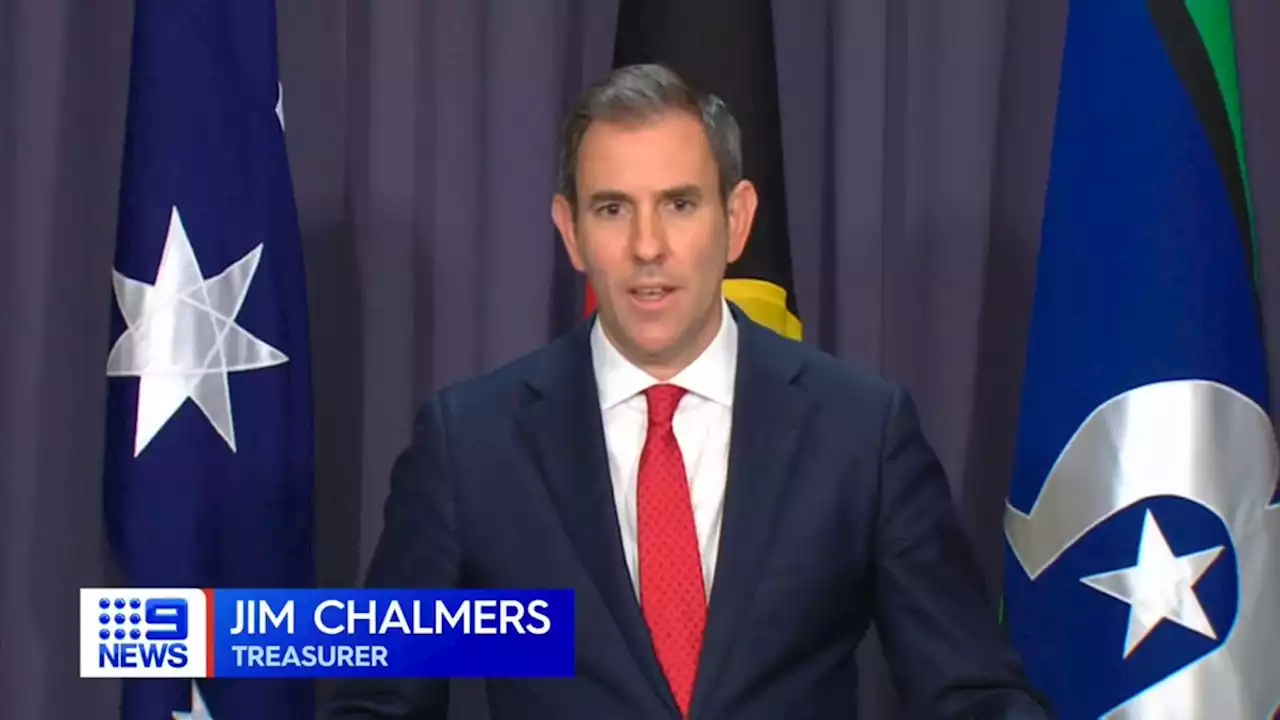

'These interest rate rises will sting': Treasurer issues grim warning as RBA review loomsThe Treasurer is insisting a newly announced review of the Reserve Bank is designed to build confidence in the institution, not take potshots. Read more: ElizaEdNews AusPol 9News

'These interest rate rises will sting': Treasurer issues grim warning as RBA review loomsThe Treasurer is insisting a newly announced review of the Reserve Bank is designed to build confidence in the institution, not take potshots. Read more: ElizaEdNews AusPol 9News

Read more »

Big lenders cut fixed rates despite RBA cash rate hikesSeveral big lenders have cut their fixed interest rates despite the Reserve Bank of Australia continuously hiking Australia's cash rate. 9News

Read more »

ASX LIVE: ASX to slip, RBA rate decision in focusAustralian shares are set to slip; US markets closed for July 4th. Cash rate forecast to rise 0.05 percentage points. $A higher. Follow updates here.

ASX LIVE: ASX to slip, RBA rate decision in focusAustralian shares are set to slip; US markets closed for July 4th. Cash rate forecast to rise 0.05 percentage points. $A higher. Follow updates here.

Read more »

Challenge for Chalmers as RBA slams the brakesThe RBA surprised the market with its move to raise rates by half a percentage point, but will this still be too little, too late to suppress inflation?

Challenge for Chalmers as RBA slams the brakesThe RBA surprised the market with its move to raise rates by half a percentage point, but will this still be too little, too late to suppress inflation?

Read more »

RBA goes under the microscopeThe Reserve Bank of Australia has arguably not faced such political and public scrutiny since at least 1989, when the cash rate hit 17 per cent.

RBA goes under the microscopeThe Reserve Bank of Australia has arguably not faced such political and public scrutiny since at least 1989, when the cash rate hit 17 per cent.

Read more »