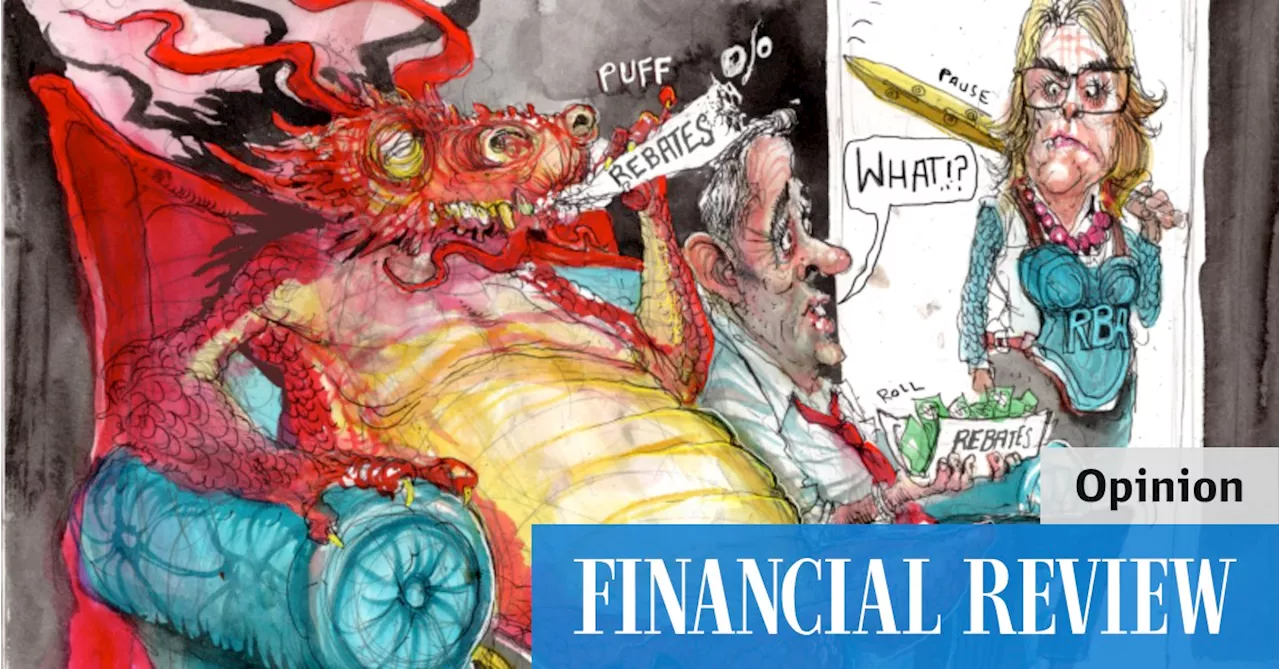

The labour market is softening only at a glacial pace, thanks in no small part to strong public sector jobs growth. That leaves the RBA in a bind.

On the day that the US central bank cut interest rates for the first time in four years, it was fitting the latest jobs and population data confirmed Australia’s central bank is some way from following suit.

Not only is Australia’s jobs market clearly having no trouble absorbing all these new arrivals, but rapid population growth is adding to demand, and feeding into rising house prices and household wealth. RBA governor Michele Bullock has told investors not to expect a rate cut this side of Christmas and Bloxham isn’t straying from his view that the first RBA cut won’t arrive until the middle of next calendar year. And he sees only 0.5 per cent of rate cuts in 2025.

“They’re becoming more impatient, and they’re starting to deliver more support. And that’s why you’re seeing public demand starting to be supportive, and fiscal policy a bit looser now. That’s going to mean that it takes longer for inflation to come down.”

Australia Latest News, Australia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

RBA: Lower inflation could pressure the Reserve Bank to cut interest ratesVery low inflation readings in the coming months will change the interest rate debate.

RBA: Lower inflation could pressure the Reserve Bank to cut interest ratesVery low inflation readings in the coming months will change the interest rate debate.

Read more »

Reserve Bank reform: Genuine bipartisanship is needed on the RBA dual board planThe question now is what Labor and the Coalition are prepared to do to ensure those best qualified are in the room when monetary policy is being set.

Reserve Bank reform: Genuine bipartisanship is needed on the RBA dual board planThe question now is what Labor and the Coalition are prepared to do to ensure those best qualified are in the room when monetary policy is being set.

Read more »

RBA: Political perception is why Treasurer Jim Chalmers is hammering the Reserve Bank of AustraliaThe treasurer’s attack on the central bank signals a new era where politicians will target entities deemed to be hurting ordinary Australians.

RBA: Political perception is why Treasurer Jim Chalmers is hammering the Reserve Bank of AustraliaThe treasurer’s attack on the central bank signals a new era where politicians will target entities deemed to be hurting ordinary Australians.

Read more »

Reserve Bank of Australia: RBA board split not dead says Treasurer Jim ChalmersThe treasurer offers to shift all RBA board members onto a new interest rate-setting board, presenting a potential breakthrough in stalled Coalition negotiations.

Reserve Bank of Australia: RBA board split not dead says Treasurer Jim ChalmersThe treasurer offers to shift all RBA board members onto a new interest rate-setting board, presenting a potential breakthrough in stalled Coalition negotiations.

Read more »

RBA interest rates: Inflation could become entrenched, former RBA research boss John Simon warnsThe central bank’s former top researcher, John Simon, says the decision not to raise rates further has not been adequately scrutinised by the board.

RBA interest rates: Inflation could become entrenched, former RBA research boss John Simon warnsThe central bank’s former top researcher, John Simon, says the decision not to raise rates further has not been adequately scrutinised by the board.

Read more »

Prime minister affirms 'respect' for Reserve Bank after Wayne Swan blasts its interest rates strategyThe comments come after a week in which Treasurer Jim Chalmers and RBA governor Michele Bullock downplayed suggestions of a rift.

Prime minister affirms 'respect' for Reserve Bank after Wayne Swan blasts its interest rates strategyThe comments come after a week in which Treasurer Jim Chalmers and RBA governor Michele Bullock downplayed suggestions of a rift.

Read more »