OPINION: Some economists fear the Reserve’s vigour against inflation will crush the housing market. But the central bank reckons they are wrong.

The Reserve Bank of Australia has slapped down the pessimists who are concerned that its super-sized interest rate rises will crush the housing market and the economy.

Nevertheless, Bullock delivered an extra nugget by foreshadowing that the current 1.35 per cent cash rate must go a “fair bit higher” to reach neutral, the estimated level at which monetary policy is neither stimulatory nor restrictive.RBA board meeting minutes were also hawkish on Tuesday, stating the cash rate was “well below” the lower range of estimates for the neutral rate.

Bullock says a 10 per cent national house price fall will put only 0.4 per cent of home borrowers in negative equity. A caveat other analysts point to is that the RBA’s average national house price scenario omits that outer suburbs will typically experience larger price falls. These areas have more marginal borrowers susceptible to job losses, loan defaults and mortgage stress.

”Almost three-quarters of debt outstanding is held by households in the top 40 per cent of the income distribution; indebted households in the bottom 20 per cent of the income distribution hold less than 5 per cent of the debt,” Bullock says.Advertisement

Australia Latest News, Australia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Cashed up and employed: RBA says households can withstand higher ratesReserve Bank deputy governor Michele Bullock says households enjoying a strong jobs market can use COVID-era savings to manage a lift in interest rates.

Cashed up and employed: RBA says households can withstand higher ratesReserve Bank deputy governor Michele Bullock says households enjoying a strong jobs market can use COVID-era savings to manage a lift in interest rates.

Read more »

RBA says households can handle interest rate rises, but experts warn mortgage repayments will surgeAs the Reserve Bank prepares to keep lifting interest rates and says households can cope with rising repayments, analysts warn both it and mortgage borrowers could be in for a rude shock.

RBA says households can handle interest rate rises, but experts warn mortgage repayments will surgeAs the Reserve Bank prepares to keep lifting interest rates and says households can cope with rising repayments, analysts warn both it and mortgage borrowers could be in for a rude shock.

Read more »

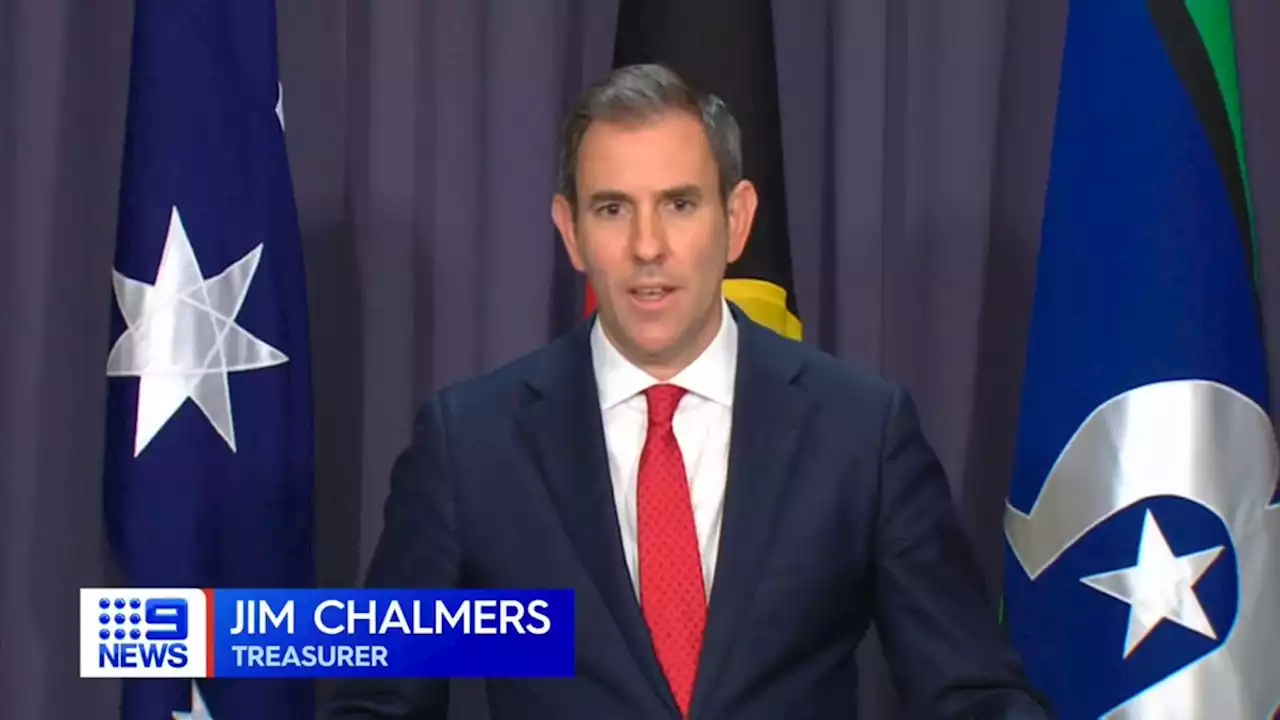

'These interest rate rises will sting': Treasurer issues grim warning as RBA review loomsThe Treasurer is insisting a newly announced review of the Reserve Bank is designed to build confidence in the institution, not take potshots. Read more: ElizaEdNews AusPol 9News

'These interest rate rises will sting': Treasurer issues grim warning as RBA review loomsThe Treasurer is insisting a newly announced review of the Reserve Bank is designed to build confidence in the institution, not take potshots. Read more: ElizaEdNews AusPol 9News

Read more »

RBA cash rate set to double in coming monthsRBA governor Philip Lowe has indicated the official interest rate could almost double in coming months as the central bank moves swiftly to normalise pandemic era monetary policy and curb rising prices.

RBA cash rate set to double in coming monthsRBA governor Philip Lowe has indicated the official interest rate could almost double in coming months as the central bank moves swiftly to normalise pandemic era monetary policy and curb rising prices.

Read more »

RBA culture, board and inflation target to be review focusTreasurer Jim Chalmers will on Wednesday announce the terms of reference for the RBA review, with the board, the inflation target and its performance all in the spotlight. auspol

RBA culture, board and inflation target to be review focusTreasurer Jim Chalmers will on Wednesday announce the terms of reference for the RBA review, with the board, the inflation target and its performance all in the spotlight. auspol

Read more »

'These interest rate rises will sting': Treasurer issues grim warning as RBA review loomsThe Treasurer is insisting a newly announced review of the Reserve Bank is designed to build confidence in the institution, not take potshots. Read more: ElizaEdNews AusPol 9News

'These interest rate rises will sting': Treasurer issues grim warning as RBA review loomsThe Treasurer is insisting a newly announced review of the Reserve Bank is designed to build confidence in the institution, not take potshots. Read more: ElizaEdNews AusPol 9News

Read more »