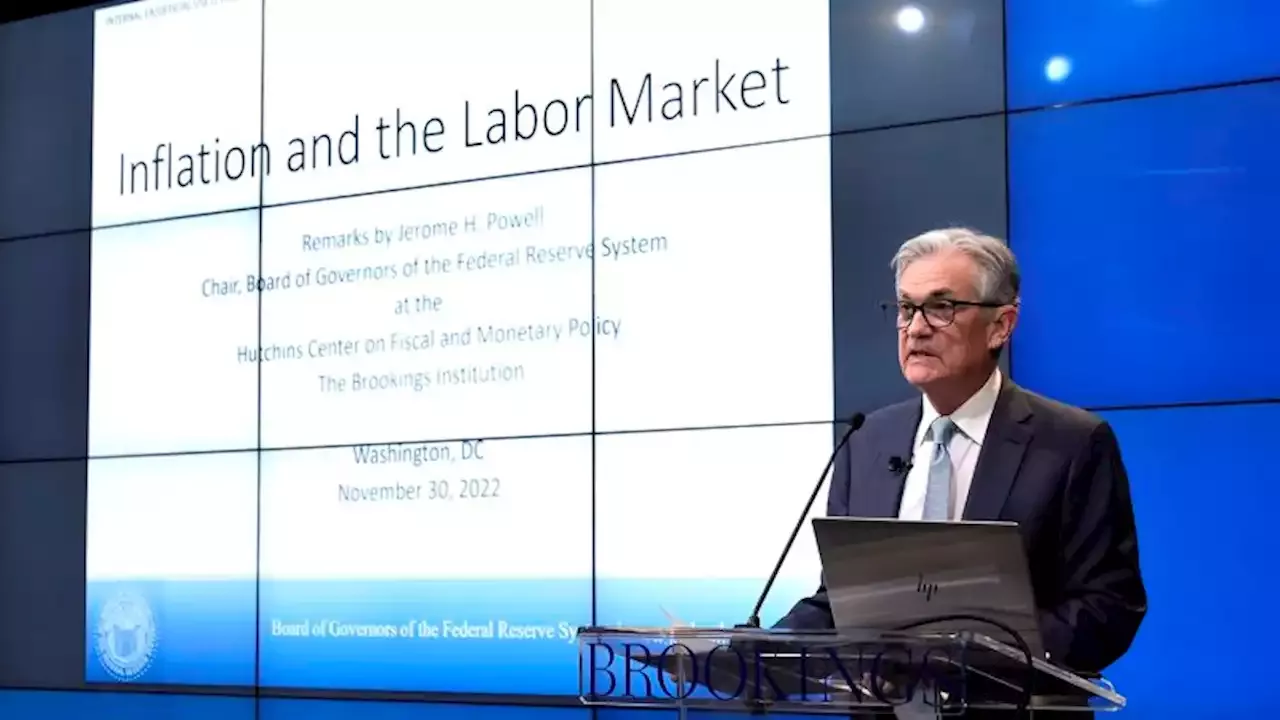

The Federal Reserve could pull back on the pace of its aggressive rate hikes as soon as December, Fed Chairman Jerome Powell said at an economic forum.

“The time for moderating the pace of rate increases may come as soon as the December meeting,” he said in remarks at the Hutchins Center on Fiscal and Monetary Policy, his last public appearance before the central bank enters a blackout period ahead of its December 13-14 policymaking meeting. “Despite some promising developments, we have a long way to go,” Powell said, noting that the Fed has “not seen clear progress” on decades-high inflation plaguing the economy.

The decline in job openings is a positive development, Powell said Wednesday. While the relationship between job openings and unemployment is a “very fraught one,” he noted, he and other Fed officials believe there’s a possibility that the labor market could come back into balance via a decline in job openings as opposed to a spike in job losses. “We’ve seen that so far, but it’s way too early,” he said.

Australia Latest News, Australia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Fed Chair Powell says smaller interest rate hikes could start in DecemberFederal Reserve Chairman Jerome Powell confirmed Wednesday that smaller interest rate increases are likely ahead.

Fed Chair Powell says smaller interest rate hikes could start in DecemberFederal Reserve Chairman Jerome Powell confirmed Wednesday that smaller interest rate increases are likely ahead.

Read more »

Jerome Powell Signals Fed Prepared to Slow Rate-Rise Pace in DecemberBreaking: Federal Reserve Chairman Jerome Powell signaled that Fed officials are on track to lift interest rates by a half percentage point in December, a smaller increase than the previous four rises

Jerome Powell Signals Fed Prepared to Slow Rate-Rise Pace in DecemberBreaking: Federal Reserve Chairman Jerome Powell signaled that Fed officials are on track to lift interest rates by a half percentage point in December, a smaller increase than the previous four rises

Read more »

U.S. stocks rally as Powell says pace of rate hikes likely to slow in DecemberU.S. stocks rallied Wednesday afternoon after Federal Reserve Chairman Jerome Powell said the central bank could slow the pace of interest-rate hikes in...

U.S. stocks rally as Powell says pace of rate hikes likely to slow in DecemberU.S. stocks rallied Wednesday afternoon after Federal Reserve Chairman Jerome Powell said the central bank could slow the pace of interest-rate hikes in...

Read more »

Powell says pace of interest-rate increases can slow as soon as December meetingFed Chair Jerome Powell said the ultimate level of interest rates would have to be higher than was thought a few months ago – and that he tried to keep any talk of rate cuts off the table. Powell laid out three components to watch during his speech.

Powell says pace of interest-rate increases can slow as soon as December meetingFed Chair Jerome Powell said the ultimate level of interest rates would have to be higher than was thought a few months ago – and that he tried to keep any talk of rate cuts off the table. Powell laid out three components to watch during his speech.

Read more »

USD/CHF bears approach 0.9450 with eyes on Swiss GDP, Fed Chair PowellUSD/CHF takes offers to refresh intraday low near 0.9460 heading into Tuesday’s European session as it snaps the three-day uptrend. Although the risk-

USD/CHF bears approach 0.9450 with eyes on Swiss GDP, Fed Chair PowellUSD/CHF takes offers to refresh intraday low near 0.9460 heading into Tuesday’s European session as it snaps the three-day uptrend. Although the risk-

Read more »

Fed Chair Jerome Powell is once again the center of attention for marketsRecent comments from St. Louis Fed president Bullard and vice chair Brainard have everyone convinced Powell will pull another Jackson Hole on Wednesday.

Fed Chair Jerome Powell is once again the center of attention for marketsRecent comments from St. Louis Fed president Bullard and vice chair Brainard have everyone convinced Powell will pull another Jackson Hole on Wednesday.

Read more »